| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5907008090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5208224020 | Doc | 63.4% | CN | US | 2025-05-12 |

| 5209110020 | Doc | 61.5% | CN | US | 2025-05-12 |

| 6006909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6006420085 | Doc | 65.0% | CN | US | 2025-05-12 |

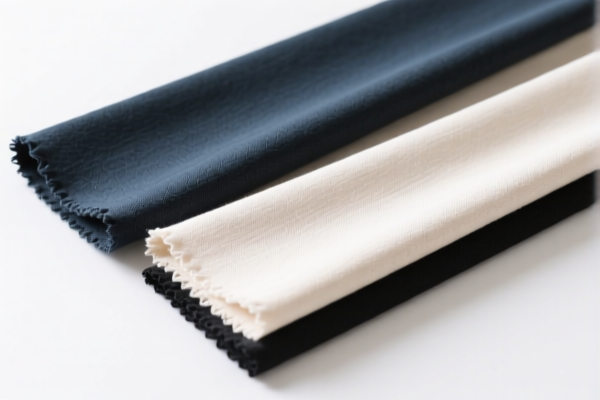

Here is the structured classification and tariff information for the textile fabrics you provided, with key details and alerts for customs compliance:

✅ HS CODE: 5907008090

Product Name: Coated textile fabric

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This product is subject to the April 11 Special Tariff starting from April 11, 2025.

- Verify if the coating material or process affects classification.

- Proactive Advice: Confirm the coating type and whether it's considered a "coated fabric" under HS 5907.

✅ HS CODE: 5208224020

Product Name: Cotton household textile fabric

- Base Tariff Rate: 8.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.4%

- Notes:

- This is a cotton-based fabric used for household purposes.

- April 11 Special Tariff applies.

- Proactive Advice: Ensure the fabric is not classified under a different HS code due to blending or finishing.

✅ HS CODE: 5209110020

Product Name: Cotton household textile fabric

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- Similar to 5208224020, but may differ in material composition or end-use.

- April 11 Special Tariff applies.

- Proactive Advice: Confirm the fabric’s end-use (e.g., for bedding, upholstery) to avoid misclassification.

✅ HS CODE: 6006909000

Product Name: Knitted fabric for apparel

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This is a knitted fabric intended for clothing.

- April 11 Special Tariff applies.

- Proactive Advice: Ensure the fabric is not classified under a different HS code (e.g., 6006420085) based on fiber content or construction.

✅ HS CODE: 6006420085

Product Name: Knitted fabric for apparel

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

- Notes:

- This code may apply to blended or synthetic knitted fabrics.

- April 11 Special Tariff applies.

- Proactive Advice: Verify the fiber composition (e.g., cotton, polyester blends) to ensure correct classification.

📌 Important Alerts:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30.0% tariff starting from April 11, 2025.

- Anti-dumping duties: Not applicable for textile products in the provided list.

- Certifications: Ensure compliance with any required import certifications (e.g., origin, material safety, etc.) depending on the destination country.

🛠️ Action Steps for Importers:

- Verify the material composition and end-use of the fabric to ensure correct HS code classification.

- Check for any additional duties based on trade agreements or bilateral policies.

- Confirm origin documentation (e.g., Form A, Form E) if applicable for preferential tariff treatment.

- Monitor tariff changes post-April 11, 2025, and update your import strategy accordingly.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

I couldn’t have done my export planning without the detailed HS code and tariff info. Highly recommend this page.

The page has all the necessary trade details for plastic doors. I wish there were more examples, but it's still helpful.

I was looking for HS code 3925 details and found exactly what I needed. This site is a lifesaver for exporters.

The HS code information was spot on, and the tariff rates are clearly laid out. A bit technical, but very accurate.

Great resource for understanding the trade requirements for exporting plastic builder’s doors to the US. Easy to follow.