| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7318290000 | Doc | 107.8% | CN | US | 2025-05-12 |

| 7415290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 7415390000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 7318210090 | Doc | 110.8% | CN | US | 2025-05-12 |

| 7318290000 | Doc | 107.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for flat gaskets based on the provided HS codes:

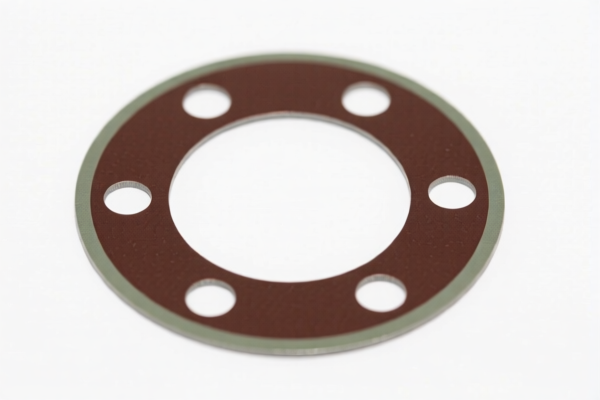

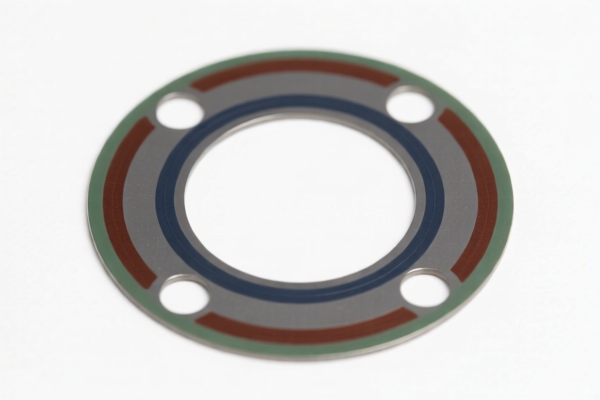

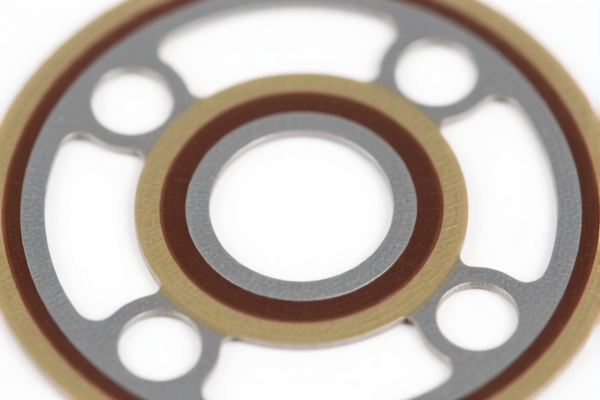

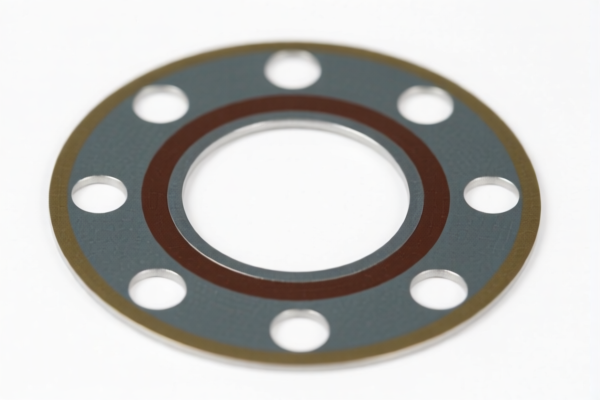

✅ Product Classification: Flat Gasket

🔍 HS CODE: 7318290000

- Description: Non-threaded articles (e.g., flat gaskets made of steel or aluminum)

- Base Tariff Rate: 2.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Steel/Aluminum Additional Tariff: 50.0%

- Total Tax Rate: 107.8%

- Key Notes:

- Applicable to non-threaded steel or aluminum products.

- High tax burden due to multiple layers of tariffs.

- Verify material composition (steel vs. aluminum) to determine exact rate.

🔍 HS CODE: 7415290000

- Description: Nails, tacks, staples, etc., including flat gaskets (as part of similar items)

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- Broad category that may include flat gaskets.

- Lower tax rate compared to 7318290000.

- Confirm product description to ensure correct classification.

🔍 HS CODE: 7415390000

- Description: Washers (including spring washers), flat gaskets, etc., made of copper, iron, or steel

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- Most accurate classification for flat gaskets.

- Lower tax burden than steel/aluminum products in 7318290000.

- Material verification is still important (e.g., copper vs. steel).

🔍 HS CODE: 7318210090

- Description: Other non-threaded articles (e.g., flat gaskets)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Steel/Aluminum Additional Tariff: 50.0%

- Total Tax Rate: 110.8%

- Key Notes:

- Higher base tariff than 7415390000.

- Highly sensitive to material type (steel/aluminum).

- Avoid if possible unless product description strictly matches this code.

🔍 HS CODE: 3926904590

- Description: Seals, gaskets, and other sealing articles (e.g., rubber or plastic flat gaskets)

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.5%

- Key Notes:

- Applicable to non-metallic flat gaskets (e.g., rubber, plastic).

- Lower tax rate than metallic gaskets.

- Material verification is critical (metal vs. non-metal).

📌 Proactive Advice for Importers:

- Verify Material: Confirm whether the flat gasket is made of steel, aluminum, copper, or non-metallic materials (e.g., rubber, plastic). This will determine the correct HS code and tax rate.

- Check Product Description: Ensure the product description aligns with the HS code (e.g., "flat gasket" vs. "nails" or "spring washers").

- Review Tariff Changes: Be aware of the April 11, 2025 tariff increase and anti-dumping duties if applicable.

- Certifications: Some products may require import licenses or technical certifications, especially for non-metallic gaskets or those used in regulated industries (e.g., automotive, aerospace).

- Consult a Customs Broker: For complex classifications or high-value shipments, seek professional assistance to avoid misclassification penalties.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

This page was a lifesaver! The info on tariff rates and HS codes for plastic builder’s doors was exactly what I needed for my business.

The details on HS code 3925 were spot on. I wish there was more about the documentation required when exporting, but overall a solid resource.

I was impressed with how clearly the HS code and tariff information were presented. This made my export process much smoother.

The page gave a good overview of the tariff rates for plastic builder’s doors. It would have been helpful to see more examples of similar products.

I was looking for details on HS code 3925, and this page had everything I needed. Highly recommend it to anyone exporting plastic doors.