| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482105064 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482101040 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8482200030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8482800040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8483304040 | Doc | 59.5% | CN | US | 2025-05-12 |

Here is the classification and tariff information for the bearing unit products, based on the provided HS codes and tax details:

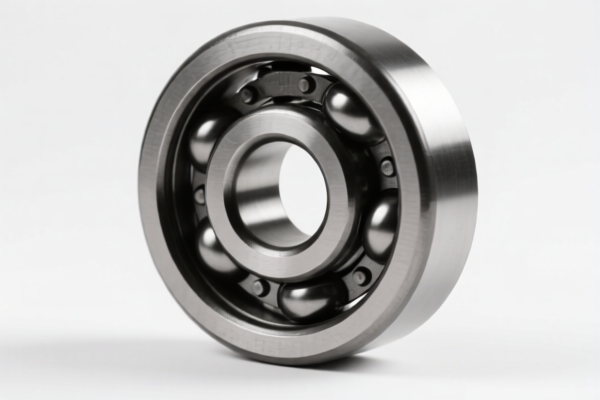

📌 HS CODE: 8482105064

Product Description: Ball or roller bearings, specifically ball bearings

Total Tax Rate: 64.0%

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

- Proactive Advice: Confirm the exact type of bearing (ball vs. roller) and whether it is part of a larger unit or standalone.

📌 HS CODE: 8482101040

Product Description: Ball bearings with an integral shaft, external diameter not exceeding 30 mm

Total Tax Rate: 57.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

- Proactive Advice: Verify the external diameter and whether the shaft is integral to the bearing unit.

📌 HS CODE: 8482200030

Product Description: Automotive bearing units

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

- Proactive Advice: Confirm the application (e.g., for cars, trucks, or other vehicles) and whether it is a complete unit or component.

📌 HS CODE: 8482800040

Product Description: Combined bearing units

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

- Proactive Advice: Clarify the composition of the unit (e.g., whether it includes multiple bearings or other components).

📌 HS CODE: 8483304040

Product Description: Bearing housing units

Total Tax Rate: 59.5%

- Base Tariff Rate: 4.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

- Proactive Advice: Confirm whether the unit is a complete housing unit or a component of a larger system.

📌 General Notes:

- April 11 Special Tariff: Applies to all products listed above after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- Additional Tariffs: These are currently in effect and are likely to remain in place unless policy changes occur.

- Anti-dumping duties: Not currently applicable to bearing units, but always verify if the product is subject to any ongoing anti-dumping investigations.

- Certifications: Depending on the application (e.g., automotive, industrial), certain certifications (e.g., ISO, CE, RoHS) may be required for customs clearance.

✅ Action Steps:

- Verify the exact product description and material composition to ensure correct HS code classification.

- Check for any applicable certifications required for import.

- Be aware of the April 11 Special Tariff and plan accordingly for increased costs after that date.

- Consider customs brokerage services to ensure compliance and avoid delays.

Let me know if you need help determining the correct HS code for a specific bearing unit or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.