| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708925000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8708998180 | Doc | 57.5% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325100080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7325995000 | Doc | 82.9% | CN | US | 2025-05-12 |

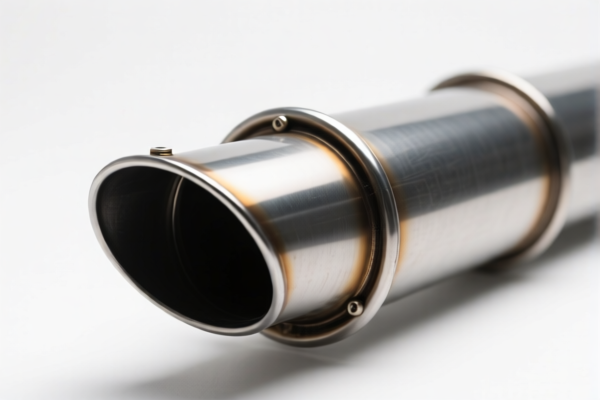

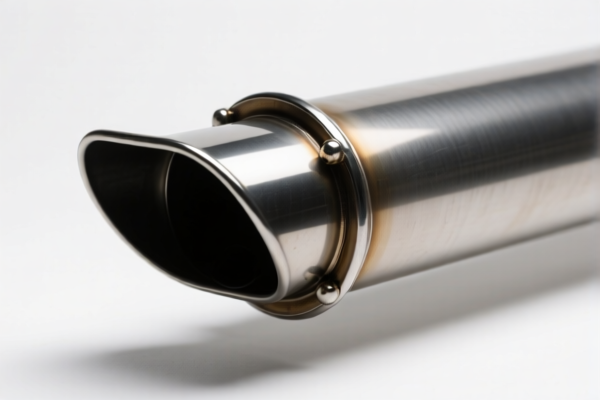

Here's a classification breakdown for "car exhaust pipe" based on available data:

-

8708.92.50.00: This HS code specifically covers Parts and accessories of motor vehicles; bodies, trailers and semi-trailers; other parts and accessories. More specifically, it targets Other parts and accessories: Mufflers and exhaust pipes; parts thereof: Mufflers and exhaust pipes: For other vehicles. This is a primary candidate for standard car exhaust pipes. 8708 indicates parts/accessories for motor vehicles, 08 specifies other parts, 92 focuses on mufflers/exhaust pipes, and 50 denotes exhaust pipes for other vehicles. Total tax rate: 57.5%.

-

7326.90.86.88: This code covers Other articles of iron or steel. This is relevant if the exhaust pipe is manufactured from iron or steel. 73 denotes articles of iron or steel, 26 covers other articles, 90 specifies other, and 86 denotes other. Total tax rate: 82.9%. Note that this HS code has an additional 25% tariff on steel/aluminum products effective after April 2, 2025.

Important Considerations:

- Material Composition: The material of the exhaust pipe is critical. If it’s steel or iron, 7326.90.86.88 is more appropriate. If it's another material, 8708.92.50.00 is likely the better fit.

- Vehicle Type: 8708.92.50.00 is for exhaust pipes intended for motor vehicles.

- Detailed Description: Provide a more specific description of the exhaust pipe (e.g., catalytic converter exhaust pipe, stainless steel exhaust pipe) to ensure the most accurate classification.

- Pricing and Certification: You should verify the price and whether any specific certifications are needed.

- Date of Import: Be aware that tariffs on steel/aluminum products under 7326.90.86.88 change after April 2, 2025.

Customer Reviews

No reviews yet.