| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5514410030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5407930520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212226090 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5516940030 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5804299090 | Doc | 60.0% | CN | US | 2025-05-12 |

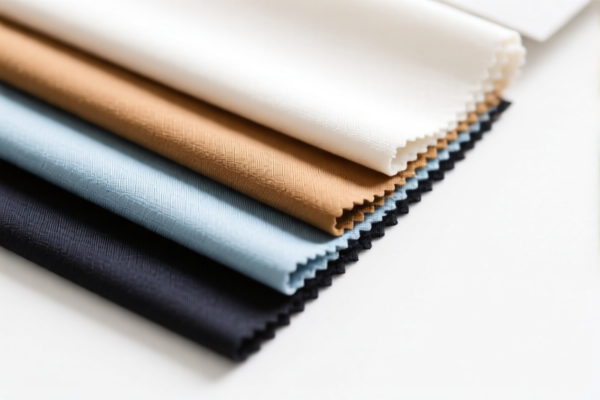

Here is the structured classification and tariff information for the fabric samples you provided, with a focus on customs compliance and tax implications:

✅ Fabric Sample Classification & Tariff Overview

1. HS CODE: 5514410030

Product Description: Printed polyester-cotton blended fabric (bedding fabric), woven, plain weave, not shirred, with weight over 170g/m².

- Base Tariff Rate: 14.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

- Key Notes:

- This is a textile product with a high blend of polyester and cotton.

- Verify the fabric composition and weight to ensure it falls under this code.

- Certifications (e.g., textile origin, environmental compliance) may be required depending on the destination country.

2. HS CODE: 5407930520

Product Description: Colored synthetic fiber woven fabric, blended with wool or fine animal hair (≥36%), carded.

- Base Tariff Rate: 25.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

- Key Notes:

- This is a high-value textile due to the wool content and special processing (carded).

- Check the exact wool percentage and processing method to confirm classification.

- Anti-dumping duties may apply if the product is from countries under such measures.

3. HS CODE: 5212226090

Product Description: Cotton woven fabric, other than for apparel or home textiles.

- Base Tariff Rate: 7.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.8%

- Key Notes:

- This is a general cotton fabric, likely used for crafts or industrial purposes.

- Confirm the end-use to avoid misclassification.

- Check for any preferential trade agreements (e.g., RCEP, CPTPP) that may reduce the tariff.

4. HS CODE: 5516940030

Product Description: Decorative printed fabric, made of man-made short fibers, woven, printed.

- Base Tariff Rate: 12.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

- Key Notes:

- This is a decorative fabric, likely used for interior design or fashion accessories.

- Verify the printing method and fabric composition to ensure correct classification.

- Check for any design or brand-specific restrictions in the importing country.

5. HS CODE: 5804299090

Product Description: Net fabric, non-woven, non-knitted, non-hooked.

- Base Tariff Rate: 5.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

- Key Notes:

- This is a net or mesh fabric, commonly used for agricultural, industrial, or decorative purposes.

- Confirm the material composition and structure (e.g., woven vs. non-woven).

- Check for any import restrictions related to mesh or net products.

📌 Proactive Compliance Advice:

- Verify Material Composition: Ensure the fabric composition (e.g., cotton, polyester, wool) and weight match the HS code description.

- Check for Additional Tariffs: The special tariff after April 11, 2025 applies to all products listed, so plan import timelines accordingly.

- Review Certifications: Some products may require textile origin certificates, environmental compliance documents, or anti-dumping duty exemptions.

- Consult Local Customs Authorities: For specific country requirements, especially if importing into China, the EU, or the US.

Let me know if you need help with certification requirements or import documentation for any of these products.

Customer Reviews

No reviews yet.