Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8211929045 | Doc | 0.4¢ each + 6.1%+37.5% | CN | US | 2025-05-12 |

| 8211929030 | Doc | 0.4¢ each + 6.1%+37.5% | CN | US | 2025-05-12 |

| 8211945000 | Doc | 1¢ each + 5.4%+55.0% | CN | US | 2025-05-12 |

| 8438600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8436800060 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the vegetable cutter products you provided, with a focus on HS codes, tax rates, and compliance considerations:

📌 HS CODE: 8211929045 – Vegetable Cutter

- Base Tariff Rate: 0.4¢ per unit + 6.1%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 0.4¢ + 6.1% + 30.0% = 36.1%

- Note: This code applies to vegetable cutters (not blades or automated machines).

- Action Required: Verify the material (e.g., stainless steel, plastic) and unit price to ensure correct classification.

📌 HS CODE: 8211929030 – Vegetable Cutter

- Base Tariff Rate: 0.4¢ per unit + 6.1%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 0.4¢ + 6.1% + 30.0% = 36.1%

- Note: This code is similar to 8211929045 but may differ in material or design.

- Action Required: Confirm product specifications to avoid misclassification.

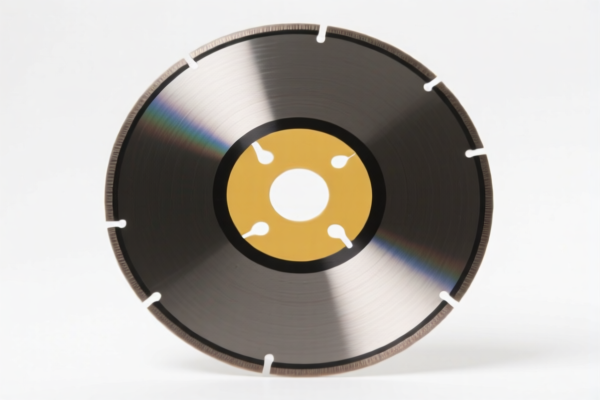

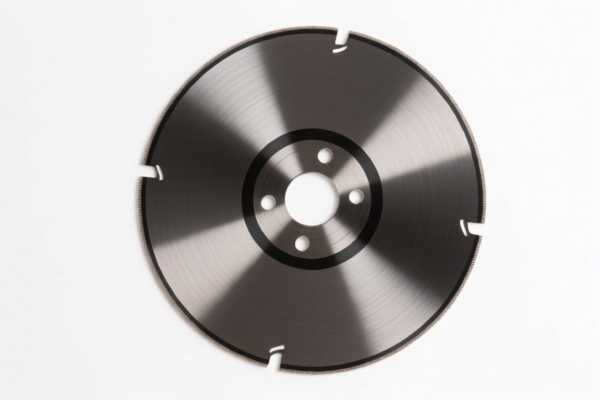

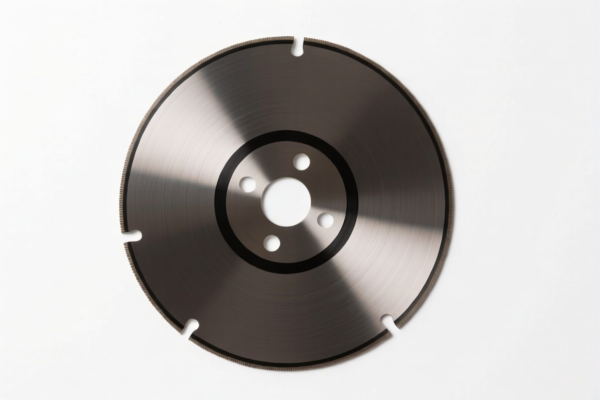

📌 HS CODE: 8211945000 – Vegetable Cutter Blades

- Base Tariff Rate: 1¢ per unit + 5.4%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 1¢ + 5.4% + 30.0% = 35.4%

- Note: This code applies to blades or parts used in vegetable cutters.

- Action Required: Ensure the product is not classified as a complete tool (e.g., blade only vs. full cutter).

📌 HS CODE: 8438600000 – Automated Vegetable Cutter

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 25.0% + 30.0% = 55.0%

- Note: This code applies to machines with automated functions.

- Action Required: Confirm whether the product is fully automated or manual to avoid misclassification.

📌 HS CODE: 8436800060 – Vegetable Dicer

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 25.0% + 30.0% = 55.0%

- Note: This code applies to machines used for cutting vegetables into small pieces (e.g., dicing).

- Action Required: Ensure the product is not classified as a manual tool (e.g., blade or hand cutter).

📌 Key Compliance Notes:

- April 11, 2025, Special Tariff: A 30.0% additional tariff will be applied to all products after this date, regardless of their classification.

- Anti-dumping duties: Not applicable for these products unless they are made of iron or aluminum (check material composition).

- Certifications: Ensure compliance with product safety standards (e.g., CE, FDA) if exporting to EU or US markets.

- Documentation: Maintain product specifications, material declarations, and certifications for customs audits.

✅ Proactive Advice:

- Verify the exact product type (e.g., blade, manual tool, automated machine) to avoid misclassification.

- Check the material (e.g., stainless steel, plastic, aluminum) to determine if anti-dumping duties apply.

- Track the import date to prepare for the April 11, 2025 tariff increase.

- Consult a customs broker if the product is complex or involves multiple components.

Let me know if you need help with certification requirements or customs documentation templates.

Customer Reviews

No reviews yet.