Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9506290080 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9506995500 | Doc | 67.8% | CN | US | 2025-05-12 |

| 9505906000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9505902000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3926901000 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3926907500 | Doc | 34.2% | CN | US | 2025-05-12 |

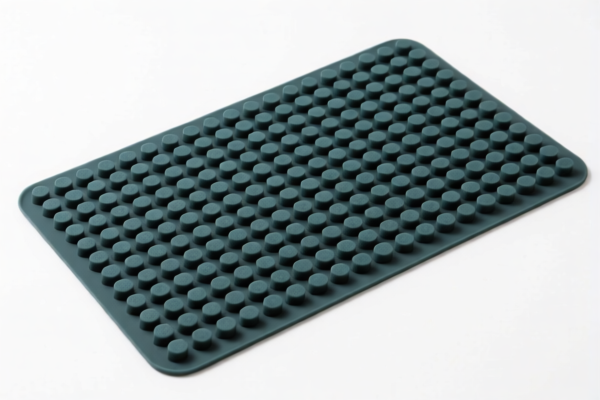

Here's a classification of "children's water mats" based on the provided data, presented in a structured format:

-

9506290080: Articles and equipment for general physical exercise, gymnastics, athletics, other sports (including table-tennis) or outdoor games, not specified or included elsewhere in this chapter.

- 95: Chapter 95 signifies articles for sports, games or toys.

- 06: Within Chapter 95, this code specifically covers exercise equipment, games and outdoor recreation items.

- 29: Further specifies other articles.

- 00: Indicates "other".

- 80: Further specifies “other”.

- Tax Rate: Base tariff: 0.0%, Additional tariff: 7.5%, Post 2025.4.2: 30%, Total: 37.5%. This is suitable if the mat is considered a recreational item for children.

-

3926907500: Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Pneumatic mattresses and other inflatable articles, not elsewhere specified or included.

- 39: Chapter 39 covers plastics and articles thereof.

- 26: Within Chapter 39, this code covers articles of plastics.

- 90: Further specifies other articles.

- 75: Indicates “Pneumatic mattresses and other inflatable articles”.

- 00: Further specifies “other”.

- Tax Rate: Base tariff: 4.2%, Additional tariff: 0.0%, Post 2025.4.2: 30%, Total: 34.2%. This is applicable if the mat is made of plastic and inflatable.

Important Considerations:

- Material Composition: The primary material of the water mat is crucial. If it's primarily plastic,

3926907500is more appropriate. If it’s a composite material or primarily used for sports/recreation,9506290080is better. - Intended Use: If the mat is specifically marketed as a sports or exercise item,

9506290080is the better choice. - Inflatable vs. Non-Inflatable: If the mat is inflatable,

3926907500becomes more relevant. - Certification: Please verify if any specific safety certifications are required for children's products in your destination market.

- Single Invoice: Confirm the single invoice price for the final tax rate.

Customer Reviews

No reviews yet.