| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482910010 | Doc | 59.4% | CN | US | 2025-05-12 |

| 8482993500 | Doc | 64.9% | CN | US | 2025-05-12 |

| 8483204040 | Doc | 59.5% | CN | US | 2025-05-12 |

| 8483908080 | Doc | 57.8% | CN | US | 2025-05-12 |

| 7326110000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325910000 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325991000 | Doc | 80.0% | CN | US | 2025-05-12 |

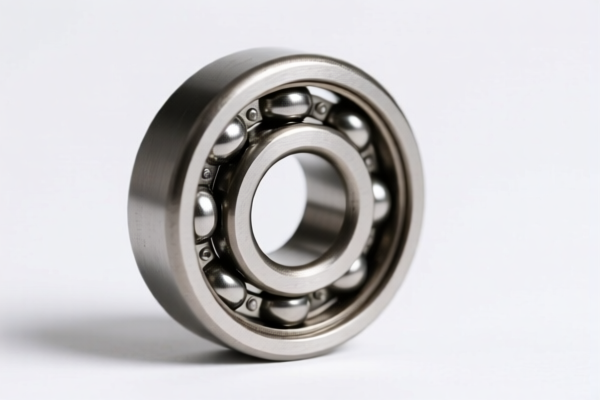

Bearing Steel Ball

Bearing steel balls are precision-manufactured spheres commonly used in bearings and a variety of other applications requiring low friction, high load capacity, and durability.

Material

The most common material for bearing steel balls is high-carbon chromium steel, typically SAE 52100 in North America, 100Cr6 in Europe, or SUJ2 in Japan. This alloy provides a good balance of hardness, wear resistance, and fatigue life. Other materials used include:

- Stainless Steel: (e.g., 440C, 316) – Offers corrosion resistance, suitable for applications in wet or corrosive environments.

- Ceramic: (e.g., Silicon Nitride, Zirconium Dioxide) – Provides high hardness, wear resistance, and resistance to high temperatures and corrosion, but are more brittle and expensive.

- Carbon Steel: Used for low-cost applications where high precision and durability are not required.

- Plastic: (e.g., Nylon, PTFE) – Lightweight and corrosion-resistant, used in low-load applications.

Purpose

The primary purpose of bearing steel balls is to reduce friction between moving parts. They facilitate smooth, efficient rotation or linear motion.

Function

Bearing steel balls function by:

- Rolling Element: Acting as the rolling element between races, converting sliding friction into rolling friction.

- Load Transfer: Distributing loads evenly across the bearing, increasing load capacity.

- Precise Movement: Enabling precise and controlled motion.

Usage Scenarios

Bearing steel balls are used in a wide range of applications, including:

- Bearings: The most common application, found in everything from skateboards and bicycles to automotive engines and industrial machinery. Types include ball bearings, roller bearings, and thrust bearings.

- Aerospace: Used in aircraft control surfaces, engines, and landing gear.

- Automotive: Used in wheel bearings, transmissions, and steering systems.

- Medical Devices: Used in surgical instruments and implants.

- Precision Instruments: Used in gyroscopes, compasses, and measuring devices.

- Valves and Pumps: Used to control fluid flow.

- Hardware: Used in drawer slides, door hinges, and locking mechanisms.

Common Types

Bearing steel balls are categorized based on precision, material, and finish:

- Precision Grade: Grades range from G10 (lowest precision) to G25 (highest precision). Higher grades have tighter tolerances and smoother surfaces.

- Full Balls: Used in most bearing applications.

- Cage Balls: Balls separated by a cage to maintain spacing and reduce friction.

- Retaining Balls: Balls held in place by a retaining ring.

- Flanged Balls: Balls with a flange for easy installation.

- Hollow Balls: Lightweight balls used in specialized applications.

- Stainless Steel Balls: Corrosion resistant.

- Ceramic Balls: High hardness and temperature resistance.

Bearing steel balls are components used in ball bearings to reduce friction and enable smooth rotational movement. They are typically manufactured from alloy steel, known for its hardness and durability. These balls find applications in various industries, including automotive, aerospace, and machinery.

The following HS codes are relevant to bearing steel balls, based on the provided information:

- 8482910010: This HS code falls under Chapter 84 ("Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof") and specifically covers "Ball or roller bearings, and parts thereof: Parts: Balls, needles and rollers". The subheading "Balls: Of alloy steel" directly applies to bearing steel balls made from alloy steel. The basic duty is 4.4%, with an additional 25.0% tariff, increasing to 30% after April 2, 2025, resulting in a total tariff of 59.4%.

- 7326110000: This HS code is categorized under Chapter 73 ("Articles of iron or steel"). It covers "Other articles of iron or steel: Forged or stamped, but not further worked: Grinding balls and similar articles for mills". While primarily for grinding balls, it could apply if the bearing steel balls are manufactured through forging or stamping processes. The basic duty is 0.0%, with an additional 25.0% tariff, increasing to 30% after April 2, 2025, resulting in a total tariff of 80.0%.

- 7325910000: This HS code falls under Chapter 73 ("Articles of iron or steel"). It covers "Other cast articles of iron or steel: Other: Grinding balls and similar articles for mills". If the bearing steel balls are manufactured through a casting process, this HS code may be applicable. The basic duty is 2.9%, with an additional 25.0% tariff, increasing to 30% after April 2, 2025, resulting in a total tariff of 82.9%.

Important Note: Regarding HS codes 7326110000 and 7325910000, the applicability depends on the manufacturing process (forging/stamping or casting, respectively). Please verify the specific production method used to determine the correct HS code. Additionally, for HS codes 7326110000, 7325910000, and 7325991000, a 25% additional tariff applies to steel and aluminum products, increasing to 30% after April 2, 2025.

Customer Reviews

No reviews yet.