| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8543706000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8471801000 | Doc | 45.0% | CN | US | 2025-05-12 |

| 8471607000 | Doc | 45.0% | CN | US | 2025-05-12 |

| 8536694040 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the classification and tariff information for cable adapters based on the provided HS codes and tariff details:

✅ HS CODE: 8543706000

Product Description: Communication data line adapters

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to adapters designed for connecting to telegraph or telephone equipment or networks.

- Proactive Advice: Confirm if the adapter is specifically for telecommunication use (e.g., phone lines, modems, etc.).

✅ HS CODE: 8471801000

Product Description: Data interface adapters, data communication adapters, etc.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 20.0%

- Total Tax Rate: 45.0%

Key Notes:

- This code applies to adapters used in automatic data processing machines (e.g., servers, computers).

- Proactive Advice: Ensure the adapter is used in data processing systems and not for general telecommunication.

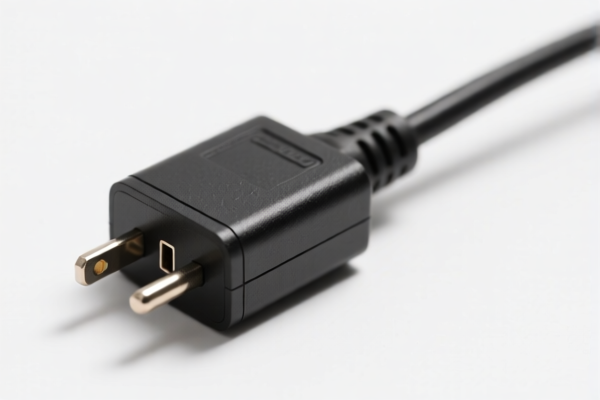

✅ HS CODE: 8536694040

Product Description: Connector adapters

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code covers electrical devices used for switching, protecting, or connecting circuits (e.g., power adapters, USB adapters).

- Proactive Advice: Verify if the adapter is used for circuit switching or protection (e.g., power strips, surge protectors).

✅ HS CODE: 8544421000

Product Description: Telephone line adapters

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to insulated wires or cables with modular telephone connectors (e.g., RJ11, RJ45).

- Proactive Advice: Confirm if the adapter includes a modular telephone connector and is used for telephone lines.

✅ HS CODE: 8548000000

Product Description: General-purpose adapters (not otherwise specified)

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This is a catch-all code for adapters not covered under more specific classifications.

- Proactive Advice: Use this code only when the adapter cannot be classified under more specific HS codes.

📌 Important Reminders:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to most of the above codes starting from this date.

- Anti-dumping duties: Not applicable for these products.

- Certifications: Ensure compliance with any required certifications (e.g., CE, FCC, RoHS) depending on the destination market.

- Material and Unit Price: Verify the exact material and unit price to ensure correct classification and avoid misdeclaration.

Let me know if you need help determining the most accurate HS code for your specific product model or brand.

Customer Reviews

No reviews yet.