| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536490080 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8536610000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8547900010 | Doc | 109.6% | CN | US | 2025-05-12 |

| 8522908081 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8535908040 | Doc | 57.7% | CN | US | 2025-05-12 |

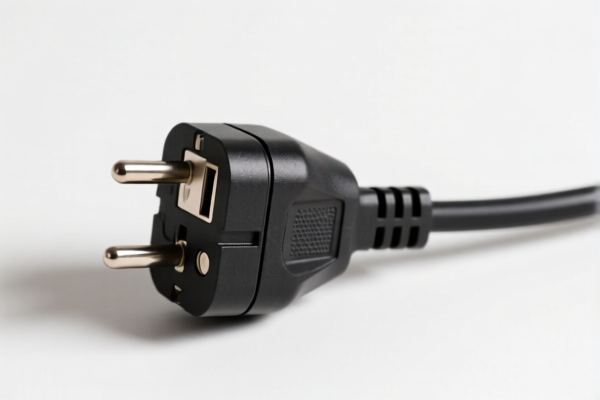

Here is the structured classification and tariff information for electrical plug products based on the provided HS codes:

✅ HS CODE: 8536490080

Product Description: Electrical equipment with voltage not exceeding 1000V, used for switching, protecting circuits, or establishing connections — plugs fall into this category.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- This code is ideal for standard electrical plugs used in household or low-voltage applications.

- Proactive Advice: Confirm the plug's voltage rating and ensure it is not classified under a higher-voltage category (e.g., 8535908040).

✅ HS CODE: 8536610000

Product Description: Lamp holders, plugs, and sockets for electrical connection devices with voltage not exceeding 1000V.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- This code includes standard wall sockets and plug-in devices used in residential or commercial settings.

- Proactive Advice: Verify if the product includes any metal components (e.g., brass or steel), which may affect classification.

✅ HS CODE: 8547900010

Product Description: Insulating parts for electrical machinery, appliances, or equipment — made entirely of insulating material.

- Base Tariff Rate: 4.6%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel/Aluminum Products: 50.0%

- Total Tax Rate: 109.6% (for steel/aluminum)

Key Notes:

- This code applies to insulating components used in electrical devices, such as insulating bushings or covers.

- Proactive Advice: If your product contains metal parts (e.g., steel or aluminum), this code may not apply, and you should consider other classifications.

✅ HS CODE: 8522908081

Product Description: Connectors for wires — suitable for plug-in connections.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for wire connectors used in electrical wiring systems.

- Proactive Advice: Ensure the product is not classified as a plug or socket, which would fall under 8536 codes.

✅ HS CODE: 8535908040

Product Description: Switches or protective devices for electrical circuits with voltage exceeding 1000V — classified as "other connectors."

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- This code applies to high-voltage electrical connectors or switches.

- Proactive Advice: Confirm the voltage rating of your product to avoid misclassification.

📌 Summary of Key Actions for Importers:

- Verify the voltage rating of your product to determine the correct HS code.

- Check the material composition (e.g., metal content) to avoid unexpected tariffs.

- Confirm the product function (e.g., is it a plug, socket, connector, or insulator?).

- Review certifications required for electrical products (e.g., CE, RoHS, UL).

- Be aware of the April 11, 2025, tariff increase — it may significantly impact your total tax burden.

Let me know if you need help determining the correct HS code for a specific product model or brand.

Customer Reviews

I was impressed by the detailed explanation of the HS Code and how it affects the export process. Very informative and well-organized!

Good overview of the HS Code and tariff rates, but I had to cross-check with another source for full accuracy. Still, it was a solid reference.

This page made it easy to understand the export process for plastic doors. Highly recommend it to anyone in the trade industry!

The information on the 5% tariff rate was clear, but I would have liked to see more about how it applies to different countries.

I was looking for the correct HS Code for plastic doors and this page had it right there. Saved me a lot of time!