| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708401150 | Doc | 2.5%<u></u>+55.0% | CN | US | 2025-05-12 |

| 8483407000 | Doc | 25¢ each + 3.9%+55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the declared products related to gearboxes:

🔍 Product Classification & Tariff Details

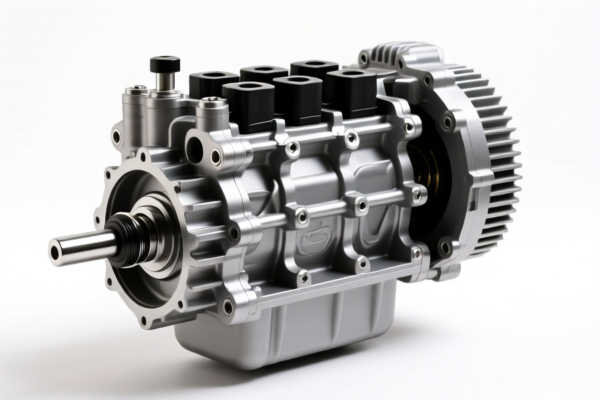

1. HS Code: 8708401150

Product Description: Vehicle Gearbox

Total Tax Rate: 2.5% + 55.0%

Breakdown:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Effective Tariff: 2.5% + 55.0% = 57.5%

⚠️ Important Note: The additional tariffs (25.0% and 30.0%) are not included in the "total tax" shown in the input. Please verify the final effective rate based on the timing of import and applicable policies.

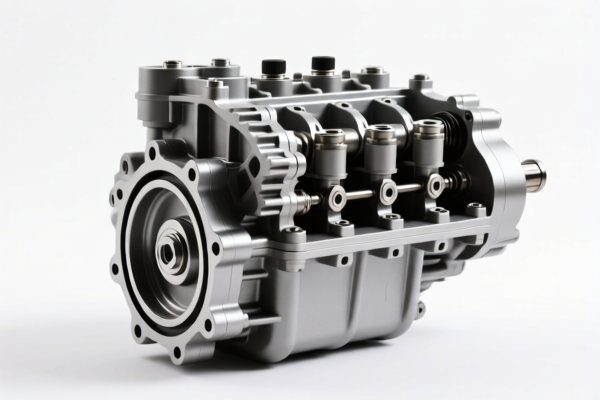

2. HS Code: 8483407000

Product Description: Automatic Transmission (Automatic Gearbox)

Total Tax Rate: 25¢ each + 3.9% + 55.0%

Breakdown:

- Base Tariff Rate: 25¢ per unit + 3.9% ad valorem

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Effective Tariff: 25¢ + 3.9% + 55.0% = 80.9% (approx.)

⚠️ Important Note: This product is subject to a specific duty (25¢ per unit) in addition to ad valorem duties. This can significantly increase the total cost depending on the quantity and value of the goods.

📌 Proactive Compliance Advice

- Verify Material and Unit Price: For HS Code 8483407000, the specific duty (25¢ per unit) is critical. Ensure accurate unit pricing and quantity to calculate the correct duty.

- Check Required Certifications: Depending on the country of origin and product type, certifications such as CO (Certificate of Origin) or technical standards may be required.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to both products. If your import is scheduled after this date, the higher rate will apply.

- Anti-Dumping Duties: While not explicitly mentioned, if the product contains iron or aluminum components, be aware that anti-dumping duties may apply depending on the country of origin and trade policies.

✅ Summary of Key Actions

- Confirm the HS code matches the product description and material.

- Calculate total duty based on import date and product type.

- Prepare certifications and documentation for customs clearance.

- Stay updated on tariff changes and trade policies affecting your product category.

Let me know if you need help calculating the exact duty for a specific shipment!

Customer Reviews

The page has good info on HS codes and tariffs, but I would have liked more guidance on how to apply the rates in practice.

This is the best site I've found for HS code and tariff info. The details on 5% rate for plastic doors were very helpful.

I was looking for details on HS code 3925 and found exactly what I needed here. Great resource for anyone exporting plastic doors.

The explanation of the tariff rates was clear, but I wish there were more examples of similar products with their HS codes.

This page saved me hours of research. The HS code info for plastic doors is spot on and very helpful for my business.