| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708405000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8529909800 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8607215000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 9032100090 | Doc | 56.7% | CN | US | 2025-05-12 |

| 9032896085 | Doc | 56.7% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the declared products (actuators and related components), based on the provided HS codes and tax details:

✅ Product Classification & Tariff Overview

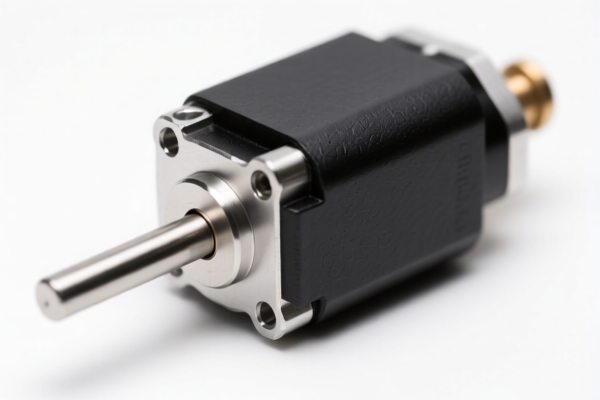

1. Transmission Actuator

HS CODE: 8708405000

- Base Tariff Rate: 2.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

- Key Notes:

- This product is classified under automotive parts, specifically for transmission systems.

- The high total tax rate is due to the combination of base and additional tariffs.

- Action Required: Verify if the product is part of a complete vehicle or component, as this may affect classification.

2. Actuator Connector Wire

HS CODE: 8529909800

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This is a wiring component used in actuator systems.

- The base tariff is zero, but the additional tariffs significantly increase the total cost.

- Action Required: Confirm the exact use and material composition to ensure correct classification.

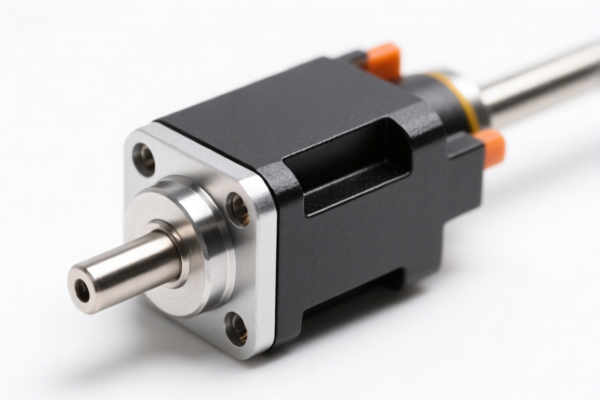

3. Brake System Actuator

HS CODE: 8607215000

- Base Tariff Rate: 3.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

- Key Notes:

- This product is part of the braking system, which is subject to higher base tariffs.

- The total tax rate is among the highest due to the combination of base and additional tariffs.

- Action Required: Ensure compliance with any safety or certification requirements for automotive components.

4. Temperature Control Actuator

HS CODE: 9032100090

- Base Tariff Rate: 1.7%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 56.7%

- Key Notes:

- This is a control device used in temperature regulation systems.

- The base tariff is relatively low, but the additional tariffs significantly increase the total cost.

- Action Required: Confirm if the product is used in industrial or consumer applications, as this may affect classification.

5. Process Control Actuator

HS CODE: 9032896085

- Base Tariff Rate: 1.7%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 56.7%

- Key Notes:

- This is a general-purpose actuator used in industrial process control systems.

- The tariff structure is similar to the temperature control actuator.

- Action Required: Verify if the product requires any specific certifications (e.g., CE, RoHS) for import.

📌 Important Alerts & Recommendations

- April 11, 2025, Tariff Adjustment:

- All products listed above will be subject to an additional 5% increase in tariffs after April 11, 2025.

-

This could significantly impact your import costs, so plan accordingly.

-

Anti-Dumping Duties:

- While not explicitly mentioned in the provided data, anti-dumping duties may apply to certain iron and aluminum products.

-

If your actuator contains these materials, verify if anti-dumping duties apply.

-

Certifications & Documentation:

- Ensure all necessary certifications (e.g., CE, RoHS, REACH) are in place.

-

Provide detailed product specifications (material, function, unit price) to customs to avoid delays or reclassification.

-

Tariff Calculation Tool:

- Use a customs tariff calculator to estimate total costs based on the HS code and product value.

Let me know if you need help with certification requirements, customs documentation, or import cost estimation.

Customer Reviews

No reviews yet.