| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708401150 | Doc | 2.5%<u></u>+55.0% | CN | US | 2025-05-12 |

| 8483407000 | Doc | 25¢ each + 3.9%+55.0% | CN | US | 2025-05-12 |

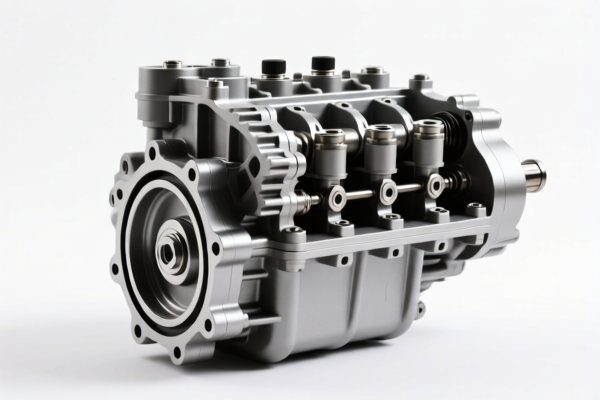

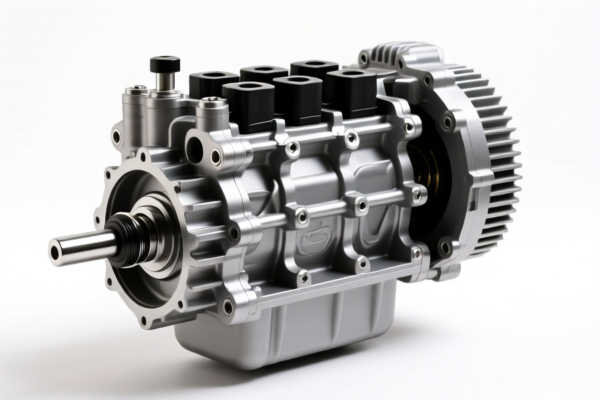

- Product Name: Gearbox

- HS CODE 1: 8708401150 (Vehicle Transmission)

- HS CODE 2: 8483407000 (Automatic Transmission)

Tax Overview:

- Base Tariff Rate:

- 8708401150: 2.5%

-

8483407000: 3.9% + 25¢ per unit

-

Additional Tariffs (Applicable after April 11, 2025):

- Both HS codes are subject to an additional 25.0% tariff.

-

After April 2, 2025, an additional 30.0% tariff will be imposed on both HS codes.

-

Special Notes:

- For 8483407000, the tariff includes a fixed 25¢ per unit in addition to the 3.9% ad valorem rate.

- Anti-dumping duties on iron and aluminum are not explicitly mentioned for these HS codes, but it is advisable to confirm if the product contains such materials.

Proactive Advice:

- Verify Material and Unit Price:

-

For 8483407000, the 25¢ per unit tariff is critical. Ensure the customs declaration includes the correct unit price and quantity to avoid overpayment.

-

Check Required Certifications:

-

Confirm if any technical certifications (e.g., CE, ISO, or industry-specific standards) are required for import compliance.

-

Monitor Policy Updates:

-

The April 2, 2025 deadline for the 30.0% additional tariff is time-sensitive. Ensure your import plans are aligned with this timeline.

-

Consult a Customs Broker:

- For complex cases, especially involving mixed materials or customs valuation, it is recommended to work with a qualified customs broker or compliance expert.

- Product Name: Gearbox

- HS CODE 1: 8708401150 (Vehicle Transmission)

- HS CODE 2: 8483407000 (Automatic Transmission)

Tax Overview:

- Base Tariff Rate:

- 8708401150: 2.5%

-

8483407000: 3.9% + 25¢ per unit

-

Additional Tariffs (Applicable after April 11, 2025):

- Both HS codes are subject to an additional 25.0% tariff.

-

After April 2, 2025, an additional 30.0% tariff will be imposed on both HS codes.

-

Special Notes:

- For 8483407000, the tariff includes a fixed 25¢ per unit in addition to the 3.9% ad valorem rate.

- Anti-dumping duties on iron and aluminum are not explicitly mentioned for these HS codes, but it is advisable to confirm if the product contains such materials.

Proactive Advice:

- Verify Material and Unit Price:

-

For 8483407000, the 25¢ per unit tariff is critical. Ensure the customs declaration includes the correct unit price and quantity to avoid overpayment.

-

Check Required Certifications:

-

Confirm if any technical certifications (e.g., CE, ISO, or industry-specific standards) are required for import compliance.

-

Monitor Policy Updates:

-

The April 2, 2025 deadline for the 30.0% additional tariff is time-sensitive. Ensure your import plans are aligned with this timeline.

-

Consult a Customs Broker:

- For complex cases, especially involving mixed materials or customs valuation, it is recommended to work with a qualified customs broker or compliance expert.

Customer Reviews

No reviews yet.