| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 4016996050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8451909010 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8307903000 | Doc | 58.8% | CN | US | 2025-05-12 |

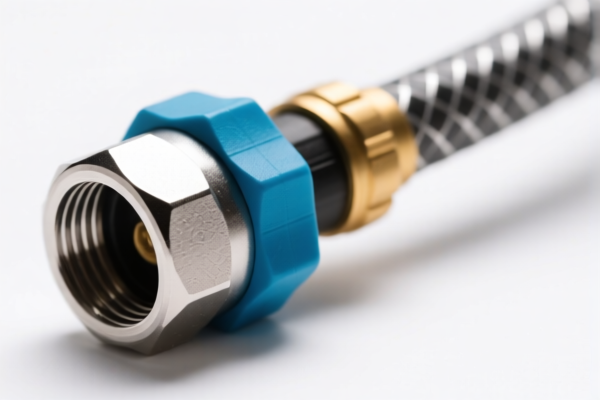

Here is the detailed classification and tariff information for the hose connector product, based on the provided HS codes and tax details:

🔍 HS CODE: 3917330000

Product Description: Plastic hose connector

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties apply for this category.

- Proactive Advice: Confirm the material is purely plastic and not mixed with metal or other components. Ensure the product is not classified under a more specific code.

🔍 HS CODE: 3917390050

Product Description: Other plastic tubes and pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may include hose connectors made of plastic.

- Proactive Advice: Verify if the product is specifically a hose connector or falls under a more general category.

🔍 HS CODE: 4016996050

Product Description: Other vulcanized rubber products

Total Tax Rate: 57.5%

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to rubber hose connectors.

- Proactive Advice: Confirm the product is made of rubber and not a composite material. Check if it's subject to any anti-dumping duties.

🔍 HS CODE: 8451909010

Product Description: Parts of machines for cleaning, washing, drying, ironing, pressing, etc.

Total Tax Rate: 58.5%

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for parts of textile machinery and is unlikely to apply to a hose connector.

- Proactive Advice: This is not a suitable classification for a hose connector. Double-check the product's function and use.

🔍 HS CODE: 8307903000

Product Description: Brass hose connector

Total Tax Rate: 58.8%

- Base Tariff Rate: 3.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to brass hose connectors.

- Proactive Advice: Confirm the material is brass and not another type of metal. Check if any anti-dumping duties apply to brass products.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date.

- Material Verification: Ensure the product is made of the correct material (plastic, rubber, brass, etc.) to avoid misclassification.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import.

- Unit Price: Be aware of the unit price, as it may affect the total duty payable.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the detailed classification and tariff information for the hose connector product, based on the provided HS codes and tax details:

🔍 HS CODE: 3917330000

Product Description: Plastic hose connector

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No anti-dumping duties apply for this category.

- Proactive Advice: Confirm the material is purely plastic and not mixed with metal or other components. Ensure the product is not classified under a more specific code.

🔍 HS CODE: 3917390050

Product Description: Other plastic tubes and pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may include hose connectors made of plastic.

- Proactive Advice: Verify if the product is specifically a hose connector or falls under a more general category.

🔍 HS CODE: 4016996050

Product Description: Other vulcanized rubber products

Total Tax Rate: 57.5%

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to rubber hose connectors.

- Proactive Advice: Confirm the product is made of rubber and not a composite material. Check if it's subject to any anti-dumping duties.

🔍 HS CODE: 8451909010

Product Description: Parts of machines for cleaning, washing, drying, ironing, pressing, etc.

Total Tax Rate: 58.5%

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for parts of textile machinery and is unlikely to apply to a hose connector.

- Proactive Advice: This is not a suitable classification for a hose connector. Double-check the product's function and use.

🔍 HS CODE: 8307903000

Product Description: Brass hose connector

Total Tax Rate: 58.8%

- Base Tariff Rate: 3.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to brass hose connectors.

- Proactive Advice: Confirm the material is brass and not another type of metal. Check if any anti-dumping duties apply to brass products.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date.

- Material Verification: Ensure the product is made of the correct material (plastic, rubber, brass, etc.) to avoid misclassification.

- Certifications: Check if any certifications (e.g., RoHS, REACH) are required for import.

- Unit Price: Be aware of the unit price, as it may affect the total duty payable.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.