| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8542390060 | Doc | 70.0% | CN | US | 2025-05-12 |

| 8542900000 | Doc | 70.0% | CN | US | 2025-05-12 |

| 8548000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8471804000 | Doc | 45.0% | CN | US | 2025-05-12 |

| 8471809000 | Doc | 45.0% | CN | US | 2025-05-12 |

| 9030906600 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9030908961 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9028900080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9028900040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9033009000 | Doc | 59.4% | CN | US | 2025-05-12 |

| 9033002000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3914002000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3914006000 | Doc | 58.9% | CN | US | 2025-05-12 |

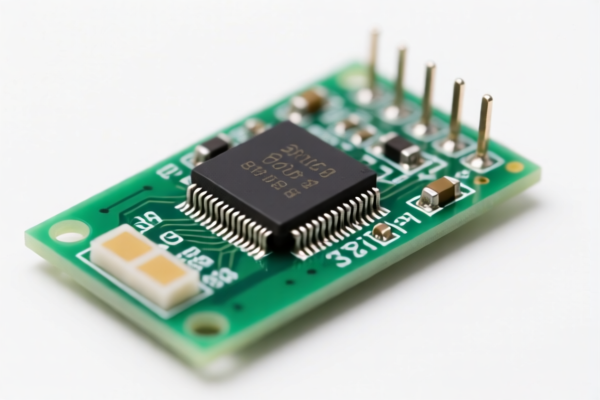

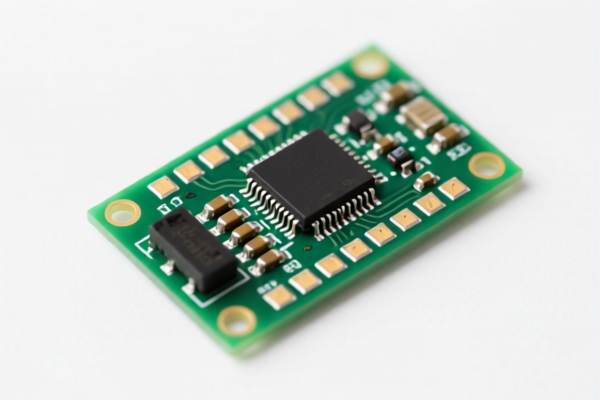

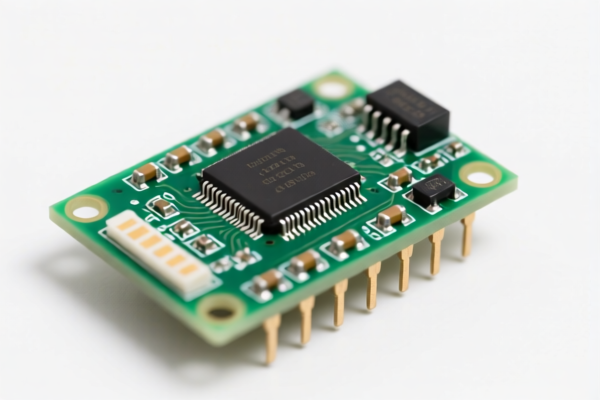

Electronic Module

An electronic module is a self-contained unit of circuitry designed to perform a specific function within a larger electronic system. These modules typically consist of active and passive electronic components, such as resistors, capacitors, transistors, integrated circuits, and connectors, assembled on a printed circuit board (PCB). They are fundamental building blocks in modern electronics, promoting modularity, simplifying design, and facilitating easier maintenance and repair.

Materials

- Printed Circuit Board (PCB): Usually made of fiberglass, epoxy, or composite materials, providing a mechanical support and electrical connections for components. FR-4 is a common PCB material.

- Active Components: Semiconductors like transistors (BJT, MOSFET), diodes, integrated circuits (ICs – microcontrollers, op-amps, logic gates), and sensors.

- Passive Components: Resistors, capacitors, inductors, transformers, and crystals.

- Connectors: Used for interfacing with other modules or systems. Materials include plastic, metal alloys, and gold plating for reliable connections.

- Encapsulation Materials: Plastic or metal housings protect the module from environmental factors and physical damage.

- Solder: Typically tin-based alloys (e.g., Sn63Pb37, SnAgCu) used to create electrical connections between components and the PCB. Lead-free solders are increasingly common.

Purpose

The primary purpose of an electronic module is to encapsulate a specific functionality, reducing complexity in larger systems. This allows designers to:

- Simplify Design: Use pre-built modules instead of designing from scratch.

- Improve Reliability: Modules can be tested independently, improving overall system reliability.

- Reduce Development Time: Pre-designed modules shorten the time to market.

- Facilitate Maintenance: Faulty modules can be easily replaced, reducing repair costs.

