| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9701910000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911914040 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911912020 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9702900000 | Doc | 37.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for decorative paintings, based on the provided HS codes and tax details:

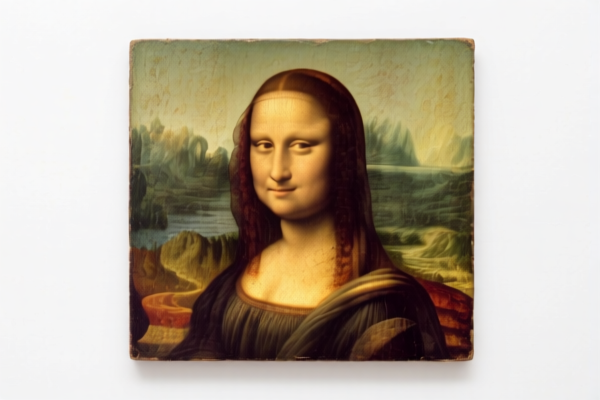

✅ HS CODE: 9701910000

Product Description: Decorative paintings made entirely by hand (e.g., hand-painted paintings, sketches, and pastels).

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

Key Notes:

- This classification applies to handmade decorative paintings.

- Verify whether the product is entirely hand-painted or includes any printed elements, as this may affect classification.

- Certifications may be required if the product is being imported for commercial use (e.g., origin documentation, artistic certification).

✅ HS CODE: 4911998000

Product Description: Decorative paintings classified under printed materials (e.g., printed images, photos, or posters).

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

Key Notes:

- This code applies to printed decorative paintings, not hand-painted ones.

- Material and production method are critical for correct classification.

- Check if the product is printed on paper, cardboard, or other materials, as this may influence the applicable code.

✅ HS CODE: 4911914040

Product Description: Decorative paintings classified under printed images or photos (e.g., posters, printed art).

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

Key Notes:

- This code is for printed decorative paintings, typically used for advertising or interior decoration.

- Confirm the printing method and material (e.g., paper, cardboard) to ensure correct classification.

- Documentation such as printing proofs or production records may be required for customs clearance.

✅ HS CODE: 4911912020

Product Description: Decorative paintings classified under lithographs or posters made of paper or cardboard with thickness ≤ 0.51 mm and not more than 20 years old.

Total Tax Rate: 30.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

Key Notes:

- This code applies to lithographic prints or posters made of thin paper or cardboard.

- Age of the product is a factor (must be less than 20 years old).

- Material thickness must be verified to ensure compliance with the code.

✅ HS CODE: 9702900000

Product Description: Decorative paintings classified under original prints (e.g., woodcuts, engravings, lithographs).

Total Tax Rate: 37.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

Key Notes:

- This code applies to original prints such as woodcuts, engravings, or lithographs.

- Verify whether the product is an original print or a reproduction, as this affects classification.

- Certifications may be required for artistic or collectible items.

📌 Proactive Advice for Importers:

- Verify the production method (handmade vs. printed) and material (paper, cardboard, etc.) to ensure correct HS code classification.

- Check the age of the product if it falls under code 4911912020.

- Review the unit price and material composition to determine if any additional duties apply.

- Stay updated on the April 11, 2025 tariff changes, as they may significantly increase the total tax burden.

- Consult with a customs broker or import compliance expert to ensure full compliance with local regulations.

Let me know if you need help determining the correct HS code for a specific product sample.

Customer Reviews

I found the plastic builder’s door HS code and tariff details very precise. Perfect for my export planning.

The information on the 5% tariff rate was helpful, though I would have liked a bit more context on how it’s calculated.

Finally a page that clearly explains the HS code and tariff for plastic doors. Saved me hours of research.

The tariff details for 2025 are well laid out. Helped me understand the cost implications for my business.

I was looking for HS code info for plastic doors and found exactly what I needed. Great resource for exporters.