| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8544110020 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8544606000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 8544429010 | Doc | 57.6% | CN | US | 2025-05-12 |

| 8544499000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 8529102190 | Doc | 55.0% | CN | US | 2025-05-12 |

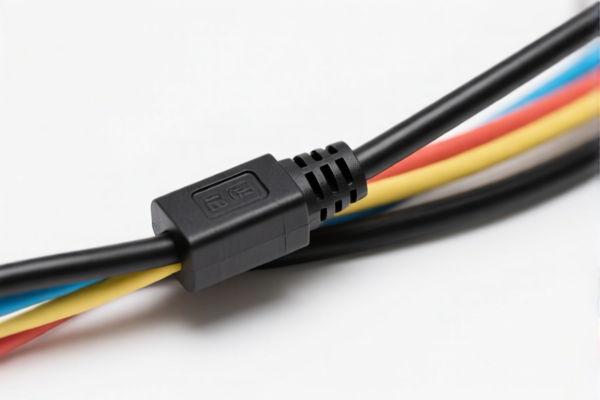

Here is the classification and tariff information for electric cables based on the provided HS codes. This breakdown includes the applicable tariffs and key considerations for customs compliance:

✅ HS CODE: 8544110020

Product Description: Insulated wires, not exceeding diameter limits

Total Tax Rate: 58.5%

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to insulated wires with specific diameter restrictions.

- Action Required: Verify the wire's diameter and insulation type to ensure correct classification.

✅ HS CODE: 8544606000

Product Description: Insulated wires, cables (including coaxial cables), and other insulated conductors, whether or not fitted with connectors

Total Tax Rate: 58.2%

- Base Tariff Rate: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code covers a broad range of insulated cables, including coaxial types.

- Action Required: Confirm whether the cable includes connectors or is part of a larger assembly.

✅ HS CODE: 8544429010

Product Description: Extension cords as defined in statistical note 6

Total Tax Rate: 57.6%

- Base Tariff Rate: 2.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to extension cords defined under statistical note 6.

- Action Required: Ensure the product matches the definition in statistical note 6.

✅ HS CODE: 8544499000

Product Description: Insulated wires, cables, and other insulated conductors, with voltage not exceeding 1000V

Total Tax Rate: 58.9%

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to low-voltage insulated cables.

- Action Required: Confirm the voltage rating of the cable to ensure correct classification.

✅ HS CODE: 8529102190

Product Description: Other television antenna accessories

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for accessories related to TV antennas, not general cables.

- Action Required: Ensure the product is not classified under a more general cable code.

📌 Important Notes for All Products:

- Time-Sensitive Policy:

- Additional tariffs of 25.0% are currently in effect.

- Special tariffs of 30.0% will be imposed after April 11, 2025.

-

Be sure to plan your import timeline accordingly.

-

Anti-Dumping Duties:

- Not applicable for electric cables unless the product is made of iron or aluminum and subject to specific anti-dumping measures.

-

Action Required: If your product contains such materials, verify if it is subject to anti-dumping duties.

-

Certifications Required:

- Depending on the destination country, certifications such as CE, RoHS, or UL may be required.

-

Action Required: Confirm the required certifications for your target market.

-

Material and Unit Price Verification:

- Accurate classification depends on the material composition and technical specifications of the product.

- Action Required: Always verify the product’s material and unit price to avoid misclassification and potential penalties.

Let me know if you need help determining the correct HS code for a specific type of electric cable or assistance with customs documentation.

Customer Reviews

I was impressed by how clearly the HS code 3925 is explained. Very helpful for someone new to international trade.

The information is accurate and well-organized. I would have liked a comparison with other similar products though.

This page saved me hours of research. The HS code and tariff info for plastic doors is spot on.

The details on exporting plastic doors to the US were very helpful. I just wish there were more countries covered.

Finally found a resource that explains the 5% tariff rate for plastic doors in simple terms. Exactly what I needed for my business.