| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7315120060 | Doc | 105.0% | CN | US | 2025-05-12 |

| 8714998000 | Doc | 47.5% | CN | US | 2025-05-12 |

| 8448205090 | Doc | 40.8% | CN | US | 2025-05-12 |

| 8448399000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8487900080 | Doc | 108.9% | CN | US | 2025-05-12 |

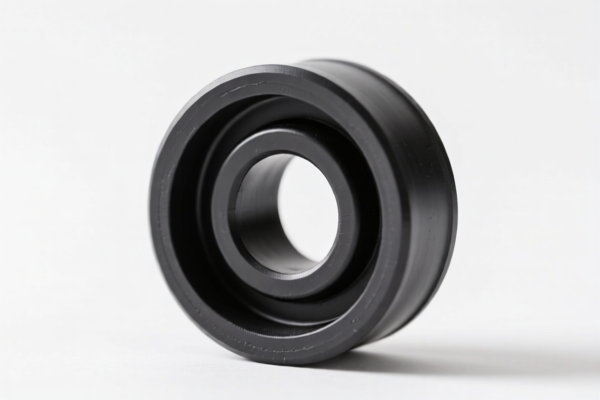

Bushing

A bushing is a mechanical component used to reduce friction, provide cushioning, and/or provide electrical insulation between two parts. They are typically cylindrical and are inserted into or around a rotating or sliding component to allow smooth motion.

Material

Bushings are manufactured from a wide variety of materials, selected based on the application’s load, speed, temperature, and environment. Common materials include:

- Metals: Bronze, brass, steel, stainless steel, aluminum alloys. These offer high load capacity and durability.

- Polymers: Nylon, Delrin, PTFE (Teflon), UHMW polyethylene. Polymers are often chosen for their self-lubricating properties, corrosion resistance, and low noise.

- Elastomers: Rubber, polyurethane. These provide vibration damping and shock absorption.

- Composite Materials: Fiber-reinforced polymers offer a combination of strength and low friction.

Purpose & Function

- Friction Reduction: The primary function is to minimize friction between moving parts, reducing wear and energy loss.

- Wear Protection: Bushings protect shafts and other components from direct contact and wear.

- Vibration Damping: Elastomeric bushings absorb vibrations and reduce noise.

- Electrical Insulation: Some bushings are made from non-conductive materials to isolate electrical components.

- Alignment: Bushings can help maintain proper alignment between components.

- Load Distribution: They distribute loads evenly across a larger surface area.

Usage Scenarios

Bushings are found in a vast range of applications, including:

- Automotive: Suspension systems, engine mounts, steering components, transmission components.

- Industrial Machinery: Bearings, pivots, linkages, gears.

- Construction Equipment: Heavy machinery joints, pivots, and wear surfaces.

- Electronics: Insulating components, connectors.

- Household Appliances: Motors, hinges, pivots.

- Aerospace: Control surfaces, landing gear components.

Common Types

- Sleeve Bushings: The simplest type, a cylindrical sleeve that fits over a shaft.

- Flanged Bushings: Feature a flange at one or both ends for easier mounting and alignment.

- Split Bushings: Cut lengthwise, allowing for easy installation without removing other components.

- Self-Lubricating Bushings: Contain internal lubrication (e.g., graphite, PTFE) for reduced maintenance.

- Roller Bushings: Utilize rollers to reduce friction and provide higher load capacity.

- Needle Bushings: Use a cylindrical array of needles for high load capacity in a small space.

- Elastomeric Bushings: Made from rubber or polyurethane, providing vibration damping and shock absorption.

Based on the provided reference material, determining the precise HS code for "bushing" requires further clarification of its material and application. However, several HS codes may be relevant depending on the bushing's composition and intended use.

Here are potential HS codes based on the information available:

- 8483308040: This code covers “Transmission shafts (including camshafts and crankshafts) and cranks; bearing housings, housed bearings and plain shaft bearings; gears and gearing; ball or roller screws; gear boxes and other speed changers, including torque converters; flywheels and pulleys, including pulley blocks; clutches and shaft couplings (including universal joints); parts thereof: Bearing housings; plain shaft bearings: Other Bearing housings: Other”. If the bushing is part of a bearing housing assembly, this code may apply. The total tax rate is 59.5%.

- 8483308090: This code covers “Transmission shafts (including camshafts and crankshafts) and cranks; bearing housings, plain shaft bearings; gears and gearing; ball or roller screws; gear boxes and other speed changers, including torque converters; flywheels and pulleys, including pulley blocks; clutches and shaft couplings (including universal joints); parts thereof: Bearing housings; plain shaft bearings: Other Plain shaft bearings: Without housing: Other”. If the bushing is a plain shaft bearing without a housing, this code may be applicable. The total tax rate is 59.5%.

- 7326908688: This code covers “Other articles of iron or steel: Other: Other: Other: Other Other”. If the bushing is made of iron or steel and doesn't fall into other specific categories, this code could be considered. The total tax rate is 82.9%. Note that verification of steel or aluminum material is required, with an additional 25% tariff.

- 4016993000: This code covers “Other articles of vulcanized rubber other than hard rubber: Other: Other: Of natural rubber: Vibration control goods of a kind used in the vehicles of headings 8701 through 8705”. If the bushing is made of natural rubber and used for vibration control in vehicles, this code may apply. The total tax rate is 55.0%.

- 4016995500: This code covers “Other articles of vulcanized rubber other than hard rubber: Other: Other: Other: Other: Vibration control goods of a kind used in the vehicles of headings 8701 through 8705”. If the bushing is made of vulcanized rubber (not natural rubber) and used for vibration control in vehicles, this code may be applicable. The total tax rate is 57.5%.

Important Considerations:

- The material composition of the bushing is crucial for accurate classification.

- If the bushing is used in vehicles (headings 8701-8705), codes 4016993000 or 4016995500 may be relevant.

- For iron or steel bushings (7326908688), material verification is required, and an additional 25% tariff applies if it is steel or aluminum.

Customer Reviews

This site is a goldmine for HS code information. The detailed explanation of the 8483308040 code and its application in bearing housings was exactly what I needed.

The review of potential HS codes for different materials was very helpful. I wish there were more examples of how to choose between similar codes, though.

I found the section on vibration control goods made of rubber very informative. It clarified why some codes have higher tariff rates than others.

The list of potential HS codes for bushings was useful, especially the breakdown of tax rates for each. I had to dig a bit, but it was worth it.

I was impressed by the clear explanation of how material type affects HS code classification. This will save me a lot of time during customs clearance.