| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708994100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8409991060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8409913000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8503009550 | Doc | 58.0% | CN | US | 2025-05-12 |

| 8412310040 | Doc | 55.0% | CN | US | 2025-05-12 |

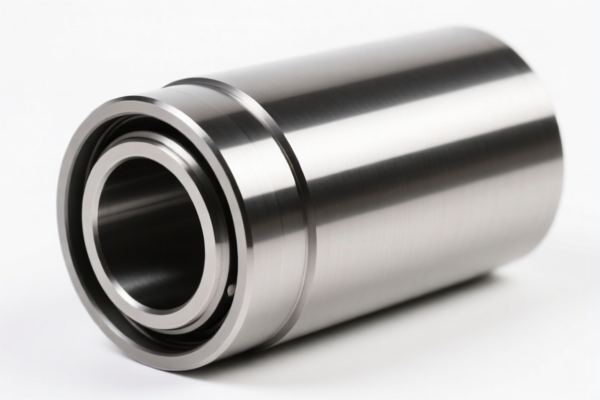

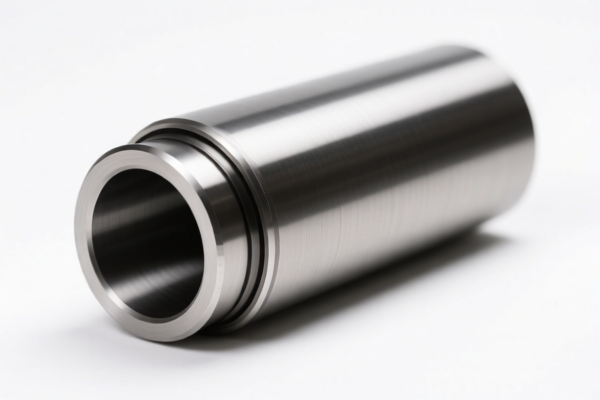

Based on the product "cylinder liners", here is the detailed classification and tariff information for the relevant HS codes:

✅ HS CODE: 8708994100

Product Description: Tractor cylinder liners (parts and accessories of vehicles)

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is specifically for tractor-related cylinder liners.

- Ensure the product is not used in other types of engines (e.g., marine or industrial), as that would change the classification.

✅ HS CODE: 8409991060

Product Description: Cast iron cylinder liners for marine engines

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to marine engine parts, specifically cast iron cylinder liners.

- Confirm the material (must be cast iron) and intended use (marine engine) to ensure correct classification.

✅ HS CODE: 8409913000

Product Description: Cylinder liners for internal combustion engines

- Base Tariff Rate: 2.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.5%

- Notes:

- This code is for general-purpose cylinder liners used in internal combustion engines.

- May apply to automotive, industrial, or other engine types.

- Higher base rate compared to other codes, so material and use must be carefully verified.

✅ HS CODE: 8409999990

Product Description: Parts of engines (e.g., cylinder blocks)

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is for engine parts under HS Chapters 8407 or 8408.

- Cylinder liners may fall under this code if they are not specifically marine or tractor-related.

- Ensure the engine type is not covered by more specific codes (e.g., 8409991060 or 8708994100).

✅ HS CODE: 8409999290

Product Description: Cylinder heads for marine engines

- Base Tariff Rate: 2.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.5%

- Notes:

- This code is for marine engine cylinder heads, not cylinder liners.

- Not applicable to your product unless it is a cylinder head, not a liner.

📌 Proactive Advice for Importers:

- Verify the exact product type: Is it a liner, cylinder head, or block?

- Confirm the material: Cast iron, aluminum, or other? (May affect anti-dumping duties)

- Check the intended use: Tractor, marine, automotive, or industrial?

- Review certifications: Some products may require technical documentation or origin certificates.

- Monitor the April 11, 2025, tariff change: This will increase the additional tariff by 5 percentage points.

- Check for anti-dumping duties: If the product is aluminum or iron-based, additional duties may apply depending on the country of origin.

Let me know if you need help determining the most accurate HS code based on your product specifications.

Customer Reviews

The information on the difference between cylinder liners and cylinder heads was very enlightening and saved me from a potential classification error.

The notes on verifying the material and intended use for HS Code 8409913000 were incredibly useful for my product classification.

I found the explanation of the 57.5% tax rate for HS Code 8409913000 very clear. It helped me understand the base rate and additional tariffs.

The section on 8409999290 was a bit confusing. I was looking for cylinder liners, not cylinder heads, so that code didn’t apply to me.

The breakdown of HS Code 8409991060 with the material and use notes was exactly what I needed for my cast iron marine cylinder liners.