Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8421290065 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8409999990 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8421390115 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8421230000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8421390105 | Doc | 55.0% | CN | US | 2025-05-12 |

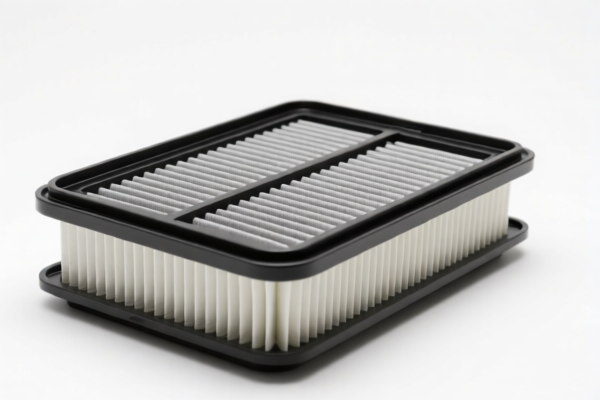

Here is the classification and tariff information for the air filter element based on the provided HS codes and details:

✅ HS CODE: 8421390115

Product Description: Filter elements for mechanical and equipment used in gas filtration or purification

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not relevant for this product category)

📌 Key Notes:

- This HS code is the most accurate classification for air filter elements used in gas filtration systems.

- The total tax rate is 55.0%, which includes the additional 25.0% and the special 30.0% tariff that will apply after April 11, 2025.

- No anti-dumping duties are currently applicable for this product category.

🛠️ Proactive Advice:

- Verify the material of the filter element (e.g., paper, synthetic, or metal-based) to ensure correct classification.

- Check the unit price and certifications required (e.g., CE, ISO, or other industry-specific standards).

- Monitor the April 11, 2025 deadline for potential tariff increases and plan accordingly for cost management.

📌 Alternative HS Codes (for reference):

- 8421290065 – Filter elements for liquid filtration or purification (not applicable for air filters)

- 8409999990 – Engine parts (not applicable for air filters)

- 8421230000 – Fuel filter elements (not applicable for air filters)

- 8421390105 – Filter elements for gas filtration (similar to 8421390115, but may vary by subcategory)

If you have more details about the material, intended use, or origin of the air filter element, I can help refine the classification further.

Customer Reviews

No reviews yet.