Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3801900000 | Doc | 59.9% | CN | US | 2025-05-12 |

| 3801200000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6812992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6903100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820300040 | Doc | 55.0% | CN | US | 2025-05-12 |

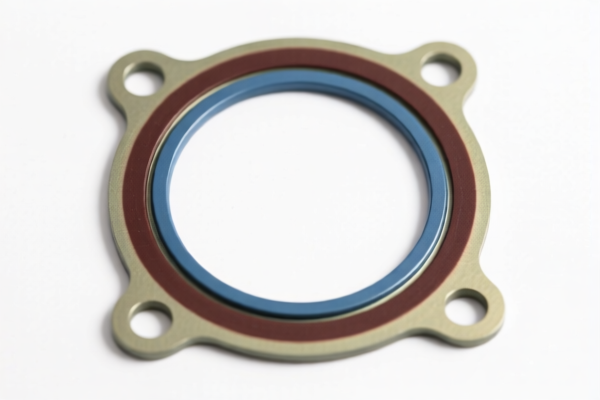

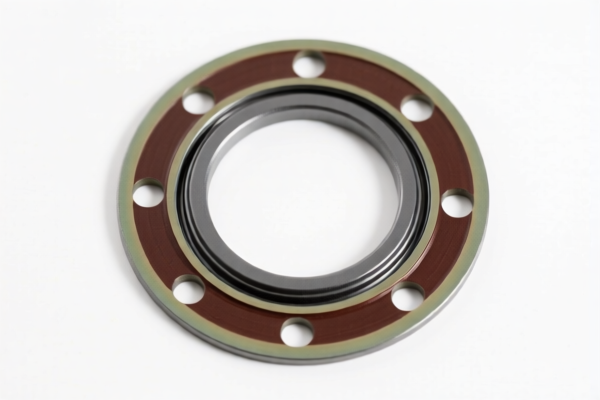

Customs Classification and Tariff Analysis for Graphite Gaskets

Based on the product name "graphite gasket", the following HS codes and tariff details are relevant. Please note that the correct classification depends on the material composition, form, and intended use of the product.

✅ Recommended HS Code: 3801900000

Product Description:

- Graphite gaskets, graphite sealing pads, graphite sheets, graphite blocks, and graphite sheeting.

Tariff Details:

- Base Tariff Rate: 4.9%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 59.9%

📌 Other Possible HS Codes (for Reference):

HS Code: 3801200000

- Product Description: Graphite-based sealing pads (usually in sheet or semi-finished form).

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

HS Code: 6812992000

- Product Description: Asbestos fiber gaskets with graphite.

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

HS Code: 6903100000

- Product Description: Graphite fire-resistant gaskets (if graphite content > 50%).

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

HS Code: 4820300040

- Product Description: Paper or cardboard gaskets (e.g., ink-absorbing paper gaskets).

- Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

⚠️ Important Notes:

- Material Composition: If your product contains asbestos, it must be classified under 6812992000. If it is carbon-based and used for fire resistance, 6903100000 may apply.

- Form and Use: If it is a finished sealing product made of graphite, 3801900000 is the most accurate classification.

- Tariff Changes: Starting April 11, 2025, an additional 30% tariff will be applied to all products in the above categories.

- Anti-Dumping Duties: Not applicable for graphite gaskets (unless imported from specific countries under anti-dumping investigations).

📌 Proactive Advice:

- Verify Material: Confirm whether the product is made of pure graphite, asbestos with graphite, or carbon-based materials.

- Check Unit Price: High-value products may be subject to additional scrutiny or anti-dumping investigations.

- Certifications Required: If the product contains asbestos, certifications may be required for import compliance.

- Consult a Customs Broker: For complex classifications or large-volume imports, consult a professional customs broker to ensure compliance.

Let me know if you need help determining the exact HS code based on your product specifications.

Customer Reviews

No reviews yet.