| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536904000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536490080 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8535908060 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8522908081 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536694040 | Doc | 55.0% | CN | US | 2025-05-12 |

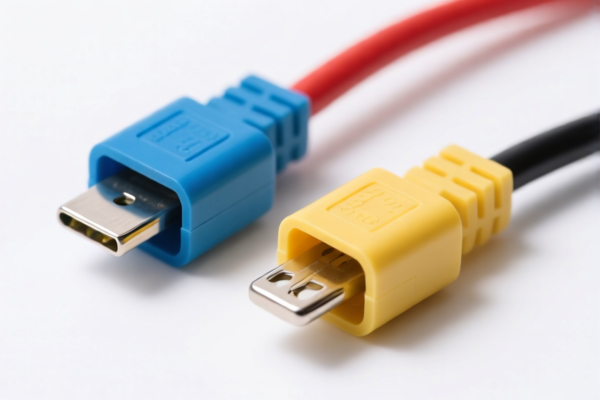

Here is the classification and tariff information for the electrical connector product based on the provided HS codes:

✅ HS CODE: 8536904000

Product Description: Electrical connection devices for circuits, including terminals and wiring connectors

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8536490080

Product Description: Electrical equipment for switching, protecting circuits, or establishing connections, including connectors

Total Tax Rate: 57.7%

Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8535908060

Product Description: Electrical equipment for switching, protecting circuits, or establishing connections

Total Tax Rate: 57.7%

Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8522908081

Product Description: Parts and accessories for equipment under heading 8519 or 8521

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8536694040

Product Description: Power connectors (as per HS code 8536694040)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not applicable for electrical connectors in the current context. -

Certifications Required:

Depending on the specific use and destination, certifications such as CE, RoHS, or FCC may be required. Confirm with local customs or a compliance expert. -

Material and Unit Price:

Verify the material composition (e.g., whether it contains iron or aluminum) and unit price to ensure correct classification and avoid unexpected duties.

🛑 Action Required:

- Confirm the exact product description and material to ensure correct HS code classification.

- Check if certifications are needed for the target market.

- Plan for increased costs due to the April 11, 2025, tariff increase.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.