| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5907002500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5907008090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5907001500 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5905001000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5516140085 | Doc | 65.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the product "backdrop" based on the provided HS codes and tax details:

✅ HS CODE: 5907002500

Product Description: Stage, ballet, and opera scenery and props, including scenery

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specifically for stage scenery and props, which aligns well with the product "backdrop" used in performances.

- Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

- Proactive Advice: Confirm the product is used for stage or performance purposes and not for general decorative use, which may fall under a different HS code.

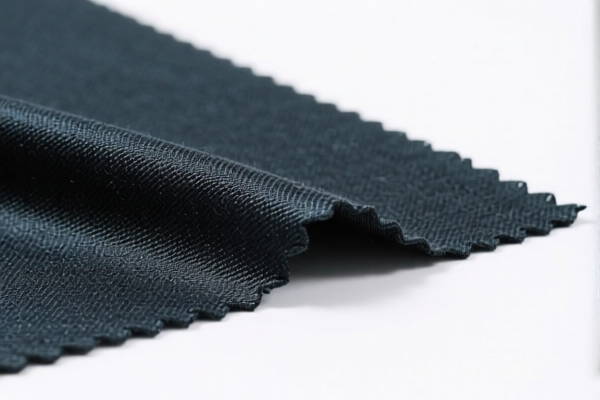

✅ HS CODE: 5907008090

Product Description: Coated, impregnated, or covered textile fabrics

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to textile fabrics that are treated or covered, which may be relevant if the backdrop is made of such materials.

- Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

- Proactive Advice: Verify the material composition and treatment process to ensure correct classification.

✅ HS CODE: 5907001500

Product Description: Canvas used for stage scenery, studio backdrops, etc.

Total Tax Rate: 63.0%

Tax Breakdown:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specifically for canvas used as backdrops, making it the most accurate classification for your product.

- Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

- Proactive Advice: Ensure the product is canvas-based and used for stage or studio purposes to qualify under this code.

✅ HS CODE: 5905001000

Product Description: Textile wall coverings with paper permanently adhered to the back

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to textile wall coverings, which may be relevant if the backdrop is used as a wall covering.

- Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

- Proactive Advice: Confirm the intended use and material composition to avoid misclassification.

✅ HS CODE: 5516140085

Product Description: Printed woven fabrics containing 85% or more by weight of man-made short fibers

Total Tax Rate: 65.0%

Tax Breakdown:

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to printed woven fabrics with high content of man-made fibers.

- Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

- Proactive Advice: If the backdrop is made of printed woven fabric with high man-made fiber content, this may be a possible classification.

📌 Recommendation Summary:

- Best Fit: HS CODE 5907001500 is the most accurate for a backdrop made of canvas used for stage or studio purposes.

- Time-sensitive Alert: All codes will be subject to 30.0% additional tariffs after April 11, 2025.

- Action Required:

- Verify the material composition (e.g., canvas, fabric type, treatment).

- Confirm the intended use (stage, studio, or general decorative).

- Check if any certifications are required (e.g., origin, environmental compliance).

- Consider import timing to avoid higher tariffs after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.