| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8541499500 | Doc | 70.0% | CN | US | 2025-05-12 |

| 8541430010 | Doc | 20.0% | CN | US | 2025-05-12 |

| 8501721000 | Doc | 32.5% | CN | US | 2025-05-12 |

| 8504907500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8419120000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8507600020 | Doc | 33.4% | CN | US | 2025-05-12 |

| 8541420080 | Doc | 20.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for solar panels and related products, based on the provided HS codes and tariff details:

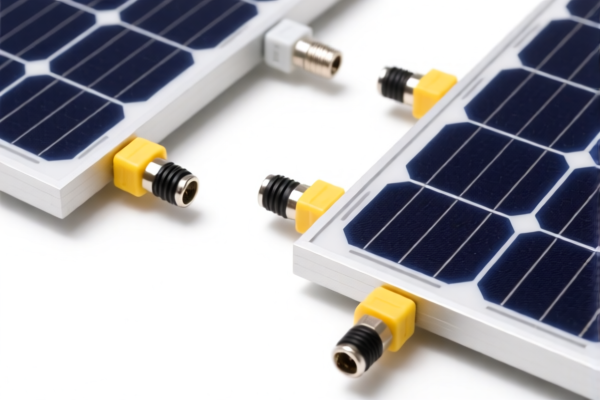

✅ HS CODE: 8541499500

Product: Solar charging panels, solar cells

- Base Tariff Rate: 0.0%

- Additional Tariff: 50.0%

- April 11 Special Tariff (after April 11, 2025): 20.0%

- Total Tax Rate: 70.0%

- Key Notes:

- High tax burden due to both additional and special tariffs.

- Proactive Advice: Verify if the product is classified under this code or a more specific one (e.g., 8541430010 for monocrystalline or polycrystalline solar panels).

✅ HS CODE: 8541430010

Product: Monocrystalline, polycrystalline, or thin-film silicon solar panels

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 20.0%

- Total Tax Rate: 20.0%

- Key Notes:

- Lower tax rate compared to 8541499500.

- Proactive Advice: Ensure the product is not misclassified as a general solar charging panel (8541499500).

✅ HS CODE: 8501721000

Product: Outdoor or portable solar power panels

- Base Tariff Rate: 2.5%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 32.5%

- Key Notes:

- Includes a base tariff, so total tax is higher than some other solar products.

- Proactive Advice: Confirm if the product is intended for outdoor or portable use, as this classification is specific to such applications.

✅ HS CODE: 8504907500

Product: Solar power circuit boards

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- High tax rate due to additional and special tariffs.

- Proactive Advice: Ensure the product is not misclassified as a general PCB or solar panel.

✅ HS CODE: 8419120000

Product: Solar heat collectors (solar thermal panels)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- High tax rate due to additional and special tariffs.

- Proactive Advice: Confirm whether the product is for photovoltaic (electricity) or thermal (heat) use, as classification differs.

✅ HS CODE: 8507600020

Product: Lithium-ion batteries for solar panels

- Base Tariff Rate: 3.4%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.4%

- Key Notes:

- Includes a base tariff, so total tax is higher than some other components.

- Proactive Advice: Verify if the battery is specifically for solar use or general-purpose, as this may affect classification.

✅ HS CODE: 8541420080

Product: Back panels for solar cells

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 20.0%

- Total Tax Rate: 20.0%

- Key Notes:

- Lower tax rate, but still subject to the April 11 special tariff.

- Proactive Advice: Ensure the product is not misclassified as a solar panel or circuit board.

✅ HS CODE: 8802609020

Product: Solar panels for satellites

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- High tax rate due to additional and special tariffs.

- Proactive Advice: Confirm the product is intended for satellite use, as this classification is specific.

✅ HS CODE: 8543906800

Product: PCB boards for solar inverters

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- High tax rate due to additional and special tariffs.

- Proactive Advice: Ensure the product is not misclassified as a general PCB or solar panel.

📌 Important Reminders:

- April 11, 2025 Special Tariff: Applies to most solar products, increasing the total tax rate significantly.

- Certifications Required: Depending on the product, certifications like CE, RoHS, or REACH may be required for import.

- Material and Unit Price: Verify the exact composition and unit price to ensure correct classification and tax calculation.

- Customs Declaration: Accurate product description and HS code selection are critical to avoid delays or penalties.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.