| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4107115000 | Doc | 32.8% | CN | US | 2025-05-12 |

| 6006909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6006420085 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6003909000 | Doc | 61.6% | CN | US | 2025-05-12 |

| 5907008090 | Doc | 55.0% | CN | US | 2025-05-12 |

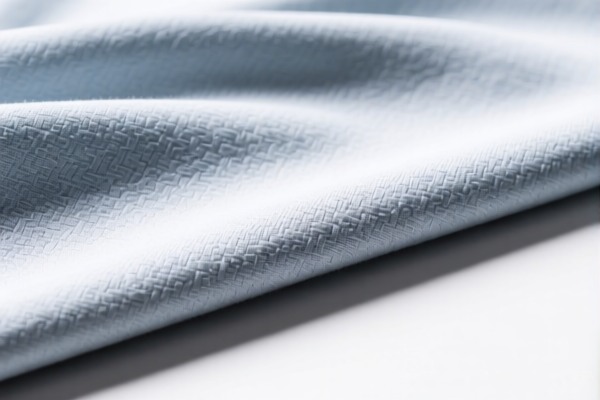

Here is the structured classification and tariff information for the fabric products you provided, with a focus on HS codes, tariff rates, and customs compliance considerations:

✅ HS CODE: 6006909000

Product Description: Knitted or crocheted fabrics for apparel, classified under "Other knitted or crocheted fabrics" – "Other".

- Base Tariff Rate: 0.0%

- Additional Tariff (2025.04.02 onwards): 30.0%

- Total Tax Rate: 30.0%

- Key Notes:

- No anti-dumping duties apply.

- Verify if the fabric is made of synthetic or natural fibers, as this may affect classification.

- Ensure proper documentation for customs clearance.

✅ HS CODE: 6006420085

Product Description: Knitted fabric for apparel, specifically "knitted" fabric.

- Base Tariff Rate: 10.0%

- Additional Tariff (2025.04.02 onwards): 30.0%

- Total Tax Rate: 40.0%

- Key Notes:

- Higher base rate due to specific classification.

- Be aware of the April 11 Special Tariff if applicable.

- Confirm the fiber composition and whether it's woven or knitted.

✅ HS CODE: 6003909000

Product Description: Knitted or crocheted fabric for apparel, with a width not exceeding 30 cm.

- Base Tariff Rate: 6.6%

- Additional Tariff (2025.04.02 onwards): 30.0%

- Total Tax Rate: 36.6%

- Key Notes:

- Width is a critical factor in classification.

- Ensure the fabric is not wider than 30 cm.

- Check if any anti-dumping duties apply based on the origin of the fabric.

✅ HS CODE: 5907008090

Product Description: Coated, impregnated, or otherwise covered textile fabrics.

- Base Tariff Rate: 0.0%

- Additional Tariff (2025.04.02 onwards): 30.0%

- Total Tax Rate: 30.0%

- Key Notes:

- This classification applies to coated or laminated fabrics.

- Confirm the coating material and its purpose (e.g., waterproofing, fire resistance).

- May be subject to special import regulations depending on the coating.

✅ HS CODE: 6005420020

Product Description: Knitted fabric made of man-made fibers, dyed, and classified as other types of needle-punched products.

- Base Tariff Rate: 10.0%

- Additional Tariff (2025.04.02 onwards): 30.0%

- Total Tax Rate: 40.0%

- Key Notes:

- This code applies to dyed and needle-punched fabrics.

- Verify the fiber content and processing method to ensure correct classification.

- Be aware of anti-dumping duties if the fabric is imported from certain countries.

📌 Proactive Compliance Advice:

- Verify Material Composition: Confirm the fiber content (e.g., cotton, polyester, etc.) and processing method (e.g., dyed, coated, etc.) to ensure correct HS code classification.

- Check Width for 6003909000: If the fabric is wider than 30 cm, it may be classified under a different code.

- Review Certifications: Some fabrics may require certifications (e.g., REACH, OEKO-TEX) depending on the end-use or destination country.

- Monitor Tariff Changes: The April 11 Special Tariff and 2025.04.02 additional tariffs are time-sensitive. Ensure your import timeline aligns with these dates.

- Anti-Dumping Duty Check: If the fabric is imported from countries with known anti-dumping duties (e.g., China, Vietnam), additional costs may apply.

Let me know if you need help determining the correct HS code for a specific fabric sample or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.