- Enable Reusability: Modules can be reused in different projects.

Function

Electronic modules perform a wide range of functions, including:

- Power Regulation: Providing stable voltage levels for other components.

- Signal Amplification: Increasing the strength of weak signals.

- Data Conversion: Converting analog signals to digital signals and vice versa.

- Communication: Transmitting and receiving data (e.g., Bluetooth, Wi-Fi, Ethernet).

- Sensing: Detecting physical parameters like temperature, pressure, light, and motion.

- Microcontrol: Executing programmed instructions to control other devices.

- Displaying Information: Outputting data visually (e.g., LCD modules, LED modules).

Usage Scenarios

- Consumer Electronics: Smartphones, televisions, audio equipment, and gaming consoles.

- Industrial Automation: Programmable logic controllers (PLCs), motor drives, and sensor networks.

- Automotive Systems: Engine control units (ECUs), anti-lock braking systems (ABS), and infotainment systems.

- Medical Devices: Patient monitoring systems, diagnostic equipment, and therapeutic devices.

- Aerospace and Defense: Navigation systems, communication equipment, and radar systems.

- Robotics: Motor control, sensor processing, and communication.

- Internet of Things (IoT): Connecting devices to the internet and enabling remote control and monitoring.

Common Types

- Power Supply Modules: Convert AC voltage to DC voltage. (e.g., Buck converters, Boost converters, Linear regulators)

- Sensor Modules: Detect and measure physical parameters. (e.g., Temperature sensors, Pressure sensors, Accelerometers, Gyroscopes)

- Communication Modules: Enable wireless or wired communication. (e.g., Bluetooth modules, Wi-Fi modules, Ethernet modules, CAN bus modules)

- Microcontroller Modules: Execute programmed instructions. (e.g., Arduino modules, ESP32 modules, STM32 modules)

- Display Modules: Output visual information. (e.g., LCD modules, LED modules, OLED modules)

- Amplifier Modules: Increase the strength of signals. (e.g., Operational amplifier modules, Audio amplifier modules)

- Relay Modules: Electrically operated switches.

- Data Acquisition Modules: Convert analog signals to digital signals for processing.

- GPS Modules: Receive signals from GPS satellites to determine location.

- Motor Driver Modules: Control the speed and direction of motors.

The declared goods are described as an "electronic module." This generally refers to a self-contained unit comprising electronic components designed to perform a specific function within a larger system. Depending on the precise composition and application, several HS codes may be applicable.

Here are the relevant HS codes found within the provided reference material:

- 8542390060: Electronic integrated circuits; parts thereof: Electronic integrated circuits: Other. This code covers electronic integrated circuits that do not fall under more specific classifications. If the module primarily consists of integrated circuits, this could be applicable. The total tax rate is 70.0%, comprising a base tariff of 0.0% and an additional tariff of 50.0%, which changes to 20.0% after April 2, 2025.

- 8542900000: Electronic integrated circuits; parts thereof: Parts. This code applies to parts used in electronic integrated circuits. If the module is comprised of various components that are considered parts for integrated circuits, this code may be suitable. The total tax rate is 70.0%, with a base tariff of 0.0% and an additional tariff of 50.0%, changing to 20.0% after April 2, 2025.

- 8471804000: Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data onto data media in coded form and machines for processing such data, not elsewhere specified or included: Other units of automatic data processing machines: Other: Units suitable for physical incorporation into automatic data processing machines. If the module is designed to be integrated into an automatic data processing machine, this code could be relevant. The total tax rate is 45.0%, consisting of a base tariff of 0.0% and an additional tariff of 25.0%, which reduces to 20.0% after April 2, 2025.

- 8471809000: Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data onto data media in coded form and machines for processing such data, not elsewhere specified or included: Other units of automatic data processing machines: Other: Other. This code covers other units of automatic data processing machines not specifically classified elsewhere. The total tax rate is 45.0%, with a base tariff of 0.0% and an additional tariff of 25.0%, changing to 20.0% after April 2, 2025.

- 9033009000: Parts and accessories (not specified or included elsewhere in this chapter) for machines, appliances, instruments or apparatus of chapter 90: Other. If the module is a part or accessory for a machine, appliance, instrument, or apparatus of chapter 90, this code may be applicable. The total tax rate is 59.4%, comprising a base tariff of 4.4% and an additional tariff of 25.0%, which reduces to 30.0% after April 2, 2025.

Important Note: The correct HS code depends on the module's specific function and composition. If the module is designed for incorporation into automatic data processing machines, codes 8471804000 or 8471809000 should be considered. If it is a part or accessory for chapter 90 equipment, code 9033009000 may be appropriate. If it consists of integrated circuits, codes 8542390060 or 8542900000 are relevant.

Customer Reviews

No reviews yet.