| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8501102000 | Doc | 61.7% | CN | US | 2025-05-12 |

| 8501402020 | Doc | 58.3% | CN | US | 2025-05-12 |

| 8479891000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8479904100 | Doc | 37.5% | CN | US | 2025-05-12 |

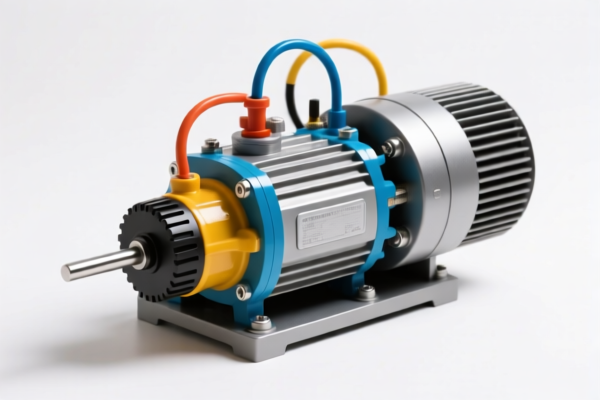

Electric Machinery

Electric machinery encompasses a broad range of devices that convert electrical energy into mechanical energy, or vice versa. These machines are fundamental to numerous applications across diverse industries.

Core Principle:

The operation of electric machinery relies on the principles of electromagnetism, specifically the interaction between magnetic fields and electric currents. When an electric current flows through a conductor within a magnetic field, a force is generated. This force can be harnessed to produce motion, or conversely, motion can be used to generate electricity.

Types of Electric Machinery:

Electric machinery is broadly categorized into two main types: rotary and linear. Within these categories are numerous sub-types, each suited for specific applications.

-

Rotary Machines: These machines involve the rotation of a shaft.

- Motors: Convert electrical energy into mechanical energy.

- DC Motors: Utilize direct current. Common types include:

- Brushed DC Motors: Simpler construction, lower cost, but require regular maintenance due to brush wear.

- Brushless DC Motors (BLDC): Higher efficiency, longer lifespan, quieter operation, but more complex control.

- Servo Motors: Precise position control, used in robotics and automation.

- AC Motors: Utilize alternating current. Common types include:

- Induction Motors: Robust, widely used in industrial applications, relatively low cost. Further divided into:

- Squirrel-Cage Induction Motors: Most common type, simple construction, high reliability.

- Wound-Rotor Induction Motors: Allow for speed control, but more complex and expensive.

- Synchronous Motors: Maintain a constant speed synchronized with the AC power frequency, used in applications requiring precise speed control.

- Induction Motors: Robust, widely used in industrial applications, relatively low cost. Further divided into:

- Universal Motors: Can operate on both AC and DC power, high starting torque, used in portable power tools.

- DC Motors: Utilize direct current. Common types include:

- Generators: Convert mechanical energy into electrical energy.

- DC Generators: Produce direct current.

- AC Generators (Alternators): Produce alternating current. These are the primary source of electricity in power plants.

- Motors: Convert electrical energy into mechanical energy.

-

Linear Machines: These machines produce linear motion.

- Linear Motors: Directly convert electrical energy into linear force. Used in high-speed trains, actuators, and precision positioning systems.

- Linear Generators: Convert linear motion into electrical energy.

Materials:

The construction of electric machinery utilizes a variety of materials:

- Conductors: Copper and aluminum are commonly used for windings due to their high electrical conductivity.

- Magnetic Materials: Iron, steel, and specialized alloys (e.g., silicon steel) are used for cores and rotors to concentrate magnetic flux. Rare-earth magnets (e.g., neodymium magnets) are used in high-performance motors.

- Insulation: Various materials (e.g., polymers, ceramics) are used to electrically isolate windings and other components.

- Structural Materials: Steel, aluminum, and composite materials are used for housings, frames, and shafts.

Applications:

Electric machinery is ubiquitous in modern life:

- Industrial Automation: Motors drive pumps, fans, compressors, conveyors, and robots.

- Transportation: Electric motors power electric vehicles, trains, and aircraft.

- Power Generation: Generators produce electricity in power plants.

- Household Appliances: Motors drive washing machines, refrigerators, air conditioners, and other appliances.

- HVAC Systems: Motors control fans, pumps, and compressors.

- Medical Equipment: Motors are used in MRI machines, surgical robots, and other medical devices.

Usage Scenarios & Considerations:

The selection of an appropriate electric machine depends on several factors:

- Power Requirements: The amount of power needed.

- Speed Requirements: The desired operating speed.

- Torque Requirements: The amount of rotational force needed.

- Duty Cycle: Whether the machine will operate continuously or intermittently.

- Environment: The operating temperature, humidity, and presence of contaminants.

- Efficiency: The percentage of electrical energy converted into mechanical energy.

- Cost: The initial purchase price and operating costs.

- Maintenance Requirements: The frequency and complexity of maintenance tasks.

Electric machinery broadly encompasses electric motors and generators. Based on the provided information, several HS codes may be relevant depending on the specific characteristics of the machinery.

- 8501.10.20.00: This HS code covers electric motors and generators (excluding generating sets). Specifically, it applies to motors with an output not exceeding 37.5 W, and further refined to those under 18.65 W that are synchronous and valued not over $4 each. This chapter (85) relates to electrical machinery and equipment, heading 01 specifies motors and generators, and subheading 20 further defines synchronous motors within a specific power and value range. The total tax rate is 61.7%, comprised of a 6.7% base tariff and a 25.0% additional tariff, increasing to 30.0% after April 2, 2025.

- 8501.40.20.20: This HS code also falls under electric motors and generators (excluding generating sets), but pertains to other AC motors, single-phase, with an output exceeding 37.5 W but not exceeding 74.6 W. This includes gear motors. Again, chapter 85 covers electrical machinery, heading 01 specifies motors and generators, and subheading 40 further defines single-phase AC motors within a specific power range. The total tax rate is 58.3%, consisting of a 3.3% base tariff and a 25.0% additional tariff, increasing to 30.0% after April 2, 2025.

- 8479.89.10.00: This HS code covers machines and mechanical appliances having individual functions, not specified or included elsewhere. Specifically, it applies to other machines and mechanical appliances, further defined as electromechanical appliances with self-contained electric motors, such as air humidifiers or dehumidifiers. Chapter 84 relates to nuclear reactors, boilers, machinery and mechanical appliances, heading 79 specifies machines and mechanical appliances, and subheading 89 further defines other machines and appliances with self-contained electric motors. The total tax rate is 55.0%, comprised of a 0.0% base tariff and a 25.0% additional tariff, increasing to 30.0% after April 2, 2025.

- 8479.90.41.00: This HS code covers parts of machines and mechanical appliances having individual functions, specifically parts of articles of subheading 8479.89.10 or 8479.89.70. Chapter 84 relates to nuclear reactors, boilers, machinery and mechanical appliances, heading 79 specifies machines and mechanical appliances, and subheading 90 further defines parts of these machines. The total tax rate is 37.5%, consisting of a 0.0% base tariff and a 7.5% additional tariff, increasing to 30.0% after April 2, 2025.

It is important to determine the precise specifications (output, phase, function, etc.) of the electric machinery to select the most accurate HS code.

Customer Reviews

No reviews yet.