| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8533310000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8533210090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8533908000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8533210080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8533290000 | Doc | 55.0% | CN | US | 2025-05-12 |

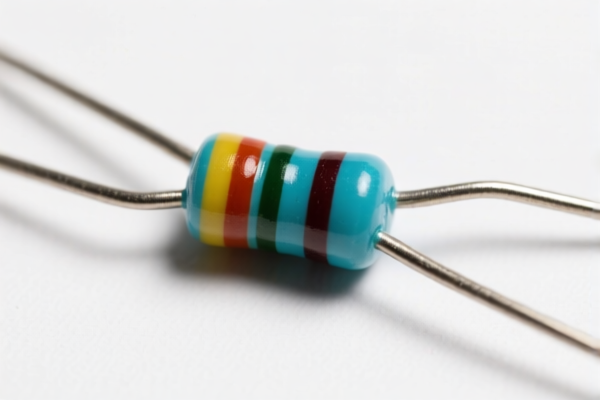

Here is the structured classification and tariff information for the resistor products you provided, with a focus on HS codes, tariff rates, and customs compliance considerations:

✅ HS Code Classification Overview for Resistors

1. HS Code: 8533310000

Product Description:

- Resistor, including variable resistors and potentiometers, wound resistors, with power handling capacity not exceeding 20W.

Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

2. HS Code: 8533210090

Product Description:

- Other fixed resistors, with power handling capacity not exceeding 20W, including metal film, metal oxide, and thick film cement resistors.

Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

3. HS Code: 8533908000

Product Description:

- Resistors (including variable resistors and potentiometers), non-heating resistors; components – other.

Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

4. HS Code: 8533210080

Product Description:

- Other fixed resistors, with power handling capacity not exceeding 20W, other types of wirewound resistors.

Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

5. HS Code: 8533290000

Product Description:

- Other fixed resistors, other.

Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes and Compliance Actions

- All listed HS codes have the same total tax rate of 55.0%, but the specific classification depends on the type of resistor, power rating, and material.

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025, so import timing is critical.

- No anti-dumping duties are currently listed for these resistor categories.

- Verify the exact product specification (e.g., material, power rating, type of resistor) to ensure correct HS code classification.

- Check if any certifications (e.g., RoHS, REACH, CE) are required for the destination market.

📌 Proactive Advice for Importers

- Confirm the resistor type (e.g., wirewound, metal film, thick film) and power rating before classification.

- Review the HS code with a customs broker or expert to avoid misclassification penalties.

- Plan import timelines carefully, considering the April 11, 2025 tariff change.

- Keep detailed documentation (e.g., product specs, invoices, certificates) for customs audits.

Let me know if you need help determining the correct HS code for a specific resistor model or if you need a comparison with other components.

Customer Reviews

The page provided all the necessary details about HS codes and tariffs. Highly recommend it for exporters.

Good overview of the export process, though I would have liked more info on customs documentation.

This page was a lifesaver! The details on plastic doors and their tariff rates were spot-on.

The HS code section was well explained, but I wish there were more examples of similar products.

The information on the 5% tariff rate for plastic doors was exactly what I needed for my export plans.