| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5514410030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5407930520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212226090 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5516940030 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5804299090 | Doc | 60.0% | CN | US | 2025-05-12 |

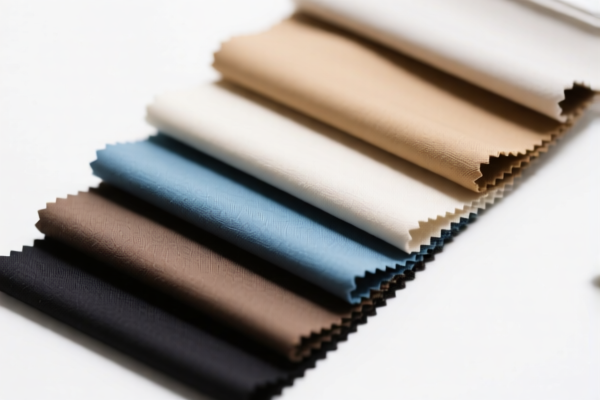

Here is the structured classification and tariff information for the fabric samples you provided, with a focus on HS CODEs, tariff rates, and customs compliance considerations:

✅ HS CODE: 5514410030

Product Description: Printed polyester-cotton bed sheet fabric sample, blended with polyester short fibers and cotton (over 170g/m²), plain weave, un-felted.

- Base Tariff Rate: 14.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

- Key Notes:

- This is a blended fabric with cotton content.

- Verify the exact composition (e.g., cotton percentage) to ensure correct classification.

- Check if any textile-specific regulations apply (e.g., quota, certifications).

✅ HS CODE: 5407930520

Product Description: Colored synthetic fiber fabric, blended with wool or fine animal hair (≥36%), carded.

- Base Tariff Rate: 25.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

- Key Notes:

- High wool content (≥36%) is critical for classification.

- Check if the fabric is carded (processed with carding machines).

- Watch for anti-dumping duties on synthetic fibers if applicable.

✅ HS CODE: 5212226090

Product Description: Cotton craft fabric, woven, not otherwise specified.

- Base Tariff Rate: 7.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

- Key Notes:

- Cotton-based fabric – ensure it is not blended with synthetic fibers.

- Check if it falls under any textile quota or preferential trade agreements.

✅ HS CODE: 5516940030

Product Description: Decorative printed fabric, made from synthetic short fibers, printed.

- Base Tariff Rate: 12.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

- Key Notes:

- Printed fabric – ensure the design is not considered a "pattern" that might change the classification.

- Verify if it is woven or non-woven (this affects the HS CODE).

✅ HS CODE: 5804299090

Product Description: Net fabric, non-woven, non-knitted, non-hooked.

- Base Tariff Rate: 5.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

- Key Notes:

- Non-woven fabric – ensure it is not classified under a different category (e.g., 5903 for coated fabrics).

- Check if it is used for industrial or decorative purposes, as this may affect duty rates.

📌 Proactive Customs Compliance Advice:

- Verify Material Composition: For blended fabrics, confirm the exact percentage of each fiber (e.g., cotton, polyester, wool).

- Check for Additional Tariffs: All samples are subject to 25% additional tariffs before April 11, 2025, and 30% after.

- Watch for Anti-Dumping Duties: If the fabric contains iron or aluminum, check for any anti-dumping duties that may apply.

- Certifications Required: Some fabrics may require textile certifications or origin documentation for preferential treatment.

- Document Sample Details: Keep clear records of fabric type, weight, and composition to avoid misclassification.

Let me know if you need help with certification requirements or customs documentation for these samples.

Customer Reviews

No reviews yet.