| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9601908000 | Doc | 41.2% | CN | US | 2025-05-12 |

| 9602004000 | Doc | 39.3% | CN | US | 2025-05-12 |

| 9602005080 | Doc | 40.2% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325995000 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325991000 | Doc | 80.0% | CN | US | 2025-05-12 |

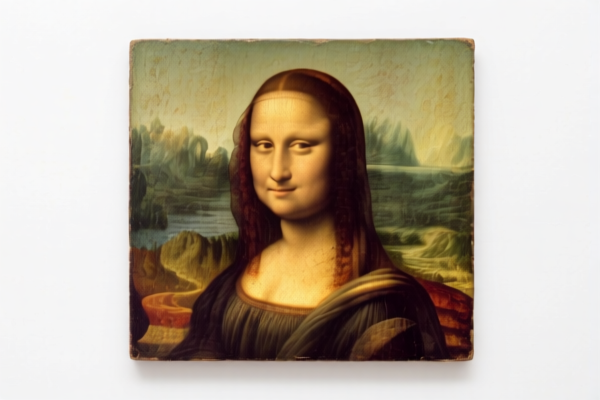

Decorative Figurine

A decorative figurine is a small, three-dimensional representation of a person, animal, or object, created primarily for aesthetic enjoyment and ornamentation rather than practical use. These items are often collectibles and are produced from a wide variety of materials.

Materials

Figurines are crafted from numerous substances, impacting their value, durability, and appearance:

- Porcelain: Highly valued for its delicate appearance, translucence, and ability to hold fine detail. Historically associated with high-quality craftsmanship (e.g., Meissen, Sèvres).

- Ceramics/Pottery: A broader category encompassing earthenware, stoneware, and other fired clay bodies. More robust than porcelain, allowing for diverse glazes and finishes.

- Glass: Can be molded, blown, or cast, offering transparency, color variation, and intricate designs (e.g., Murano glass).

- Metal: Bronze, brass, pewter, silver, and gold are used for durability and a sense of weight and permanence. Often used for detailed sculptures.

- Wood: Carved wood figurines range from simple folk art to highly detailed representations.

- Plastic/Resin: Modern materials offering affordability and versatility in design. Commonly used for mass-produced figurines.

- Stone: Marble, jade, and other stones provide a sense of permanence and often used for larger, more substantial pieces.

- Polymer Clay: A versatile material popular among hobbyists and artisans for its ease of sculpting and wide range of colors.

Purpose and Function

The primary function of a decorative figurine is aesthetic enhancement. They serve to:

- Ornament spaces: Placed on shelves, mantels, desks, or tables to add visual interest.

- Reflect personal taste: Collections often represent hobbies, interests, or cultural affiliations.

- Commemorate events or people: Figurines can depict historical figures, beloved characters, or special occasions.

- Serve as collectibles: Some figurines are produced in limited editions and gain value over time.

- Represent symbolism: Certain figures may carry cultural or religious meaning.

Usage Scenarios

- Home Décor: Most commonly used to decorate living rooms, bedrooms, dining rooms, and offices.

- Display Cases/Cabinets: Protecting valuable or delicate figurines.

- Collections: Arranged in dedicated spaces or integrated into broader collections of art and antiques.

- Gifting: Often given as presents for special occasions or as tokens of appreciation.

- Table Centerpieces: Used to enhance dining experiences.

Common Types

- Animal Figurines: Depicting a wide variety of creatures, from domestic pets to exotic wildlife.

- Human Figurines: Representing historical figures, fictional characters, or idealized forms.

- Religious Figurines: Depicting deities, saints, or biblical scenes.

- Fantasy Figurines: Dragons, unicorns, and other mythical creatures.

- Character Figurines: Based on popular books, movies, television shows, and video games.

- Abstract Figurines: Non-representational forms emphasizing shape, color, and texture.

- Nativities: Depicting the birth of Jesus, commonly displayed during Christmas.

- Ballerinas/Dancers: Often made of porcelain, representing grace and artistry.

- Miniature Figurines: Small-scale representations used in dollhouses or dioramas.

Decorative figurines can fall under several HS code classifications depending on their material composition. Here's a breakdown of potential HS codes based on the provided information:

-

9601908000: This HS code covers worked ivory, bone, tortoise-shell, horn, antlers, coral, mother-of-pearl, and other animal carving material, and articles of these materials (including articles obtained by molding). If the decorative figurine is made of any of these animal-derived materials, this is the appropriate classification. The total tax rate is 41.2%, comprised of a 3.7% base tariff, a 7.5% additional tariff, and a 30.0% additional tariff effective April 2, 2025.

-

9602004000: This HS code applies to molded or carved articles of wax. If the figurine is made of wax, this code is relevant. The total tax rate is 39.3%, consisting of a 1.8% base tariff, a 7.5% additional tariff, and a 30.0% additional tariff effective April 2, 2025.

-

9602005080: This HS code covers other worked vegetable or mineral carving material and articles of these materials, not elsewhere specified or included. If the figurine is made of vegetable or mineral materials (like stone, wood, or resin) and doesn't fall under other specific classifications, this code may apply. The total tax rate is 40.2%, consisting of a 2.7% base tariff, a 7.5% additional tariff, and a 30.0% additional tariff effective April 2, 2025.

-

7326908688: This HS code covers other articles of iron or steel. If the figurine is made of iron or steel, this code is applicable. The total tax rate is 82.9%, comprised of a 2.9% base tariff, a 25.0% additional tariff, and a 30.0% additional tariff effective April 2, 2025. Note that steel and aluminum products are subject to a 25% additional tariff.

-

7325995000: This HS code covers other cast articles of iron or steel. If the figurine is a cast iron or steel article, this code may be relevant. The total tax rate is 82.9%, comprised of a 2.9% base tariff, a 25.0% additional tariff, and a 30.0% additional tariff effective April 2, 2025. Note that steel and aluminum products are subject to a 25% additional tariff.

It is important to determine the precise material composition of the decorative figurine to select the correct HS code.

Customer Reviews

No reviews yet.