| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9025801500 | Doc | 38.5% | CN | US | 2025-05-12 |

| 9019102090 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9025801000 | Doc | 56.7% | CN | US | 2025-05-12 |

| 9014208080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9026208000 | Doc | 37.5% | CN | US | 2025-05-12 |

Here is the classification and tariff information for air pressure sensors based on the provided HS codes:

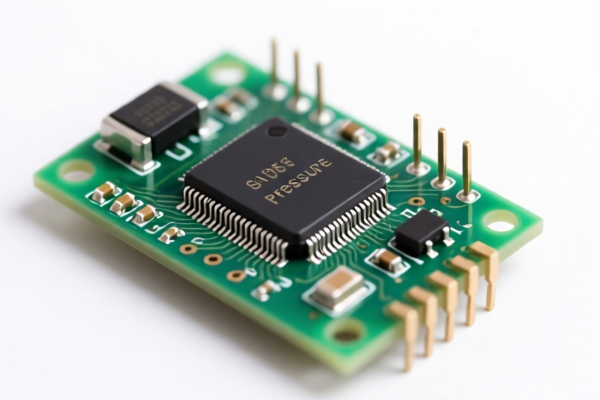

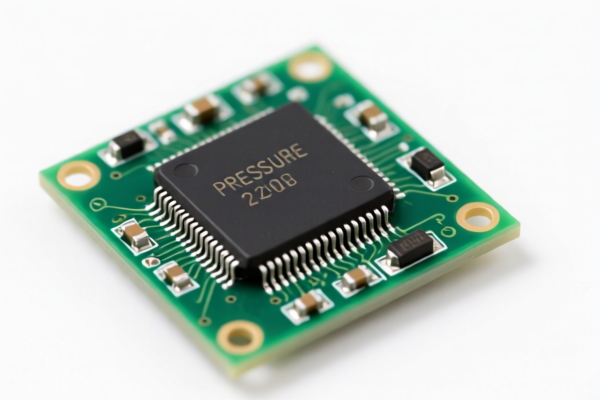

✅ HS CODE: 9025801500

Product Description: General air pressure sensor

Total Tax Rate: 38.5%

- Base Tariff Rate: 1.0%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code applies to general-purpose air pressure sensors, not specialized or high-precision models.

✅ HS CODE: 9019102090

Product Description: Air pressure sensor used in ventilators

Total Tax Rate: 30.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code is specific to medical devices like ventilators. Ensure the product is clearly used in medical applications.

✅ HS CODE: 9025801000

Product Description: High-precision air pressure sensor

Total Tax Rate: 56.7%

- Base Tariff Rate: 1.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code applies to high-precision sensors, often used in scientific or industrial applications. Higher tax due to precision and technical complexity.

✅ HS CODE: 9014208080

Product Description: Air pressure sensor for aviation

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for aviation-specific sensors. Ensure the product is clearly intended for use in aircraft or aerospace systems.

✅ HS CODE: 9026208000

Product Description: Micro-pressure sensor for measuring or checking pressure

Total Tax Rate: 37.5%

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code applies to micro-pressure sensors used in specialized applications such as industrial or scientific pressure monitoring.

📌 Proactive Advice for Importers:

- Verify Product Specifications: Confirm the exact use and technical specifications of the sensor (e.g., medical, aviation, or general use) to ensure correct HS code classification.

- Check Material and Unit Price: Some classifications may depend on the material or unit price, which can affect the final tax rate.

- Certifications Required: Ensure all necessary certifications (e.g., CE, FDA, or aviation approvals) are in place, especially for medical or aerospace applications.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes. Be prepared for increased costs after this date.

- Anti-dumping Duties: While not directly applicable to air pressure sensors, be aware of any ongoing anti-dumping investigations on related products (e.g., iron or aluminum components).

Let me know if you need help determining the correct HS code based on your product’s technical details.

Customer Reviews

No reviews yet.