| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8471490000 | Doc | 27.5% | CN | US | 2025-05-12 |

| 4820200000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820102030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8471300100 | Doc | 20.0% | CN | US | 2025-05-12 |

| 4820300040 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the declared product "notebooks" based on the provided HS codes and tax details:

✅ HS CODE: 8471490000

Product Description: Notebooks used for automatic data processing machines

Total Tax Rate: 27.5%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 20.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to electronic notebooks used in data processing systems (e.g., laptops).

- The April 11, 2025 tariff increase is significant (from 7.5% to 20.0%).

- Proactive Advice: Confirm the product is not classified under a different code (e.g., 8471.30.01.00) if it's a different type of notebook.

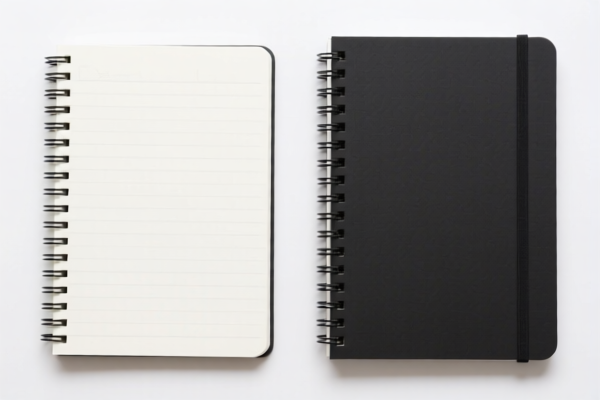

✅ HS CODE: 4820200000

Product Description: Notebooks used for practice books

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to paper-based notebooks used for educational or practice purposes.

- The April 11, 2025 tariff increase is 5% (from 25.0% to 30.0%).

- Proactive Advice: Ensure the product is not misclassified as a different type of notebook (e.g., 4820102020 or 4820300040).

✅ HS CODE: 8471.30.01.00

Product Description: Notebooks used for automatic data processing machines

Total Tax Rate: 20.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 20.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code may apply to specific types of notebooks used in data processing systems.

- No additional tariffs are currently applied.

- Proactive Advice: Verify the exact product specification to ensure correct classification.

✅ HS CODE: 4820102020

Product Description: Notebooks used for account books, ledgers, notebooks, etc.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to paper-based notebooks used for accounting or record-keeping.

- The April 11, 2025 tariff increase is 5% (from 25.0% to 30.0%).

- Proactive Advice: Confirm the product is not misclassified as a different type of notebook (e.g., 4820300040).

✅ HS CODE: 4820300040

Product Description: Notebooks used for notebooks and similar items

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to paper-based notebooks used for general purposes.

- The April 11, 2025 tariff increase is 5% (from 25.0% to 30.0%).

- Proactive Advice: Ensure the product is not misclassified as a different type of notebook (e.g., 4820102020).

📌 Summary of Key Actions:

- Verify the product type (electronic vs. paper-based) and intended use (data processing, educational, accounting, etc.) to ensure correct HS code classification.

- Check the date of import to determine whether the April 11, 2025 tariff applies.

- Confirm material and unit price to avoid misclassification.

- Check if any certifications (e.g., environmental, safety) are required for import.

- Review anti-dumping duties if the product is made of iron or aluminum (not applicable in this case).

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.