| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8501406020 | Doc | 58.7% | CN | US | 2025-05-12 |

| 8501514020 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8501512020 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8501322000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 8501316000 | Doc | 57.4% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the gearmotor products you provided, with a focus on customs compliance and tax implications:

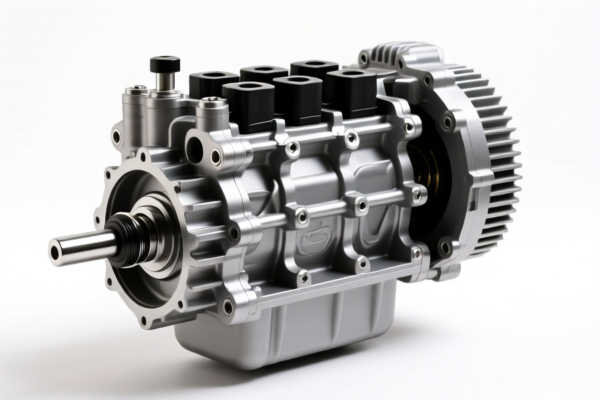

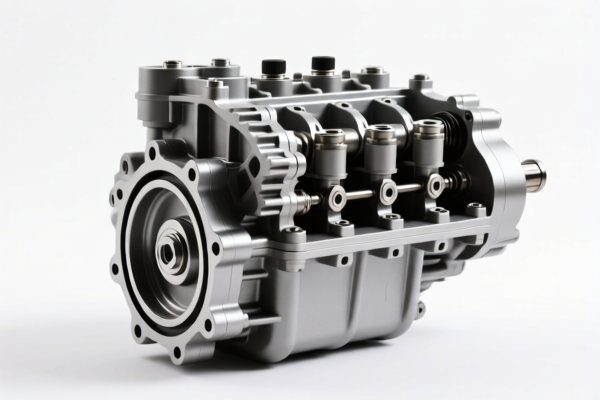

📌 HS CODE: 8501406020

Product Description: Single-phase gearmotor

Total Tax Rate: 58.7%

Tax Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8501514020

Product Description: Small gear reduction motor

Total Tax Rate: 57.5%

Tax Breakdown:

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8501512020

Product Description: Programmable gear reduction motor

Total Tax Rate: 57.5%

Tax Breakdown:

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8501322000

Product Description: DC motor with gear box

Total Tax Rate: 57.9%

Tax Breakdown:

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8501316000

Product Description: DC motor gear box

Total Tax Rate: 57.4%

Tax Breakdown:

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

All products listed above will be subject to an additional 30.0% tariff starting April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Anti-dumping duties:

Not applicable for these products (no mention of anti-dumping duties on iron or aluminum components).

✅ Proactive Advice for Importers:

-

Verify Product Specifications: Ensure the gearmotor matches the exact HS code based on its power type (e.g., DC, single-phase), function (e.g., programmable, reduction), and whether it includes a gear box or motor assembly.

-

Check Material and Unit Price: Tariff calculations depend on the declared value and material composition. Misclassification can lead to penalties.

-

Certifications Required: Confirm if any certifications (e.g., CE, RoHS, or energy efficiency standards) are required for import into the destination country.

-

Plan Ahead for April 11, 2025: If you plan to import these products after this date, budget for the 30.0% additional tariff and consider alternative sourcing or duty mitigation strategies.

Let me know if you need help determining the correct HS code for a specific gearmotor model or assistance with duty calculations.

Customer Reviews

No reviews yet.