| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 7326903500 | Doc | 87.8% | CN | US | 2025-05-12 |

| 9602001080 | Doc | 40.5% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your declared items. Here's a detailed analysis, presented in a structured format to help you understand the classification and potential costs.

Important Note: HS code classification is complex and ultimately determined by customs officials. This analysis is based on the information provided and should be used as a guide. It's crucial to verify this information with your customs broker or local customs authority.

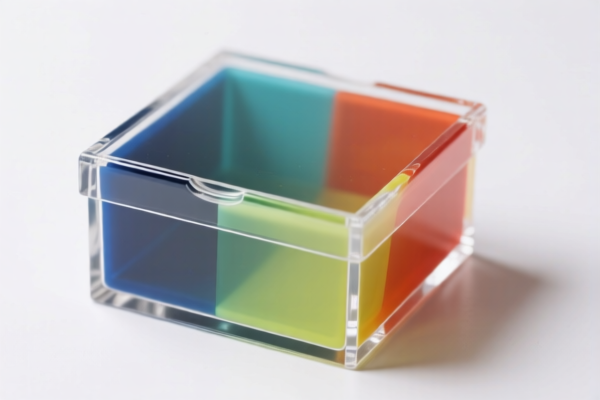

1. ACRYLIC BOX – HS Code: 3926.90.99.89

- Chapter 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914. This specifies that the item is made of plastic or a combination of plastic with other materials (covered in chapters 3901-3914).

- 3926.90: Other. This is a more specific sub-heading for plastic articles not covered elsewhere in Chapter 39.

- 3926.90.99: Other. This further narrows down the classification, indicating a plastic article that doesn't fit into more defined categories within 3926.90.

- 3926.90.99.89: Other. This is the most specific classification, used for plastic articles not specifically named elsewhere.

Tax Implications:

- Basic Duty: 5.3%

- Additional Duty: 7.5%

- Post April 2, 2025 Additional Duty: 30%

- Total Tax: 42.8%

Important Considerations:

- Material Composition: Confirm that the box is primarily made of plastic. If other materials constitute a significant portion, a different HS code might be more appropriate.

- End Use: The specific end use of the acrylic box could influence classification.

- Single-piece or Assembly: If the box is an assembly of multiple plastic parts, the classification might change.

2. Containers of a kind normally carried on the person, in the pocket or in the handbag – HS Code: 7326.90.35.00

- Chapter 73: Iron or steel articles. This chapter covers products made of iron or steel.

- 7326: Other articles of iron or steel. This is a broad category for iron or steel items not classified elsewhere.

- 7326.90: Other. This further specifies that the item is an iron or steel article not covered in more defined categories within 7326.

- 7326.90.35: Containers of a kind normally carried on the person, in the pocket or in the handbag. This specifically identifies containers designed for personal carry.

- 7326.90.35.00: This is the most specific classification for these types of containers.

Tax Implications:

- Basic Duty: 7.8%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30% (specifically for steel/aluminum products)

- Total Tax: 87.8%

Important Considerations:

- Material: Confirm the material is iron or steel. If it's aluminum, the 30% additional duty post April 2, 2025 definitely applies.

- Functionality: The container must be designed for personal carry (pocket or handbag) to fit this classification.

- Construction: The method of construction (welded, stamped, etc.) could influence classification.

3. Worked unhardened gelatin and articles thereof – HS Code: 9602.00.10.80

- Chapter 96: Miscellaneous manufactured articles. This chapter covers a variety of finished products not classified elsewhere.

- 9602: Worked vegetable or mineral carving material and articles of these materials; molded or carved articles of wax, of stearin, of natural gums or natural resins, of modeling pastes, and other molded or carved articles, not elsewhere specified or included; worked, unhardened gelatin (except gelatin of heading 3503) and articles of unhardened gelatin.

- 9602.00: Worked, unhardened gelatin (except gelatin of heading 3503) and articles of unhardened gelatin.

- 9602.00.10: Worked unhardened gelatin and articles thereof.

- 9602.00.10.80: Other. This is the most specific classification for these types of gelatin products.

Tax Implications:

- Basic Duty: 3.0%

- Additional Duty: 7.5%

- Post April 2, 2025 Additional Duty: 30%

- Total Tax: 40.5%

Important Considerations:

- Gelatin Type: Confirm that the gelatin is unhardened. Hardened gelatin would fall under a different HS code.

- Article Composition: If the article contains other materials in addition to gelatin, this could affect classification.

- Intended Use: The intended use of the gelatin article could influence classification.

Recommendations:

- Verify Material Composition: Double-check the exact materials used in each product.

- Review Single-piece vs. Assembly: If any items are assemblies, confirm the classification rules for assemblies.

- Check End Use: Confirm the intended end use of each product.

- Consult a Customs Broker: It's highly recommended to consult with a licensed customs broker in your country. They can provide expert guidance and ensure accurate classification.

- Prepare Documentation: Gather all relevant documentation, including invoices, packing lists, and material specifications.

Disclaimer: This information is for general guidance only and does not constitute professional advice. HS code classification is complex and subject to change. Always consult with a qualified customs broker or local customs authority for accurate and up-to-date information.

Customer Reviews

No reviews yet.