| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7306305026 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 7304390002 | Doc | 30.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the water pipe products you declared, based on the provided HS codes:

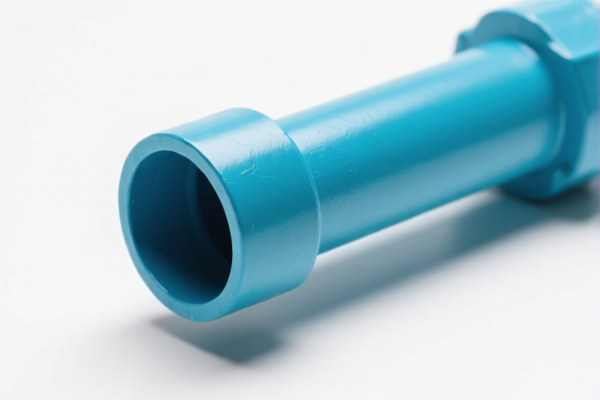

📌 HS CODE: 3917320050

Product Description: Plastic pipes and pipe fittings, not reinforced or combined with other materials, without fittings

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this category

- Special Notes:

- This code applies to general plastic pipes (not reinforced or combined with other materials).

- Proactive Advice: Confirm the material (e.g., polyethylene, PVC) and whether it is reinforced or combined with other materials, as this may affect classification.

📌 HS CODE: 7306305026

Product Description: Welded, circular section, iron or non-alloy steel pipes, usually for conveying water and other fluids

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: May apply depending on origin and specific product type

- Special Notes:

- This code is for welded steel pipes used for fluid transport.

- Proactive Advice: Verify the steel type (non-alloy or alloy), whether it is welded or seamless, and the intended use (e.g., water, gas, oil).

📌 HS CODE: 3917210000

Product Description: Rigid plastic pipes made of polyethylene

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this category

- Special Notes:

- This code is specific to rigid polyethylene pipes.

- Proactive Advice: Ensure the product is not reinforced or combined with other materials, as that would change the classification.

📌 HS CODE: 7304390002

Product Description: Seamless tubes, iron or steel, for boilers, superheaters, heat exchangers, condensers, refining furnaces, and water heaters

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: May apply depending on origin and specific product type

- Special Notes:

- This code is for seamless steel tubes used in industrial equipment.

- Proactive Advice: Confirm the exact application (e.g., boiler, heat exchanger) and whether the product is seamless or welded.

📌 HS CODE: 3917320020

Product Description: Plastic pipes and pipe fittings made of polyethylene

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this category

- Special Notes:

- This code is for polyethylene plastic pipes and fittings.

- Proactive Advice: Ensure the product is not reinforced or combined with other materials, as that would change the classification.

📌 General Notes for All Products:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all products listed above after April 11, 2025.

- Anti-dumping duties: May apply to steel products (e.g., HS codes 7306305026 and 7304390002), depending on the country of origin and whether any dumping investigations are ongoing.

- Proactive Actions:

- Verify the material composition (e.g., polyethylene, PVC, steel) and product structure (e.g., reinforced, seamless, welded).

- Confirm the intended use (e.g., water, industrial, boiler).

- Check if certifications (e.g., ISO, CE, RoHS) are required for import.

- Be aware of origin rules and anti-dumping investigations that may affect your product.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

I'm really glad I came across this page. The HS code for 3917390050 was exactly what I needed for my plastic water pipe exports, and the tax rate breakdown was spot-on.

The information is there, but I found it a bit overwhelming at first. I would have liked a summary table for the tariff rates and HS codes at the top of the page.

The detailed breakdown for 3917210000 was incredibly useful. I was able to confirm that my polyethylene pipes fit this category perfectly.

The page provided exactly what I needed for my export planning. The tariff rates and HS codes are well-organized, though I had to scroll a lot to find all the info.

I was impressed by how specific the HS code 7306305026 is for welded steel pipes. It saved me from making a costly classification mistake.