| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5514410030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5407930520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212226090 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5516940030 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5804299090 | Doc | 60.0% | CN | US | 2025-05-12 |

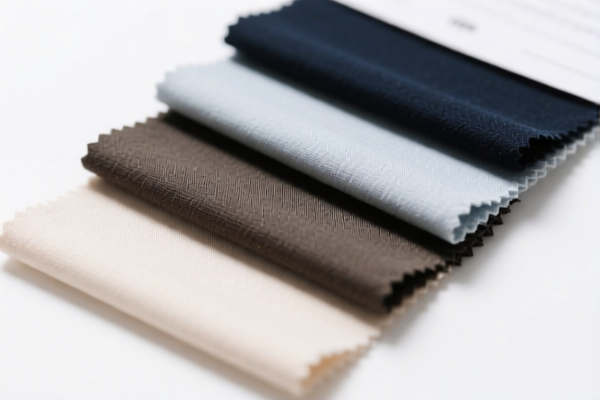

Here is the structured classification and tariff information for the fabric samples you provided, with a focus on HS CODEs, tariff rates, and customs compliance considerations:

✅ Fabric Sample Classification Overview

1. HS CODE: 5514410030

Product Description: Printed polyester-cotton blended bed sheet fabric (heavily woven, >170g/m², plain weave, not shirred)

- Base Tariff Rate: 14.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

- Key Notes:

- This is a printed blended fabric with polyester and cotton.

- Ensure the weight per square meter is over 170g/m² to match the HS CODE.

- No anti-dumping duties apply here.

2. HS CODE: 5407930520

Product Description: Colored synthetic fiber fabric, blended with wool or fine animal hair (≥36%), carded

- Base Tariff Rate: 25.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

- Key Notes:

- This is a synthetic fiber fabric blended with wool or fine animal hair (≥36%).

- Must be carded (processed with combs).

- High tax rate due to the wool content and synthetic blend.

- Anti-dumping duties may apply depending on the origin and market conditions.

3. HS CODE: 5212226090

Product Description: Cotton fabric for handicrafts, other woven cotton fabrics

- Base Tariff Rate: 7.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

- Key Notes:

- This is a pure cotton fabric used for handicrafts.

- Must be woven and not knitted or nonwoven.

- No anti-dumping duties apply.

4. HS CODE: 5516940030

Product Description: Decorative printed fabric, other types of man-made short fiber woven fabrics

- Base Tariff Rate: 12.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

- Key Notes:

- This is a printed fabric made from synthetic short fibers.

- Must be woven and not knitted or nonwoven.

- No anti-dumping duties apply.

5. HS CODE: 5804299090

Product Description: Net fabric, other nonwoven, non-knitted, non-hooked woven fabric

- Base Tariff Rate: 5.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

- Key Notes:

- This is a net fabric or nonwoven fabric.

- Must be not knitted or hooked.

- Material confirmation is critical – ensure it is not made of cotton or synthetic fibers (as that would change the classification).

- No anti-dumping duties apply.

📌 Proactive Compliance Advice

- Verify Material Composition: Confirm the fiber content (e.g., cotton, polyester, wool, synthetic) to ensure correct HS CODE classification.

- Check Weight and Weave Type: For woven fabrics, ensure the weight per square meter and weave type (e.g., plain, twill) match the HS CODE description.

- Confirm Processing: Ensure the fabric has not been shirred, knitted, or hooked, as this may change the classification.

- Check for Certifications: Some fabrics may require origin certificates or anti-dumping compliance documents, especially for wool or synthetic blends.

- Monitor Tariff Changes: Be aware that additional tariffs increase after April 11, 2025, so plan accordingly for import costs.

Let me know if you need help with certification requirements, origin documentation, or customs clearance procedures for these fabric samples.

Customer Reviews

I found the explanation of the 5% tariff and HS code for plastic doors extremely helpful. Great for exporting.

The trade details were helpful, but I had to search a bit to find the exact HS code for my product. Still worth it.

This page gave me all the details I needed about the 5% tariff for plastic doors. Perfect for my export business.

The HS code explanation was straightforward, but I wish there was more info on how to apply it in practice.

I was looking for info on plastic builder’s doors and found exactly what I needed. Great resource for trade details.