Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8466208020 | Doc | 58.7% | CN | US | 2025-05-12 |

| 8487900080 | Doc | 108.9% | CN | US | 2025-05-12 |

| 8205700090 | Doc | 60.0% | CN | US | 2025-05-12 |

| 6909195095 | Doc | 59.0% | CN | US | 2025-05-12 |

| 8466208040 | Doc | 58.7% | CN | US | 2025-05-12 |

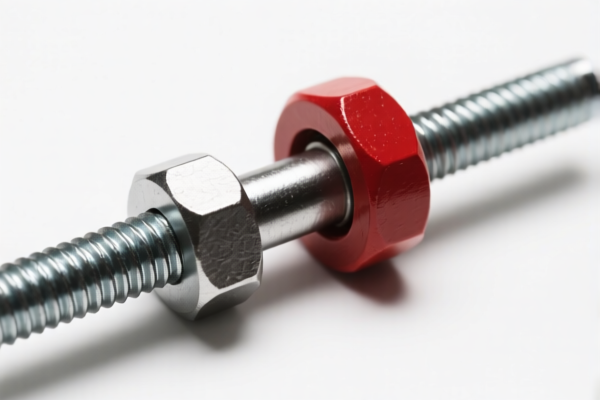

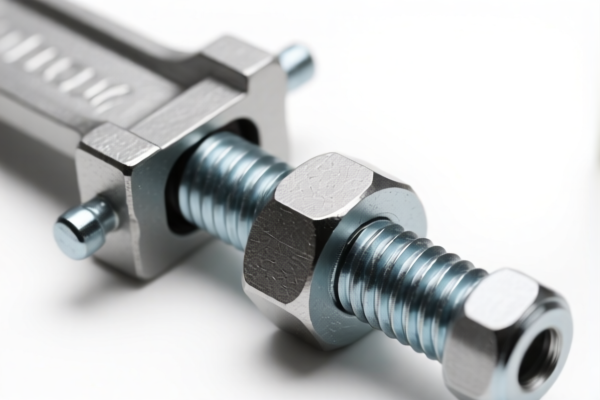

- HS CODE: 8466208020

- Product Description: Positioning jigs and fixtures for metalworking machine tools

- Base Tariff Rate: 3.7%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Key Notes:

- This code applies specifically to jigs and fixtures used in metalworking machinery.

- Verify the exact function and material of the product to ensure correct classification.

- HS CODE: 8487900080

- Product Description: Metal jigs

- Base Tariff Rate: 3.9%

- Additional Tariff (after April 11, 2025): 30.0%

- Steel and Aluminum Products Additional Tariff: 50.0%

- Total Tax Rate: 108.9%

- Key Notes:

- This code applies to metal jigs, with a significant increase in tax for steel and aluminum products.

- Be aware of the high additional tariffs if your product is made of steel or aluminum.

- Confirm the material composition before import.

- HS CODE: 8205700090

- Product Description: Woodworking jigs

- Base Tariff Rate: 5.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Key Notes:

- This code is for jigs used in woodworking machinery.

- Ensure the product is not misclassified under a different material category.

- HS CODE: 6909195095

- Product Description: Ceramic jigs

- Base Tariff Rate: 4.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.0%

- Key Notes:

- This code applies to ceramic jigs, which are not subject to anti-dumping duties.

- Confirm the material is ceramic and not a composite or mixed material.

- HS CODE: 8466208040

- Product Description: Parts and accessories for machines under headings 8456 to 8465, including working jigs

- Base Tariff Rate: 3.7%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Key Notes:

- This code covers parts and accessories for specific machinery, including jigs.

- Ensure the product is intended for use with the specified machinery.

Proactive Advice:

- Verify Material and Unit Price: Different materials (e.g., steel, aluminum, ceramic) may be subject to different additional tariffs.

- Check Required Certifications: Some products may require specific import licenses or certifications.

- Confirm Product Use: Ensure the product is correctly classified based on its intended use and function.

- Monitor Policy Changes: Be aware of any updates to tariff rates or regulations after April 11, 2025.

Customer Reviews

No reviews yet.