| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8210000000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 8214909000 | Doc | 1.4¢ each + 3.2%+30.0% | CN | US | 2025-05-12 |

| 3924104000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3924102000 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3926901600 | Doc | 40.6% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

Egg Ring

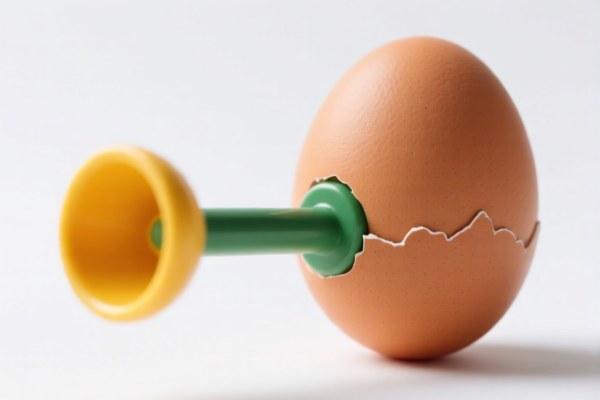

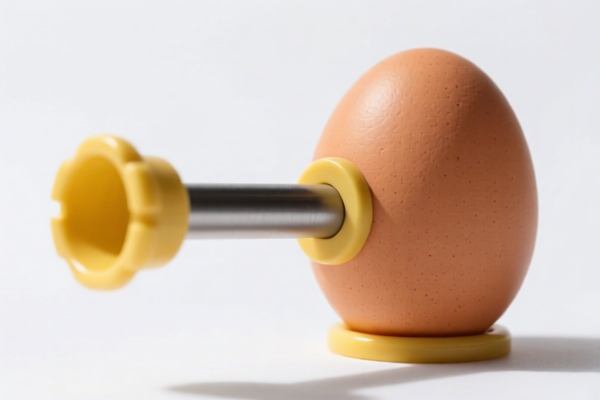

An egg ring, also known as an egg mold or egg perfector, is a kitchen tool used to cook eggs with a consistent, uniform shape. It is typically made of stainless steel, silicone, or Teflon-coated metal.

Material:

- Stainless Steel: Durable, long-lasting, and resistant to rust. Often preferred for its ability to withstand high heat.

- Silicone: Flexible, non-stick, and heat-resistant. Easier to handle and store, but may not hold its shape as well as steel at very high temperatures.

- Teflon-coated Metal: Provides a non-stick surface, but the coating can degrade over time with excessive use or improper cleaning.

Purpose:

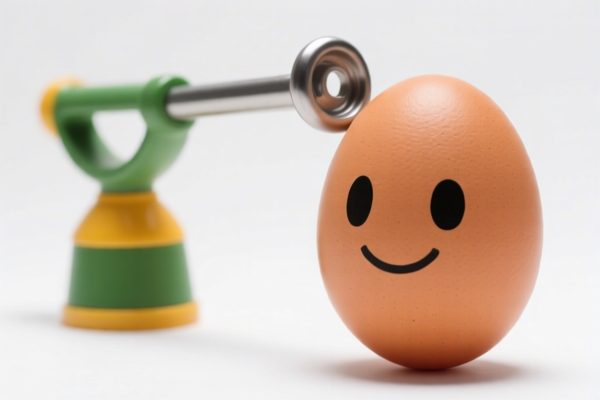

The primary purpose of an egg ring is to create perfectly shaped eggs, such as round, heart-shaped, star-shaped, or other decorative forms. This is particularly useful for breakfast presentations, brunch services, or creating visually appealing dishes.

Function:

An egg ring works by containing the egg within a defined perimeter during cooking. The ring is placed on a cooking surface (typically a griddle or frying pan) and the egg is cracked inside. The ring prevents the egg from spreading, resulting in a neatly formed shape.

Usage Scenarios:

- Breakfast: Creating uniform eggs for breakfast sandwiches, plates, or brunches.

- Brunch: Enhancing the presentation of brunch dishes with decorative egg shapes.

- Meal Preparation: Ensuring consistent egg portions for meal prepping or catering.

- Children's Meals: Making fun and appealing egg shapes to encourage children to eat.

- Benedict Eggs: Creating a perfect ring for poached eggs in Eggs Benedict.

Common Types:

- Round Egg Rings: The most common type, used for creating standard circular eggs.

- Shaped Egg Rings: Available in various shapes like hearts, stars, flowers, animals, and letters.

- Adjustable Egg Rings: Feature adjustable diameters to accommodate different egg sizes or create varying ring thicknesses.

- Non-Stick Egg Rings: Coated with Teflon or silicone for easy release and cleaning.

- Multi-Ring Sets: Include multiple rings of the same or different shapes for cooking several eggs simultaneously.

- Long Egg Rings: Designed for making long, pancake-like eggs.

Based on the material, use, and application scenarios, an egg ring is a kitchen tool used for cooking eggs, typically made of metal. Here are the relevant HS codes from the provided reference material:

- 8210000000: This HS code covers hand-operated mechanical appliances, weighing 10 kg or less, used in the preparation, conditioning or serving of food or drink, and base metal parts thereof. An egg ring falls under this category as a hand-operated appliance used in food preparation.

- 82: Chapter 82 – Articles of cutlery, forks, spoons, knives, dessert-spoons, side-forks, fish-forks and fish-knives, and parts thereof.

- 10: Heading 8210 – Articles of cutlery, forks, spoons, knives, dessert-spoons, side-forks, fish-forks and fish-knives, and parts thereof.

- 000000: This specifies all articles within the heading.

- 3926901600: This HS code covers other articles of plastics and articles of other materials of headings 3901 to 3914, specifically pacifiers. While an egg ring is not a pacifier, if it is made of plastic, this code could be relevant.

- 39: Chapter 39 – Plastics and articles thereof.

- 26: Heading 3926 – Other articles of plastics and articles of other materials of headings 3901 to 3914.

- 901600: This specifies other laboratory ware, including pacifiers.

Regarding HS code 8210000000, please note that the applicable tax rate is a base tariff of 3.7%, a surcharge of 25.0%, and a surcharge of 30.0% after April 2, 2025, resulting in a total tariff of 58.7%.

Customer Reviews

No reviews yet.