| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7318290000 | Doc | 107.8% | CN | US | 2025-05-12 |

| 3926904590 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 6909191000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8487900080 | Doc | 108.9% | CN | US | 2025-05-12 |

Here is the structured analysis of the HS codes and associated tariffs for the product "gasket" (垫圈、密封圈等), based on your input:

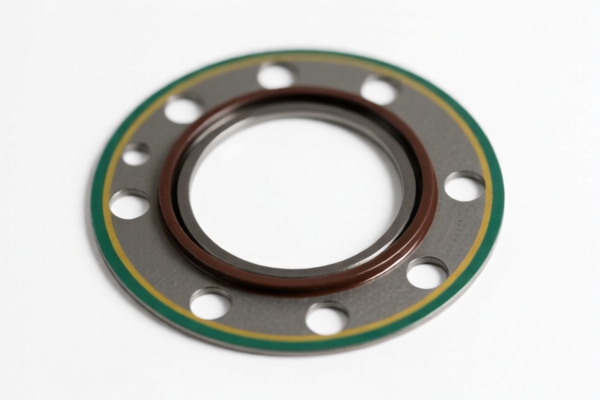

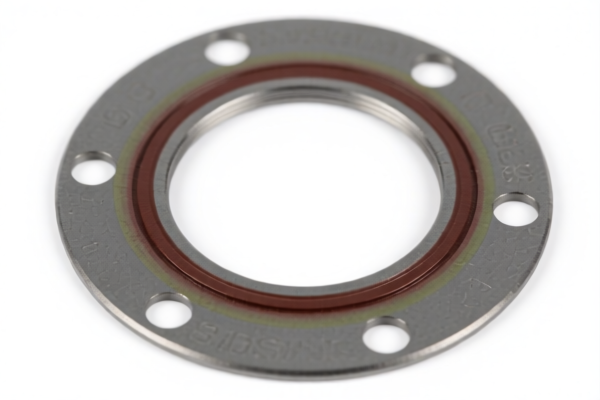

✅ HS CODE: 3926904510

Product Description: 垫圈、密封圈及O型圈 (Gaskets, seals, and O-rings)

Total Tax Rate: 58.5%

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Steel & Aluminum Additional Tariff (if applicable): Not applicable for this code

- Anti-dumping duties: Not applicable for this code

📌 Proactive Advice:

- Confirm the material of the gasket (e.g., rubber, plastic, metal) to ensure correct classification.

- If the gasket is made of steel or aluminum, check if it falls under a different HS code (e.g., 7318290000).

- Ensure compliance with technical standards or certifications if used in regulated industries (e.g., automotive, aerospace).

✅ HS CODE: 3926904590

Product Description: 垫圈、密封圈及其他密封件 其他 (Other gaskets, seals, and other sealing devices)

Total Tax Rate: 58.5%

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Steel & Aluminum Additional Tariff (if applicable): Not applicable for this code

- Anti-dumping duties: Not applicable for this code

📌 Proactive Advice:

- This code is for other types of gaskets not covered by 3926904510.

- Verify if the product is O-ring or non-O-ring to avoid misclassification.

- Confirm if the product is industrial grade or consumer grade, as this may affect customs scrutiny.

✅ HS CODE: 7318290000

Product Description: 非螺纹制品 (Non-threaded articles)

Total Tax Rate: 107.8%

- Base Tariff Rate: 2.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Steel & Aluminum Additional Tariff: 50.0% (applies to steel and aluminum products)

- Anti-dumping duties: May apply depending on the origin and material

📌 Proactive Advice:

- This code is typically for metal products, such as steel or aluminum gaskets.

- If the product is made of steel or aluminum, the additional tariff of 50% will apply.

- Check if the product is subject to anti-dumping duties based on the country of origin.

✅ HS CODE: 6909191000

Product Description: 陶瓷制品,用于实验室、化学或其他技术用途 (Ceramic articles for laboratory, chemical, or other technical uses)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Steel & Aluminum Additional Tariff (if applicable): Not applicable for this code

- Anti-dumping duties: Not applicable for this code

📌 Proactive Advice:

- This code is for ceramic gaskets used in technical or scientific applications.

- Confirm the intended use of the ceramic product to ensure correct classification.

- If the product is used in industrial or chemical processes, ensure compliance with relevant safety standards.

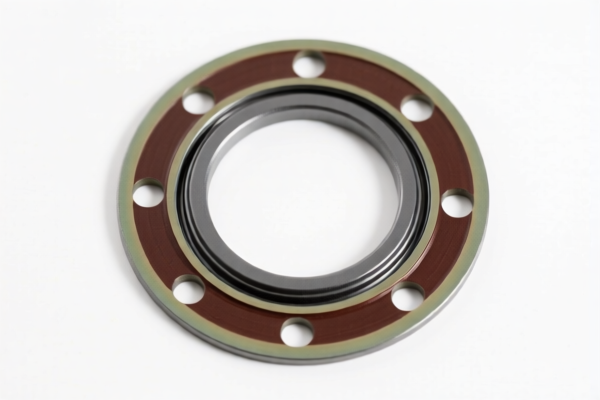

✅ HS CODE: 8487900080

Product Description: 不包含电气连接器、绝缘体、线圈、触点或其他电气特征的机械零件,且未在其他地方明确规定或包含在本章中的其他零件 (Other mechanical parts not containing electrical connectors, insulators, coils, contacts, or other electrical features)

Total Tax Rate: 108.9%

- Base Tariff Rate: 3.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Steel & Aluminum Additional Tariff: 50.0% (applies to steel and aluminum products)

- Anti-dumping duties: May apply depending on the origin and material

📌 Proactive Advice:

- This code is for mechanical parts that are not electrical in nature.

- If the product is made of steel or aluminum, the additional tariff of 50% will apply.

- Ensure the product is not classified under a more specific HS code (e.g., 3926904510 for rubber gaskets).

📌 General Reminder:

- April 2, 2025 is a critical date for tariff changes. Ensure your import timeline aligns with this to avoid unexpected costs.

- Always verify the material composition and intended use of the product to ensure correct HS code classification.

- If the product is imported from China, be aware of anti-dumping duties that may apply.

Customer Reviews

No reviews yet.