| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5607210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5607909000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 5609001000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 5609002000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5404198080 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5404191000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5908000000 | Doc | 58.4% | CN | US | 2025-05-12 |

| 5909001000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5909002000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 4201003000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4201006000 | Doc | 57.8% | CN | US | 2025-05-12 |

| 4205000500 | Doc | 57.9% | CN | US | 2025-05-12 |

| 4205001000 | Doc | 55.0% | CN | US | 2025-05-12 |

Cords

Cords are lengths of twisted or braided fibers, strands, or wires, used for binding, fastening, or connecting. Their versatility stems from their strength, flexibility, and relative inexpensiveness.

Materials

Cords are manufactured from a wide variety of materials, each imparting distinct properties:

- Natural Fibers: These include materials like:

- Cotton: Soft, comfortable, and biodegradable, but lower strength and susceptible to rot. Common in crafts and lighter applications.

- Hemp: Strong and durable, traditionally used in sailing and rope-making. Environmentally friendly.

- Jute: Coarse, strong fiber often used in packaging and construction.

- Sisal: Very strong and durable, resistant to saltwater, used in rope, twine, and rugs.

- Leather: Durable and aesthetically pleasing, used in crafting, clothing, and decorative applications.

- Synthetic Fibers: Offer enhanced strength, durability, and resistance to environmental factors:

- Nylon: High strength, elasticity, and abrasion resistance. Common in climbing ropes, parachutes, and industrial applications.

- Polyester: Strong, resistant to stretching and UV degradation. Used in clothing, webbing, and outdoor gear.

- Polypropylene: Lightweight, buoyant, and resistant to chemicals. Used in marine applications, packaging, and utility cords.

- Acrylic: Soft and resistant to sunlight, often used in decorative cords and crafting.

- Metal: Provides high strength and conductivity:

- Steel: Very strong, used in lifting, towing, and securing heavy loads. Often coated to prevent corrosion.

- Copper: Excellent conductivity, used in electrical cords and wiring.

- Aluminum: Lightweight and conductive, used in electrical applications.

Purpose & Function

The primary functions of cords include:

- Binding/Tying: Securing objects together, creating knots, and bundling items.

- Fastening: Closing bags, attaching components, and creating closures.

- Connecting: Linking objects, transmitting power (electrical cords), and transferring force (pull cords).

- Decorative: Used in crafting, jewelry making, and embellishments.

- Suspension: Supporting weight, such as in clotheslines or hanging decorations.

Usage Scenarios

Cords are employed in a vast array of applications:

- Household: Clotheslines, extension cords, appliance power cords, tie-downs, crafting, gardening.

- Outdoor/Recreational: Climbing ropes, camping cords, boating lines, fishing lines, parachute cords.

- Industrial: Lifting and towing, securing loads, construction, rigging, electrical wiring.

- Crafting/DIY: Jewelry making, macrame, weaving, tying knots, embellishing garments.

- Fashion: Drawstrings, laces, belts, decorative accents.

Common Types

- Rope: Typically thicker and stronger than cords, often used for heavy-duty applications.

- Twine: Thin, lightweight cord used for tying, packaging, and crafting.

- Paracord: Lightweight nylon cord with a core of multiple strands, known for its strength and versatility.

- Bungee Cord: Elastic cord used for securing objects with flexibility.

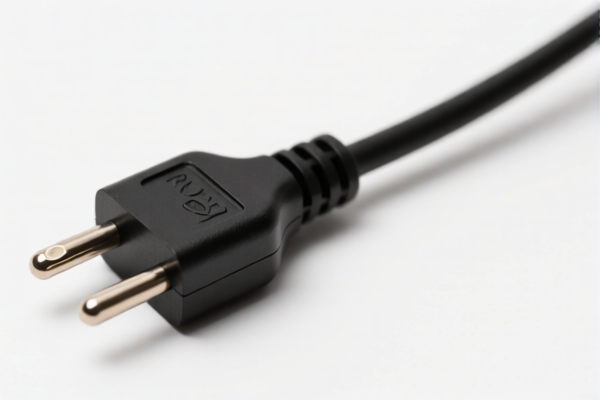

- Electrical Cord: Insulated wire used for transmitting electrical power.

- Drawstring: Cord used to close bags or garments.

- Macrame Cord: Typically made of cotton or synthetic fibers, used for the art of macrame.

- Clothesline Cord: Durable cord designed to withstand weather conditions and support wet clothing.

Based on the provided information, “cords” can potentially fall under several HS code classifications, depending on the material and specific application. Here's a breakdown of relevant HS codes:

- 5607210000: This code covers Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics: Of sisal or other textile fibers of the genus Agave: Binder or baler twine. This applies specifically to cords made from sisal or other Agave fibers used as binder or baler twine. The total tax rate is 55.0% (Base tariff: 0.0%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30.0%).

- 5607909000: This code covers Twine, cordage, ropes and cables, whether or not plaited or braided and whether or not impregnated, coated, covered or sheathed with rubber or plastics: Other: Other (201). This is a broader category for cords not specifically made from Agave fibers. The total tax rate is 61.3% (Base tariff: 6.3%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30.0%).

- 5908000000: This code covers Textile wicks, woven, plaited or knitted, for lamps, stoves, lighters, candles or the like; incandescent gas mantles and tubular knitted gas mantle fabric therefor, whether or not impregnated. If the cords are specifically textile wicks used in lamps, stoves, or similar applications, this code applies. The total tax rate is 58.4% (Base tariff: 3.4%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30.0%).

- 5609001000: This code covers Articles of yarn, strip or the like of heading 5404 or 5405, twine, cordage, rope or cables, not elsewhere specified or included: Of cotton. If the cords are made of cotton, this code is applicable. The total tax rate is 57.9% (Base tariff: 2.9%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30.0%).

- 5609002000: This code covers Articles of yarn, strip or the like of heading 5404 or 5405, twine, cordage, rope or cables, not elsewhere specified or included: Of vegetable fibers, except cotton. If the cords are made of vegetable fibers other than cotton, this code applies. The total tax rate is 55.0% (Base tariff: 0.0%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30.0%).

Important Note: The correct HS code depends on the material composition and intended use of the cords. Please verify the specific material and application to ensure accurate classification.

Customer Reviews

The information on the 5607909000 code for general cords was really helpful. The tariff details and effective dates are well-organized.

The site is good, but I had to look up the definitions of some terms like 'twine' and 'cordage' to understand the classifications better.

The table of HS codes and tariff rates for cords from China to the US is exactly what I needed for my import business. Highly recommended!

The explanation of the 5908000000 code for textile wicks was clear, but I wish there were more examples of cords used for decorative purposes.

The breakdown of different HS codes for various cord materials was really helpful. I found the 5609001000 code for cotton cords especially useful.