| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8205517500 | Doc | 58.7% | CN | US | 2025-05-12 |

| 8205598000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 8201906000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8201903000 | Doc | 2¢ each + 5.1%+55.0% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

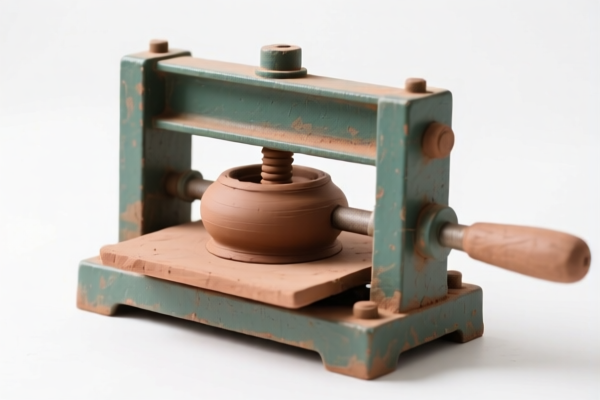

Clay Sculpting Tools

Clay sculpting tools are implements used to shape, carve, and refine clay models. These tools come in a wide variety of forms, each serving a specific purpose in the sculpting process. They are utilized across numerous disciplines, including pottery, ceramics, figurine making, and stop-motion animation.

Materials

Tools are commonly manufactured from the following materials:

- Metal: Stainless steel, carbon steel, and other alloys are durable and hold a sharp edge, suitable for carving and detail work.

- Wood: Often used for shaping larger forms, smoothing, and burnishing. Different wood types offer varying levels of hardness and flexibility.

- Plastic/Acrylic: Lightweight and inexpensive, suitable for basic shaping and smoothing, particularly for beginners.

- Rubber/Silicone: Used for smoothing, blending, and creating textures without damaging the clay.

- Wire: Used for cutting clay, creating armatures, and detailing.

Purpose & Function

The primary functions of clay sculpting tools are:

- Shaping: Adding and removing clay to create the desired form.

- Carving: Removing clay to define details and textures.

- Smoothing: Blending seams, refining surfaces, and removing imperfections.

- Detailing: Adding fine lines, patterns, and textures.

- Cutting: Separating clay pieces or creating clean edges.

Usage Scenarios

Clay sculpting tools are used in a diverse range of applications:

- Pottery & Ceramics: Shaping clay vessels, adding decorative elements, and refining forms.

- Figurative Sculpture: Creating realistic or stylized human and animal figures.

- Stop-Motion Animation: Building and manipulating clay characters for animated films.

- Relief Sculpture: Carving designs into a flat clay surface.

- Jewelry Making: Creating small, detailed clay components.

- Educational Purposes: Teaching art and sculpting techniques.

Common Types

- Loop Tools: Metal loops used for removing larger amounts of clay, often used in pottery.

- Rib Tools: Flat, curved tools used for smoothing and shaping clay surfaces.

- Needle Tools: Pointed tools used for carving fine details, scoring, and creating textures.

- Wire Cutters: Used for cutting clay from the block or separating pieces.

- Modeling Tools: A broad category encompassing tools with various shapes for shaping, smoothing, and blending. These often have pointed, rounded, or flat ends.

- Sponge: Used for smoothing surfaces and absorbing excess water.

- Scrapers: Used for removing clay and creating flat surfaces.

- Burnishers: Smooth, hard tools (often stone or metal) used to polish and refine the clay surface.

- Calipers: Used for measuring and ensuring symmetrical shapes.

- Extruders: Used for creating consistent shapes by forcing clay through a die.

The declared goods, “clay sculpting tool,” can be categorized based on material, use, and application. These tools are generally used for shaping clay, a material often employed in artistic creation, modeling, and prototyping.

The following HS codes are relevant based on the provided information:

- 8205.51.75.00: This code covers “Other handtools (including glass cutters) and parts thereof: Household tools, and parts thereof: Other”. While not explicitly mentioning sculpting tools, household tools can encompass items used for modeling and shaping, potentially including clay sculpting tools. The tax detail indicates a base tariff of 3.7%, a surcharge of 25.0%, and a surcharge of 30.0% after April 2, 2025, resulting in a total tax of 58.7%.

- 8205.59.80.00: This code refers to “Handtools (including glass cutters) not elsewhere specified or included; blow torches and similar self-contained torches; vises, clamps and the like, other than accessories for and parts of machine tools or water-jet cutting machines; anvils; portable forges; hand- or pedal-operated grinding wheels with frameworks; base metal parts thereof: Other handtools (including glass cutters) and parts thereof: Other: Other”. This is a broader category for handtools not specifically classified elsewhere, and could include sculpting tools. The tax detail is the same as 8205.51.75.00: a base tariff of 3.7%, a surcharge of 25.0%, and a surcharge of 30.0% after April 2, 2025, totaling 58.7%.

- 8201.90.60.00: This code covers “Other handtools of a kind used in agriculture, horticulture or forestry, and parts thereof: Other”. Although primarily for agricultural use, the definition of "handtools" could potentially include sculpting tools if used in a horticultural context (e.g., shaping clay for plant pots). The tax detail indicates a base tariff of 0.0%, a surcharge of 25.0%, and a surcharge of 30.0% after April 2, 2025, resulting in a total tax of 55.0%.

- 8201.90.30.00: This code refers to “Other handtools of a kind used in agriculture, horticulture or forestry, and parts thereof: Grass shears, and parts thereof (While not grass specifically, "sculpting" could be considered a form of shaping similar to shearing/cutting)”. The reference material notes that while not grass specifically, "sculpting" could be considered a form of shaping similar to shearing/cutting. The tax detail is 2¢ each + 5.1%, a surcharge of 25.0%, and a surcharge of 30.0% after April 2, 2025, totaling 2¢ each + 5.1% + 55.0%.

Customer Reviews

No reviews yet.