| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8471490000 | Doc | 27.5% | CN | US | 2025-05-12 |

| 8471300100 | Doc | 20.0% | CN | US | 2025-05-12 |

| 4820200000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820102020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820300040 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the product "notebook" based on the provided HS codes and tax details:

✅ HS CODE: 8471490000

Product Description: Notebook (electronic device, automatic data processing machine)

Total Tax Rate: 27.5%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 20.0%

Key Notes:

- This code applies to electronic notebooks (not paper-based).

- Time-sensitive: Tariff increases significantly after April 11, 2025.

- Proactive Advice: Confirm the product is an electronic device and not a paper notebook to avoid misclassification.

✅ HS CODE: 8471.30.01.00

Product Description: Notebook computer

Total Tax Rate: 20.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 20.0%

Key Notes:

- This code is also for electronic notebook computers.

- Time-sensitive: Tariff increases significantly after April 11, 2025.

- Proactive Advice: Ensure the product is classified under this code and not under paper-based categories.

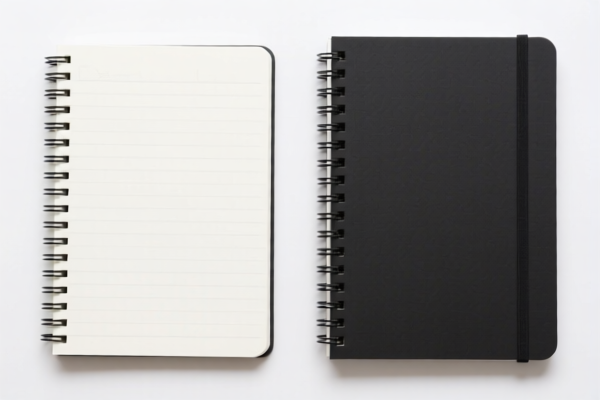

✅ HS CODE: 4820200000

Product Description: "Office notebook" (paper-based)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

Key Notes:

- This code applies to paper-based notebooks (e.g., office notebooks).

- Time-sensitive: Tariff increases after April 11, 2025.

- Proactive Advice: Confirm the product is not electronic and is made of paper to avoid misclassification.

✅ HS CODE: 4820102020

Product Description: "Student notebook" (paper-based)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

Key Notes:

- This code applies to paper-based student notebooks.

- Time-sensitive: Tariff increases after April 11, 2025.

- Proactive Advice: Ensure the product is not electronic and is made of paper.

✅ HS CODE: 4820300040

Product Description: "Paper notebook"

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

Key Notes:

- This code applies to paper-based notebooks (general category).

- Time-sensitive: Tariff increases after April 11, 2025.

- Proactive Advice: Confirm the product is not electronic and is made of paper.

📌 Summary of Key Actions:

- Clarify the product type: Determine whether the "notebook" is electronic or paper-based.

- Verify material and unit price: This will help in accurate classification and tax calculation.

- Check for certifications: Some products may require specific documentation (e.g., origin, compliance certificates).

- Monitor April 11, 2025: Tariff rates will increase significantly for all categories after this date.

- Avoid misclassification: Ensure the product is not mistakenly classified under a different HS code (e.g., paper-based vs. electronic).

Let me know if you need help determining the correct HS code based on product specifications.

Customer Reviews

I was impressed with how specific the details were about the HS Code 3925. Perfect for my export needs.

Good info on the tariff rates, though I had to double-check a few details with a customs agent.

This site made it easy to find the right HS code for my plastic doors. Saved me a lot of time.

The HS code explanation was straightforward, but I would have liked more examples of similar products.

I was looking for details on plastic doors and this page had all the specifics. Super helpful for my business.