| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4601219000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4419110000 | Doc | 33.2% | CN | US | 2025-05-12 |

| 4420110090 | Doc | 33.2% | CN | US | 2025-05-12 |

| 4823610040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4601922000 | Doc | 61.6% | CN | US | 2025-05-12 |

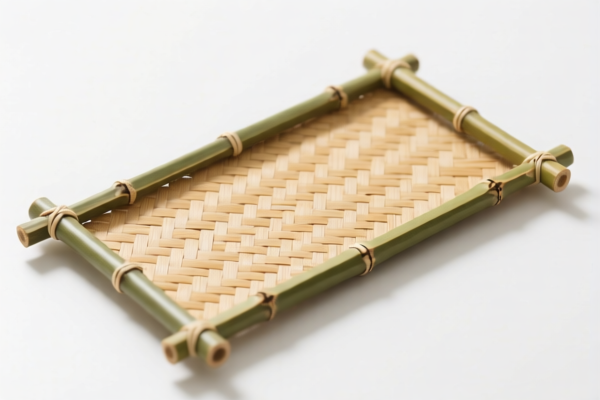

Product Name: Bamboo Tray

Classification: Based on the product's structure and use, multiple HS codes may apply. Below is a detailed breakdown of the classification options and associated tariffs:

✅ HS CODE: 4601219000

Description: Bamboo trays classified under "Bamboo mats, mats, and screens."

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 63.0%

- Notes: This classification is suitable if the bamboo tray is primarily used as a decorative or functional mat or screen.

✅ HS CODE: 4419110000

Description: Bamboo trays classified under "Bamboo breadboards, chopping boards, and similar boards."

- Base Tariff Rate: 3.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 33.2%

- Notes: This classification is appropriate if the tray is used as a cutting board or similar kitchen tool.

✅ HS CODE: 4420110090

Description: Bamboo trays classified under "Bamboo tableware and kitchen utensils."

- Base Tariff Rate: 3.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 33.2%

- Notes: This classification is suitable for trays used as tableware or kitchen utensils.

✅ HS CODE: 4823610040

Description: Bamboo trays classified under "Bamboo trays, plates, and tableware made of paper or paperboard."

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 55.0%

- Notes: This classification is for products that are made of paper or paperboard, not solid bamboo. If the tray is made of solid bamboo, this classification may not be accurate.

✅ HS CODE: 4601922000

Description: Bamboo trays classified under "Woven materials and articles thereof."

- Base Tariff Rate: 6.6%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 61.6%

- Notes: This classification is for woven bamboo products, such as baskets or trays made from woven bamboo strips.

📌 Proactive Advice:

- Verify Material: Confirm whether the tray is made of solid bamboo, woven bamboo, or paperboard, as this will determine the correct HS code.

- Check Unit Price: The tax rate may vary depending on the declared value and whether the product is considered a luxury or mass-produced item.

- Certifications: Ensure that the product meets any required certifications (e.g., food-safe, eco-friendly, etc.) if it is intended for food use.

- April 11, 2025 Deadline: Be aware that the additional 30% tariff will apply after this date. If you are shipping before this date, you may save on this extra charge.

Let me know if you need help determining the most accurate HS code based on your product's specific details.

Product Name: Bamboo Tray

Classification: Based on the product's structure and use, multiple HS codes may apply. Below is a detailed breakdown of the classification options and associated tariffs:

✅ HS CODE: 4601219000

Description: Bamboo trays classified under "Bamboo mats, mats, and screens."

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 63.0%

- Notes: This classification is suitable if the bamboo tray is primarily used as a decorative or functional mat or screen.

✅ HS CODE: 4419110000

Description: Bamboo trays classified under "Bamboo breadboards, chopping boards, and similar boards."

- Base Tariff Rate: 3.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 33.2%

- Notes: This classification is appropriate if the tray is used as a cutting board or similar kitchen tool.

✅ HS CODE: 4420110090

Description: Bamboo trays classified under "Bamboo tableware and kitchen utensils."

- Base Tariff Rate: 3.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 33.2%

- Notes: This classification is suitable for trays used as tableware or kitchen utensils.

✅ HS CODE: 4823610040

Description: Bamboo trays classified under "Bamboo trays, plates, and tableware made of paper or paperboard."

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 55.0%

- Notes: This classification is for products that are made of paper or paperboard, not solid bamboo. If the tray is made of solid bamboo, this classification may not be accurate.

✅ HS CODE: 4601922000

Description: Bamboo trays classified under "Woven materials and articles thereof."

- Base Tariff Rate: 6.6%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 61.6%

- Notes: This classification is for woven bamboo products, such as baskets or trays made from woven bamboo strips.

📌 Proactive Advice:

- Verify Material: Confirm whether the tray is made of solid bamboo, woven bamboo, or paperboard, as this will determine the correct HS code.

- Check Unit Price: The tax rate may vary depending on the declared value and whether the product is considered a luxury or mass-produced item.

- Certifications: Ensure that the product meets any required certifications (e.g., food-safe, eco-friendly, etc.) if it is intended for food use.

- April 11, 2025 Deadline: Be aware that the additional 30% tariff will apply after this date. If you are shipping before this date, you may save on this extra charge.

Let me know if you need help determining the most accurate HS code based on your product's specific details.

Customer Reviews

No reviews yet.