| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6904900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6907231011 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6913902000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 6907401005 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6904900000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for ceramic tiles based on the provided HS codes. Please note that the classification and applicable tariffs depend on the specific type and characteristics of the ceramic tile being imported.

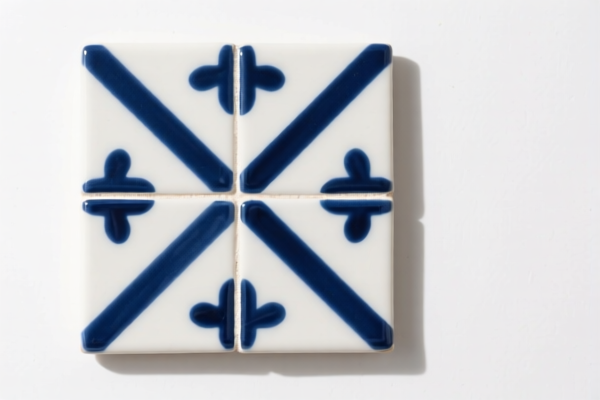

✅ HS CODE: 6904900000

Product Scope: Ceramic decorative tiles, ceramic carved tiles, ceramic painted tiles, ceramic art tiles (partially classified here)

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code covers decorative or artistic ceramic tiles that are not used for general construction.

- Proactive Advice: Confirm whether the tile is purely decorative or has functional use (e.g., wall or floor tiles), as this may affect classification.

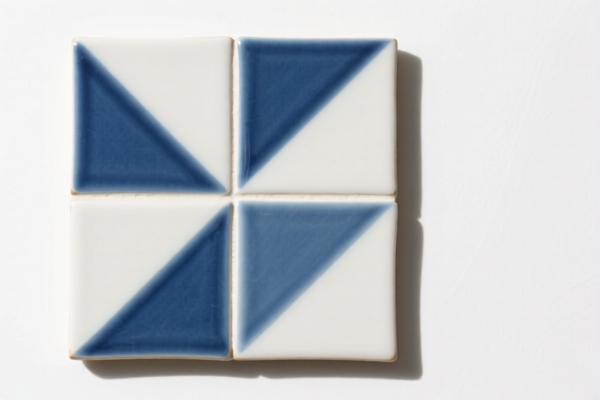

✅ HS CODE: 6907231011

Product Scope: Ceramic wall tiles

- Total Tax Rate: 65.0%

- Tariff Breakdown:

- Base Tariff: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for ceramic tiles specifically used as wall tiles.

- Proactive Advice: Ensure the product is clearly identified as a wall tile and not a floor tile, which may fall under a different code.

✅ HS CODE: 6913902000

Product Scope: Ceramic tile art decoration

- Total Tax Rate: 37.5%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for ceramic tiles used as decorative art pieces, not for construction.

- Proactive Advice: Confirm the product is not intended for structural use and is purely for artistic display.

✅ HS CODE: 6907401005

Product Scope: Ceramic art tiles (partially classified here)

- Total Tax Rate: 65.0%

- Tariff Breakdown:

- Base Tariff: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for ceramic tiles with artistic features, possibly used in interior design.

- Proactive Advice: Verify if the tile is considered an art piece or a functional tile, as this can change the classification.

✅ HS CODE: 6904100010

Product Scope: Decorative ceramic building bricks

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for decorative ceramic bricks used in construction.

- Proactive Advice: Confirm the product is not used for structural load-bearing purposes, which may fall under a different category.

✅ HS CODE: 6907219051

Product Scope: Ceramic tiles (partially classified here)

- Total Tax Rate: 63.5%

- Tariff Breakdown:

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for general-purpose ceramic tiles, possibly used for flooring or walls.

- Proactive Advice: Confirm the exact use (flooring, walling, etc.) and check for any certifications required (e.g., fire resistance, slip resistance).

✅ HS CODE: 6907211011

Product Scope: Ceramic tiles (partially classified here)

- Total Tax Rate: 65.0%

- Tariff Breakdown:

- Base Tariff: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for ceramic tiles that may be used in construction or interior design.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 6907231011 for wall tiles).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for ceramic tiles (unless specifically targeted by trade investigations).

- Certifications: Depending on the use (e.g., construction, export), you may need to provide certifications such as CE, ISO, or fire safety ratings.

- Material Verification: Confirm the material composition (e.g., porcelain, stoneware) and unit price to ensure correct classification and tax calculation.

If you provide more details about the specific type, use, and origin of the ceramic tile, I can help you determine the most accurate HS code and customs clearance strategy.

Customer Reviews

Great resource for understanding the trade regulations for plastic doors. Saved me hours of research.

The tariff rate information was clear, but I found the page a bit difficult to navigate at first.

I was impressed with how detailed the HS Code information was. It made exporting much easier for me.

The page was helpful, but I had to do a bit more research to confirm the exact duty rates for my product type.

Exactly what I needed for my import business. The details on the HS Code and duty rates were spot on.