| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8518302000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9018904000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9021904040 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7113195030 | Doc | 43.0% | CN | US | 2025-05-12 |

| 7117199000 | Doc | 48.5% | CN | US | 2025-05-12 |

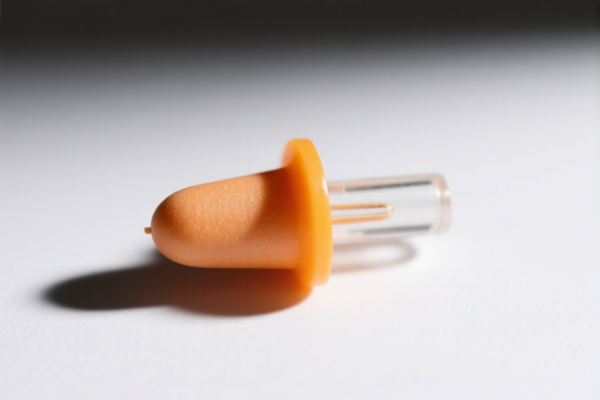

Product Name: Earplug

Classification Overview: Based on the product type and material, the following HS codes and tariff details apply:

✅ HS CODE: 8518302000

Product Type: Earbuds, wireless earbuds, noise-canceling earbuds, etc.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for general-purpose audio devices, not medical or assistive devices.

Proactive Advice:

- Confirm the product is for audio use (e.g., music, calls) and not for medical or assistive purposes.

- Be aware of the significant increase in tariffs after April 11, 2025.

✅ HS CODE: 9018904000

Product Type: Earplugs used in stethoscopes (medical instruments)

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for medical equipment parts, not general-purpose earplugs.

Proactive Advice:

- Ensure the product is specifically used with medical devices like stethoscopes.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 9021904040

Product Type: Silicone earplugs for hearing aids

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for assistive devices, not general-purpose earplugs.

Proactive Advice:

- Confirm the product is used with hearing aids or assistive listening devices.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 7113195030

Product Type: Earrings made of precious metals (e.g., gold, silver)

Tariff Summary:

- Base Tariff Rate: 5.5%

- Additional Tariff: 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for jewelry, not earplugs.

Proactive Advice:

- This code is for earrings, not earplugs. Ensure the product is jewelry and not an audio or medical device.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 7117199000

Product Type: Earrings made of other materials (e.g., plastic, alloy)

Tariff Summary:

- Base Tariff Rate: 11.0%

- Additional Tariff: 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for jewelry, not earplugs.

Proactive Advice:

- This code is for earrings, not earplugs. Ensure the product is jewelry and not an audio or medical device.

- Be aware of the 30% tariff increase after April 11, 2025.

📌 Key Takeaways:

- Earplugs used for audio devices, medical purposes, or assistive listening fall under HS CODE 8518302000, 9018904000, or 9021904040 respectively.

- Earrings are classified under 7113195030 or 7117199000, and are not related to earplugs.

- All classifications are subject to a 30% additional tariff after April 11, 2025.

- Verify the product's intended use and material to ensure correct classification and avoid customs delays or penalties.

Product Name: Earplug

Classification Overview: Based on the product type and material, the following HS codes and tariff details apply:

✅ HS CODE: 8518302000

Product Type: Earbuds, wireless earbuds, noise-canceling earbuds, etc.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for general-purpose audio devices, not medical or assistive devices.

Proactive Advice:

- Confirm the product is for audio use (e.g., music, calls) and not for medical or assistive purposes.

- Be aware of the significant increase in tariffs after April 11, 2025.

✅ HS CODE: 9018904000

Product Type: Earplugs used in stethoscopes (medical instruments)

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for medical equipment parts, not general-purpose earplugs.

Proactive Advice:

- Ensure the product is specifically used with medical devices like stethoscopes.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 9021904040

Product Type: Silicone earplugs for hearing aids

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for assistive devices, not general-purpose earplugs.

Proactive Advice:

- Confirm the product is used with hearing aids or assistive listening devices.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 7113195030

Product Type: Earrings made of precious metals (e.g., gold, silver)

Tariff Summary:

- Base Tariff Rate: 5.5%

- Additional Tariff: 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for jewelry, not earplugs.

Proactive Advice:

- This code is for earrings, not earplugs. Ensure the product is jewelry and not an audio or medical device.

- Be aware of the 30% tariff increase after April 11, 2025.

✅ HS CODE: 7117199000

Product Type: Earrings made of other materials (e.g., plastic, alloy)

Tariff Summary:

- Base Tariff Rate: 11.0%

- Additional Tariff: 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes: This classification is for jewelry, not earplugs.

Proactive Advice:

- This code is for earrings, not earplugs. Ensure the product is jewelry and not an audio or medical device.

- Be aware of the 30% tariff increase after April 11, 2025.

📌 Key Takeaways:

- Earplugs used for audio devices, medical purposes, or assistive listening fall under HS CODE 8518302000, 9018904000, or 9021904040 respectively.

- Earrings are classified under 7113195030 or 7117199000, and are not related to earplugs.

- All classifications are subject to a 30% additional tariff after April 11, 2025.

- Verify the product's intended use and material to ensure correct classification and avoid customs delays or penalties.

Customer Reviews

No reviews yet.