| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8467290035 | Doc | 37.5% | CN | US | 2025-05-12 |

| 6804226000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8208200090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8202390040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7105100011 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8467290035 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8205596000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8202916000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4107997090 | Doc | 35.0% | CN | US | 2025-05-12 |

Here is the classification and tariff information for cutting discs based on the provided HS codes and details:

✅ HS CODE: 8467290035

Product Type: Stone cutting discs (handheld tools)

Total Tax Rate: 37.5%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This classification applies to stone cutting discs used as handheld tools.

- The special tariff of 30.0% will apply after April 11, 2025.

- Proactive Advice: Confirm the material composition and intended use to ensure correct classification.

✅ HS CODE: 6804226000

Product Type: Ceramic cutting discs

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to ceramic cutting discs or other abrasive tools made of ceramic or aggregated abrasives.

- The special tariff of 30.0% will apply after April 11, 2025.

- Proactive Advice: Verify if the product is ceramic-based and whether it is used for cutting or grinding.

✅ HS CODE: 8208200090

Product Type: Wood cutting discs

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code is specific to woodworking cutting discs.

- The special tariff of 30.0% will apply after April 11, 2025.

- Proactive Advice: Ensure the product is specifically for wood cutting and not for other materials.

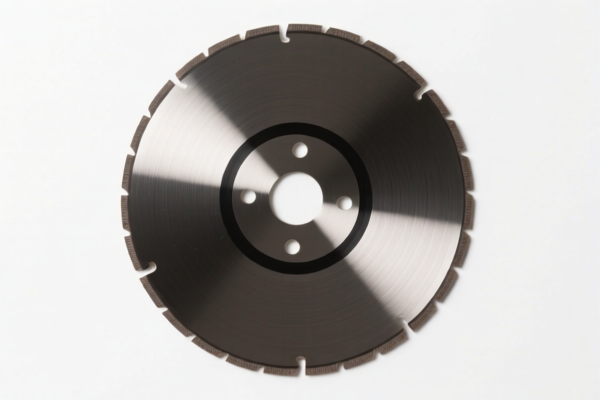

✅ HS CODE: 8202390040

Product Type: Diamond cutting discs

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to diamond-tipped cutting discs, including circular saw blades and parts.

- The special tariff of 30.0% will apply after April 11, 2025.

- Proactive Advice: Confirm the presence of diamond abrasives and the type of blade (e.g., circular, slotting).

✅ HS CODE: 8205596000

Product Type: Copper cutting discs

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code is for cutting discs made of copper, used as hand tools.

- The special tariff of 30.0% will apply after April 11, 2025.

- Proactive Advice: Verify the material is copper and the intended use (e.g., cutting, grinding).

📌 Important Reminders:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will apply to all the above products after April 11, 2025.

- Certifications: Depending on the material (e.g., diamond, ceramic), you may need to provide certifications or technical specifications for customs clearance.

- Material Verification: Always confirm the material composition and intended use to avoid misclassification and potential penalties.

Let me know if you need help determining the correct HS code for your specific cutting disc.

Customer Reviews

I was exporting plastic doors and needed HS Code info. This page gave me exactly what I was looking for—thank you!

The info on the 5% tariff rate was helpful, but I had to look up some of the trade terms. Still, it was a good starting point.

This resource saved me time. The HS Code 3925 explanation was spot-on and the trade details were exactly what I needed.

The details on the 5% tariff rate were easy to understand, but I would have liked to see more about import duties in other countries.

I was looking for HS code info for plastic doors and found exactly what I needed. Perfect for exporting to the US.