| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536904000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536490080 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8535908060 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8522908081 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536694040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8536509045 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8543908885 | Doc | 105.0% | CN | US | 2025-05-12 |

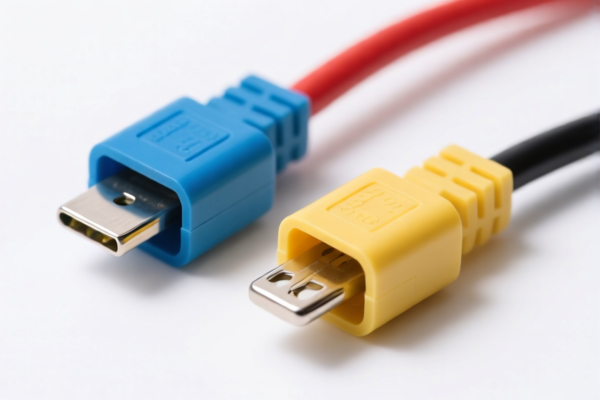

Here is the classification and tariff information for electrical connectors based on the provided HS codes:

🔍 HS CODE: 8536904000

Product Description: Electrical connection devices for circuits, including terminals and wiring connectors

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Alert: This product is subject to a special tariff increase starting April 11, 2025.

✅ Action Required: Verify the product's material composition and unit price to ensure correct classification and avoid overpayment.

🔍 HS CODE: 8536490080

Product Description: Electrical equipment for switching, protecting circuits, or establishing connections, including connectors

Total Tax Rate: 57.7%

Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Alert: This product is subject to a special tariff increase starting April 11, 2025.

✅ Action Required: Confirm the product's function and technical specifications to ensure proper classification.

🔍 HS CODE: 8535908060

Product Description: Electrical equipment for switching, protecting circuits, or establishing connections

Total Tax Rate: 57.7%

Tariff Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Alert: This product is subject to a special tariff increase starting April 11, 2025.

✅ Action Required: Ensure product documentation includes technical specifications and certifications (e.g., CE, RoHS) if required.

🔍 HS CODE: 8522908081

Product Description: Parts and accessories for equipment under heading 8519 or 8521

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Alert: This product is subject to a special tariff increase starting April 11, 2025.

✅ Action Required: Confirm the equipment type it is used with to ensure correct classification.

🔍 HS CODE: 8536694040

Product Description: Power connectors (as per HS code 8536694040)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Alert: This product is subject to a special tariff increase starting April 11, 2025.

✅ Action Required: Verify the power rating and intended use to ensure correct classification.

📌 General Notes:

- All products listed are subject to additional tariffs and a special tariff increase starting April 11, 2025.

- Anti-dumping duties may apply depending on the origin of the goods and market conditions.

- Certifications such as CE, RoHS, or REACH may be required for customs clearance and market access in the EU or other regions.

✅ Proactive Advice:

- Double-check the product description and technical specifications to ensure correct HS code classification.

- Review the origin of goods to determine if anti-dumping or countervailing duties apply.

- Prepare documentation such as commercial invoices, packing lists, and certificates of origin to facilitate customs clearance.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.