| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8427900090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8427208090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326901000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 9506320000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9506696020 | Doc | 42.4% | CN | US | 2025-05-12 |

| 9208900080 | Doc | 42.8% | CN | US | 2025-05-12 |

| 9208900040 | Doc | 42.8% | CN | US | 2025-05-12 |

英语

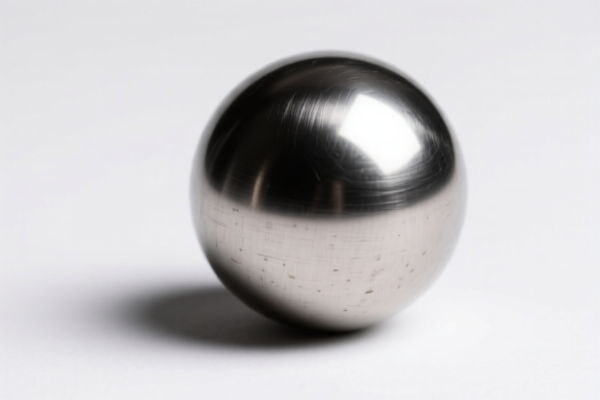

A ball fork is a specialized tool used primarily in plumbing and pipefitting for removing and installing balls in ball valves.

Material: Typically constructed from hardened steel, often chrome-plated for corrosion resistance. Alloy steels are also common for increased durability.

Purpose: Designed to safely engage and disengage the ball within a ball valve without damaging the valve body or the ball itself. Standard wrenches or pliers can damage the ball's surface, leading to leaks or valve failure.

Function: The fork's tines are shaped to fit precisely around the ball, providing a secure grip. The tool utilizes leverage to overcome the friction or corrosion holding the ball in place.

Usage Scenarios:

- Valve Repair: Used during valve maintenance to replace damaged or worn balls.

- Valve Installation: Facilitates the proper seating of the ball during valve assembly.

- Valve Inspection: Allows for removal of the ball for visual inspection of wear or damage.

- Emergency Repairs: Can be used to quickly remove a ball to bypass a blockage.

Common Types:

- Single Fork: The most common type, featuring a single, curved fork for engaging the ball.

- Double Fork: Features two forks, providing a more secure grip and greater leverage, often used for larger valves.

- Adjustable Ball Fork: Allows for variations in ball size, making it versatile for different valve types.

- T-Handle Ball Fork: Features a T-shaped handle for improved grip and control.

- Ball Valve Puller: A more robust tool that combines a fork with a pulling mechanism for stubborn balls.

Based on the provided information, “ball fork” can be interpreted as a combination of “ball” and a lifting/handling tool potentially related to “fork.” Here's a breakdown of relevant HS codes and associated details:

- 8427900090: This HS code covers “Fork-lift trucks; other works trucks fitted with lifting or handling equipment: Other self-propelled trucks: Other Other”. While this refers to entire trucks, it’s relevant if the “ball fork” is part of a self-propelled lifting device. The total tax rate is 55.0%, comprised of a 0.0% base tariff and a 25.0% additional tariff, increasing to 30.0% after April 2, 2025.

- 8427208090: This HS code covers “Fork-lift trucks; other works trucks fitted with lifting or handling equipment: Other self-propelled trucks: Other Other”. Similar to the previous code, this applies if the “ball fork” is integrated into a self-propelled truck. The total tax rate is also 55.0%, with the same tariff structure as above.

- 9506320000: This HS code covers “Articles and equipment for general physical exercise, gymnastics, athletics, other sports (including table-tennis) or outdoor games, not specified or included elsewhere in this chapter; swimming pools and wading pools; parts and accessories thereof: Golf clubs and other golf equipment; parts and accessories thereof: Balls”. If the “ball fork” is a specialized tool used in golf, specifically related to balls, this code may be applicable. The total tax rate is 37.5%, consisting of a 0.0% base tariff and a 7.5% additional tariff, increasing to 30.0% after April 2, 2025.

- 9506696020: This HS code covers “Articles and equipment for general physical exercise, gymnastics, athletics, other sports (including table-tennis) or outdoor games, not specified or included elsewhere in this chapter; swimming pools and wading pools; parts and accessories thereof: Balls, other than golf balls and table-tennis balls: Other: Other Other”. If the “ball fork” is a tool used with balls in sports other than golf or table tennis, this code could be relevant. The total tax rate is 42.4%, with a 4.9% base tariff and a 7.5% additional tariff, increasing to 30.0% after April 2, 2025.

According to the provided reference material, the HS code options related to 'ball fork' are limited, with only the following 4 found.

It is important to determine the precise function and application of the “ball fork” to select the most accurate HS code. If the item is a component of a larger machine, codes 8427900090 or 8427208090 may be appropriate. If it is a sports-related tool, codes 9506320000 or 9506696020 should be considered.

Customer Reviews

No reviews yet.