| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7318290000 | Doc | 107.8% | CN | US | 2025-05-12 |

| 3926904590 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 6909191000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6909120000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 6909195010 | Doc | 59.0% | CN | US | 2025-05-12 |

| 8487900080 | Doc | 108.9% | CN | US | 2025-05-12 |

| 9008908000 | Doc | 57.9% | CN | US | 2025-05-12 |

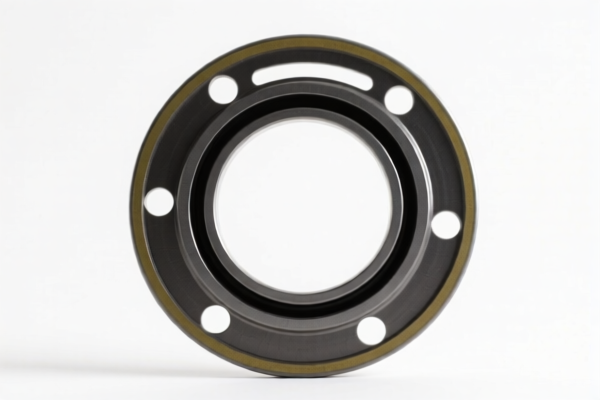

Here is the structured classification and tariff information for the gasket product based on the provided HS codes:

✅ HS CODE: 7318290000

Product Description: Non-threaded articles (e.g., steel or aluminum gaskets)

Total Tax Rate: 107.8%

Tariff Breakdown:

- Base Tariff Rate: 2.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel & Aluminum Additional Tariff: 50%

⚠️ Alert: This code applies to metal gaskets (e.g., steel or aluminum). If your product is made of these materials, the 50% additional tariff will apply, significantly increasing the total tax burden.

✅ HS CODE: 3926904590

Product Description: Gaskets, seals, or other sealing devices (other than rubber or plastic)

Total Tax Rate: 58.5%

Tariff Breakdown:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Alert: This code applies to non-rubber, non-plastic gaskets. If your product is made of rubber or plastic, this code may not be applicable.

✅ HS CODE: 9405920000

Product Description: Plastic parts (e.g., gaskets or seals)

Total Tax Rate: 58.7%

Tariff Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Alert: This code is for plastic gaskets. If your product is made of plastic, this is the correct classification.

✅ HS CODE: 3926904510

Product Description: Gaskets, seals, or O-rings (e.g., rubber or plastic)

Total Tax Rate: 58.5%

Tariff Breakdown:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Alert: This code is for O-rings or similar rubber/plastic gaskets. If your product is an O-ring, this may be the correct code.

✅ HS CODE: 6909191000

Product Description: Ceramic products for laboratory, chemical, or technical use

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Alert: This code applies to ceramic gaskets used in technical or chemical applications. If your product is ceramic and used in such contexts, this may be the correct code.

📌 Proactive Advice for Users:

- Verify Material: Confirm the material composition of your gasket (e.g., metal, plastic, rubber, ceramic) to ensure correct classification.

- Check Unit Price: High-value gaskets may be subject to anti-dumping duties or special tariffs.

- Certifications Required: Some products may require technical certifications or import licenses, especially if used in technical or chemical applications.

- Monitor Tariff Changes: The special tariff after April 11, 2025 will increase the tax burden by 5% for most products. Plan accordingly.

- Consult a Customs Broker: For complex or high-value imports, consider professional assistance to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code based on your product’s material and use.

Customer Reviews

I found the section on plastic builder’s doors very informative. It helped me understand the correct HS code and tariff rates quickly.

The information on tariff rates was accurate and up-to-date. It would have been great if there was a comparison with other countries too.

I couldn’t have done my import analysis without the HS code details. This site is a lifesaver for anyone in the trade industry.

The section on trade regulations was well-organized. I found the part about duty exemptions a bit confusing, but overall it was helpful.

I was looking for info on exporting plastic doors to the US, and this page had all the details I needed. Perfect resource!