| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482101080 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8482105004 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482105064 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482101040 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8482991550 | Doc | 60.8% | CN | US | 2025-05-12 |

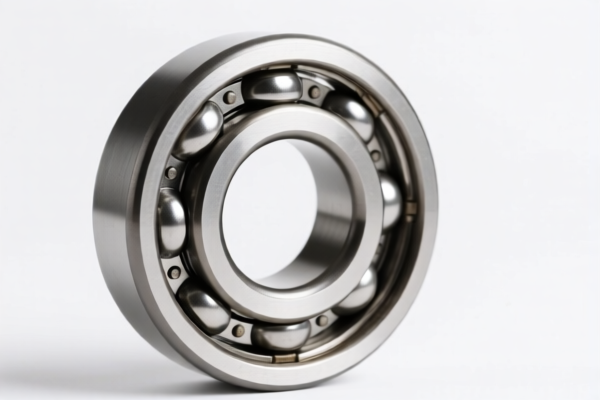

Here is the structured classification and tariff information for the declared product "bearing" based on the provided HS codes:

📌 HS CODE: 8482101080

Product Description: Ball bearings with integral shaft

Total Tax Rate: 57.4%

Tax Breakdown:

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482105004

Product Description: Ungrinded ball bearings

Total Tax Rate: 64.0%

Tax Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482105064

Product Description: Radial ball bearings

Total Tax Rate: 64.0%

Tax Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482991550

Product Description: Parts of bearings

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482992580

Product Description: Bearing races (rings)

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 5% tariff will be applied to all the above HS codes (on top of the existing 25% additional tariff).

- Anti-dumping duties: May apply depending on the country of origin and specific product type (e.g., iron or aluminum components).

- Material and Certification: Verify the material composition (e.g., whether it contains iron or aluminum) and unit price to determine if anti-dumping duties or other trade measures apply.

- Certifications: Ensure compliance with any required customs documentation, origin certificates, or technical specifications.

✅ Proactive Advice:

- Confirm the exact product type (e.g., ball bearing, radial bearing, bearing part, etc.) to ensure correct HS code classification.

- Check the country of origin to determine if additional duties or restrictions apply.

- Maintain product specifications and invoices for customs audit purposes.

Let me know if you need help determining the correct HS code based on product details.

Customer Reviews

No reviews yet.