| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5704900190 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5705002030 | Doc | 58.3% | CN | US | 2025-05-12 |

| 5702492000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 5705002090 | Doc | 58.3% | CN | US | 2025-05-12 |

| 5702392090 | Doc | 58.6% | CN | US | 2025-05-12 |

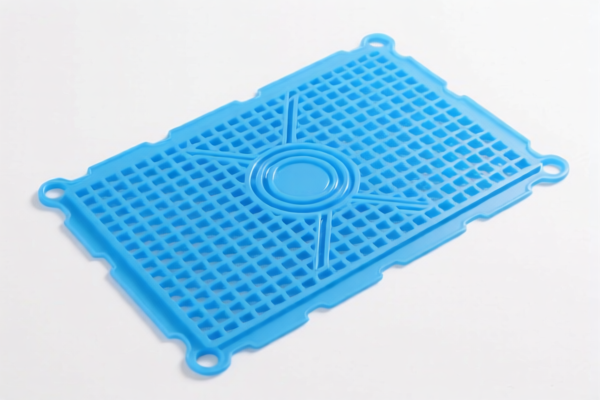

Here is the structured classification and tariff information for floor mats based on the provided HS codes:

📌 HS CODE: 5704900190

Product Description: Carpets and other textile floor coverings, of felt, not tufted or flocked

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- Key Notes:

- This code applies to felt-based floor mats, not tufted or flocked.

- The April 11, 2025 tariff increase is significant (from 25% to 30%).

- Action Required: Confirm the material is felt and not tufted or flocked.

📌 HS CODE: 5705002030

Product Description: Other carpets and other textile floor coverings, made of synthetic fibers

Total Tax Rate: 58.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- Key Notes:

- Applies to synthetic fiber-based floor mats.

- The April 11, 2025 tariff increase is significant (from 25% to 30%).

- Action Required: Confirm the material is synthetic fiber.

📌 HS CODE: 5702492000

Product Description: Woven carpets, not tufted or flocked, made up, with pile, of other textile materials

Total Tax Rate: 59.0%

- Base Tariff Rate: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- Key Notes:

- Applies to woven carpets with pile, made of other textile materials.

- The April 11, 2025 tariff increase is significant (from 25% to 30%).

- Action Required: Confirm the product is woven and has pile.

📌 HS CODE: 5705002090

Product Description: Other carpets and textile floor coverings

Total Tax Rate: 58.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- Key Notes:

- A general category for other types of carpets and floor coverings not covered by more specific codes.

- The April 11, 2025 tariff increase is significant (from 25% to 30%).

- Action Required: Confirm the product does not fall under more specific codes.

📌 HS CODE: 5702392090

Product Description: Woven carpets and other textile floor coverings, not tufted or flocked, whether or not made up, including handwoven carpets

Total Tax Rate: 58.6%

- Base Tariff Rate: 3.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- Key Notes:

- Applies to woven carpets, including handwoven ones, not tufted or flocked.

- The April 11, 2025 tariff increase is significant (from 25% to 30%).

- Action Required: Confirm the product is woven and not tufted or flocked.

✅ Proactive Advice for Importers:

- Verify Material: Confirm the exact material (e.g., felt, synthetic fiber, wool, etc.) to ensure correct HS code classification.

- Check Unit Price: High-value floor mats may be subject to additional scrutiny or duties.

- Certifications: Ensure compliance with any required certifications (e.g., safety, environmental, or origin-related).

- Monitor Tariff Changes: The April 11, 2025 tariff increase is a key date to note for cost planning.

- Consult a Customs Broker: For complex classifications or large shipments, professional assistance is recommended.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.